Fifty years is a long time to think about hanging on to anything, whether it's a pair of socks or a trio of stocks. That's partly because a lot can change in even five years, let alone 50. As recently as the early 1980s, for example, the typewriter industry was considered to be very stable. Then along came word processors and desktop computers, and you know what happened next.

With that in mind, I looked around the stock market for top companies that you could be reasonably confident about buying today and forgetting about for a half-century. Here's why you may want to consider Berkshire Hathaway (BRK.A -0.28%) (BRK.B -0.68%), LVMH (LVMUY -0.11%), and The Walt Disney Company (DIS 0.18%) as potential long-term investments.

Investing in top companies over the long term can help your nest egg grow. Image source: Getty Images.

1. Berkshire Hathaway: Diversification in one stock

If you're looking for a reliable company that you can be pretty certain will not only be surviving in 50 years, it will be thriving, you're probably looking for a business that's diversified across a number of sectors -- a so-called conglomerate. And there's one big conglomerate that comes to mind: master investor Warren Buffett's Berkshire Hathaway.

Berkshire's business model is simple: Its core insurance businesses -- including GEICO -- are stable, reliable moneymakers that generate a ton of cash. Berkshire uses that cash to invest in businesses across the stock market. Currently, Berkshire owns a number of companies outright, including Dairy Queen, BNSF railroad, and Benjamin Moore Paints. These businesses churn out additional cash that Berkshire uses to invest in other companies. Lather, rinse, repeat.

In his most recent shareholder letter, Buffett extolled the virtues of the conglomerate structure, writing, "To put the case simply: If the conglomerate form is used judiciously, it is an ideal structure for maximizing long-term capital growth."

And Berkshire has certainly seen long-term capital growth: Its stock price is up 215.5% over the last 10 years and 415.6% over the last 20 years. Buffett's strategy is likely to give investors strong returns for decades to come. Just don't expect those returns in the form of dividends. Berkshire invests its cash to create more value, rather than paying shareholders directly.

2. LVMH: The lap of luxury in one stock

Diversification alone, though, isn't necessarily enough for a company to excel. Just look, for example, at industrial conglomerate General Electric. It was considered a solid, safe, reliable buy as recently as three years ago. But despite continuing outperformance in some of its business lines, a spate of poorly timed decisions led to the collapse of the company's share price and it now faces an uncertain future.

In his letter, Buffett actually commented on how the conglomerate structure can go awry, reminiscing about the days in which conglomerates would snap up "characteristically mediocre businesses with poor long-term prospects. This incentive to bottom-fish usually led to a conglomerate's collection of underlying businesses becoming more and more junky."

To make sure your portfolio is clear of junk, you might consider investing in luxury. Specifically, in luxury goods maker Louis Vuitton Moet Hennessy (LVMH). The world's largest luxury brand not only owns the brands that make up its name, but more than 60 others as well, spanning jewelry (Bvlgari), fashion (Christian Dior), and alcohol (Dom Perignon). Over the last 10 years, the stock has actually outperformed Berkshire's, and luxury goods are widely considered to be recession-resistant. LVMH has proven to be U.S.-China trade war-resistant as well.

Fifty years from now, consumers are still going to want to indulge in quality luxury brands. LVMH has proven that it can grow and adapt its portfolio to changing tastes. That's why, even if you can't afford Louis Vuitton in your closet, you still might want to put it into your investment portfolio.

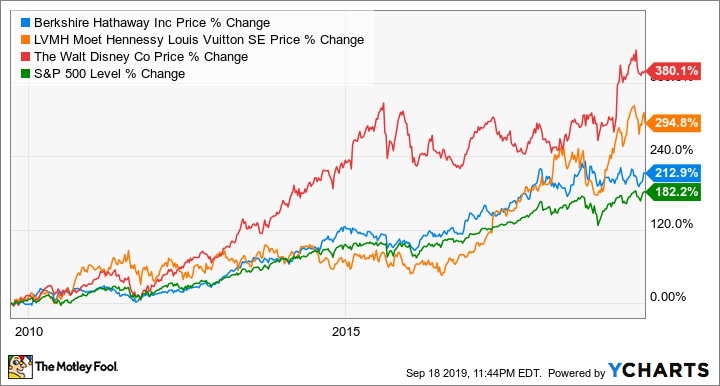

All three of these companies have outperformed the S&P 500 over the last 10 years. Note that Berkshire has two classes of stock and only BRK.B is shown. BRK.A stock's price % change path is nearly identical to BRK.B. BRK.B data by YCharts.

3. Walt Disney: All the fun in one stock

Forget industries for a moment: There are some activities that are timeless in America. Watching TV, going to a baseball game, seeing a movie, reading a comic book, or riding a roller coaster are all leisure pastimes that have endured for more than half a century. And they're all a part of the investing strategy of Disney.

The House of Mouse has endured for decades, in part by regularly churning out crowd-pleasing movies -- and a lot of them. All six of the highest-grossing movies of 2019 have been Disney releases, and when Frozen 2 and Star Wars: The Rise of Skywalker are released later this year, the company very likely will hold the top eight sales slots. The studio has already made more money from its films than any other studio ever has in a single year ... and it surpassed that milestone back in July.

Disney has proven exceptional at leveraging its portfolio of content, which includes power players like Marvel, Lucasfilm, Pixar, and the now-ubiquitous Disney Princesses. It also owns ABC and ESPN TV networks, the Disney theme parks, and far too many other properties to list. The company's rollout of its Disney+ video streaming service in November will provide it with yet another way to make money from its powerhouse content.

Disney has become an entertainment juggernaut by being very, very good at what it does. Even the occasional misstep (say, recent films like The Black Cauldron or Solo: A Star Wars Story) do nothing to lessen its myriad successes. I can't picture a world without Mickey Mouse in 50 years. Disney is a stock worth hanging on to for the long run.

Investor takeaway

Of course, while I don't recommend compulsively checking your investments too often, leaving them alone for 50 years isn't a good strategy, either. Periodic review is just part of prudent investing.

But for those interested in buying stocks and holding them for the long term, Berkshire Hathaway, LVMH, and Disney look like good options right now.