When it comes to investing in stocks, the best definition of risk is simple: the chance for a permanent loss of capital. There are several factors in play here, including the strength of the business' cash flows and balance sheet, and demand for its products or services. In general terms, the weaker the business, the higher the risk.

Yet sometimes there are companies that don't have great balance sheets or big cash flows, that still have enormous potential. In other words, high-risk, high-return stocks that could turn thousands into millions if they reach their full potential, or just as easily turn those same thousands into pocket change if funding dries up before the business pans out.

Here are three that look particularly compelling right now.

| Stock | Trailing-12-Month Revenue | Industry/Segment |

|---|---|---|

| Clean Energy Fuels (CLNE -0.89%) | $323.6 million | Natural gas for transportation |

| Jumia Technologies (JMIA -2.96%) | $144.6 million | e-commerce platform in 14 African countries |

| Tellurian (TELL 28.11%) | $12.9 million | LNG exporter |

Revenue through most recently reported quarter.

Keep reading to learn what makes these three stocks high-risk, and why the potential rewards make them worth putting on your watchlist.

Fueling the future of transportation

While the days of gasoline and diesel-powered vehicles are far from over, the momentum has clearly shifted toward cleaner alternatives. In the first half of 2019, over 1.1 million electric vehicles (EVs) were sold worldwide, up almost 50% from the first six months of 2018. This is a trend that's almost certain to accelerate; automakers see the shift in consumer demand, and some of the world's biggest are shifting their R&D spending to alternative-fueled powertrains, while cutting spending on gasoline and diesel engines.

Image source: Getty Images.

This gets a lot of attention from the media, too, and deservedly so, because reducing tailpipe emissions will have a multitude of benefits on the planet and the communities those cars operate in. Commercial transportation has proven a tougher nut to crack. Simply put, the promise of EVs is far more limited in this space, because of the weight, cost of batteries, and refueling time, that significantly limits the number of applications that EVs could possibly be suitable for anytime in the near future.

In the meantime, Clean Energy Fuels has quietly delivered double-digit growth in sales of a cleaner alternative that's cost effective and reliable today: natural gas. Not only is natural gas a cheaper than gasoline or diesel, but it also produces far-fewer of the particulates that cause acid rain, and fewer of the carbon emissions behind climate change.

Taking it a step farther, Clean Energy Fuels has prioritized biomethane, which is the natural gas that's captured from human agricultural production and landfills. By capturing and using this biomethane -- which Clean Energy sells under the "Redeem" brand -- as a transportation fuel, companies can reduce the carbon emissions from their vehicle fleets by 70% or more as compared to gasoline or diesel, while simultaneously reducing the environmental impact of the waste humans generate.

The beauty of Clean Energy as an investment today, is that it it has enormous growth prospects as Redeem takes market share from diesel, and it's a cash-flow-positive business:

CLNE Cash from Operations (TTM) data by YCharts

That's the product of the company paying off a substantial amount of debt and improving its operations over the past few years, while also steadily growing fuel sales volume at a low double-digit rate.

The risk? Development of electric and hydrogen powertrains for heavy-duty transportation happens more quickly than anticipated, taking a bigger bite out of the potential market that only natural gas can meet today as a cleaner, affordable alternative to diesel. If that were to happen, Clean Energy could see its sales growth flatten out and eventually even decline as truckers replace their natural gas trucks with electric or hydrogen.

From my years following the industry, the risk seems overstated and I expect renewable natural gas to remain a viable choice for heavy-duty transportation for potentially decades to come. But if I'm wrong, Clean Energy's cash flows will weaken, and it future will dry up like an old gas well.

