In October 2014, American Realty Capital Properties, now known as VEREIT (VER), revealed that there were accounting irregularities in the company's financial reports. Although modest in size, the irregularities set off a chain reaction that has basically led to a complete makeover for the net lease real estate investment trust (REIT).

After a recent legal settlement, the company is close to putting the issue in the rearview mirror. But how it has decided to pay -- by issuing nearly $1 billion in stock -- deserves a closer look.

Why such a big deal?

Leading up to the October 2014 revelation of accounting irregularities, American Realty Capital Properties had basically taken a growth-at-any-cost approach to its business. It scaled up quickly via acquisition, cementing its place as one of the largest net lease REITs in the U.S. However, management clearly couldn't handle the pace of growth.

Image source: Getty Images.

After the scandal erupted, the board stepped in to clean house. It brought in respected industry veteran Glenn Rufrano as the new CEO. Rufrano quickly laid out a plan to strengthen the balance sheet, rationalize a bloated property portfolio, and reinstate the dividend. He also changed the company's name to VEREIT, meant to elicit the Latin word veritas (truth). He and his team basically nailed all of the goals that were set out. Despite the hard work behind that effort, the one lingering problem that remained was a series of lawsuits related to the accounting irregularity.

Methodically, VEREIT worked to solve the impasses. The agreements started off slowly but eventually picked up steam. And in early September 2019, management was able to ink what is basically a final deal. The cost, however, was material, and it will total roughly $1 billion. While investors were pleased to see the issue finally come to an end, the question arose of how to pay. The choice, revealed in late September, was to issue 94.3 million shares of new stock.

That's a lot of stock!

The first thing