Burning cash to become the first mover

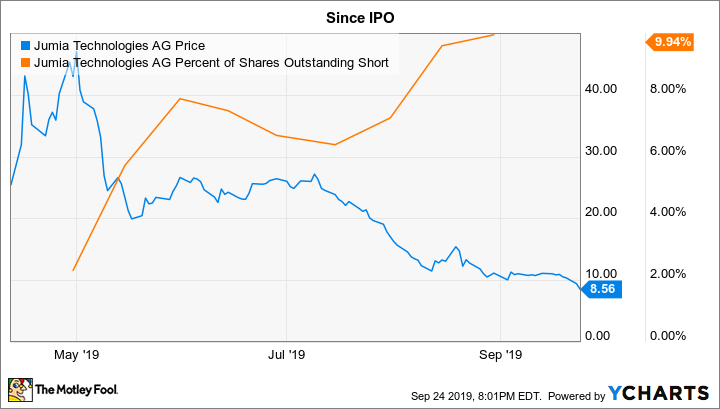

Jumia, the e-commerce company founded by Europeans and headquartered in Europe, roared out of the gate after going public earlier this year. But since the initial surge, its shares have steadily taken a beating since coming under attack from a high-profile short seller and dealing with a litany of issues related to contracted workers who were fraudulently booking (and then cancelling) orders to pump up their own numbers. Since then, a number of lawsuits have been filed against the company, alleging omissions and misstatements in company filings. If those allegations are true, management is potentially complicit in misleading investors.

I don't think that's likely to prove true. But the reality is, even removing that from the potential risks, Jumia remains incredibly risky. The company is attempting to simultaneously build -- nearly from the ground up -- e-commerce operations in 14 countries in Africa; countries where consumers view the internet as a risky place to buy goods, cash is still king, and last-mile logistics can be exceedingly difficult.

The result is a business that's absolutely burning cash, racing to build economies of scale before access to capital dries up. But the opportunity, if Jumia can pull it off, is the size of Africa. More than 1 billion consumers, and $4.2 trillion in combined annual household and business-to-business spending. If Jumia can establish itself as a trusted place for shoppers, its first-mover advantage would be enormous, and it could easily become one of the most-valuable e-commerce companies on earth.

For more context, buying Jumia today would be like buying Amazon.com in the late 1990s, or MercadoLibre a decade ago. The rewards for early movers on those two companies have been enormous. The risk? Jumia becomes just another footnote in the history of failed e-commerce start-ups, and your investment disappears like the money you emailed to that Nigerian prince 20 years ago.

The other, bigger, natural gas story

Like Clean Energy Fuels, Tellurian's business also entirely rests on the prospects for natural gas to become a bigger part of the global energy mix. In its case, Tellurian plans to play a big role in the export of natural gas from the U.S., where it is both plentiful and incredibly cheap, to markets with burgeoning energy demands.

However, unlike Clean Energy Fuels, Tellurian doesn't have a cash-positive business to fund its operations; heck, it doesn't even have an existing business at all. At this stage, Tellurian is little more than a collection of very talented people, a business plan, and a handful of important government approvals to build an export facility. But once that facility and the associated pipelines are in operation, Tellurian says it will generate about $8 per share in cash flows.

Image source: Getty Images.

For context, Tellurian's stock trades for about $8 at recent prices. 1 times future cash flows is incredibly cheap; Cheniere Energy, the best pure-play LNG exporter that could be a model for Tellurian's value, trades for over 9 times cash flows today; by that metric, Tellurian could be worth $72 per share within five years, when its operations are running near capacity.

So where's the risk? Those operations don't even exist yet. For Tellurian to get to $8 per share in cash flows, it's going to take somewhere in the neighborhood of $30 billion to build its LNG export facility and pipelines. And without an existing source of cash flows, it must count on the willingness of the capital and debt markets to fund its ambitions, and there are a litany of things that could go wrong. That includes everything from unexpected economic weakness to a downturn in energy prices to something else entirely that could derail its best-laid plans.

Why is Tellurian worth taking on that risk? Its talented leadership, which includes two co-founders who have been at the forefront of LNG exporting for decades and an executive team that's made up of the people responsible for building Cheniere, many of which own a substantial personal stake in Tellurian. These people have done it before and have skin in the game. If you're going to make a high-risk, high-reward investment, those two things significantly improve your chances of a big payday.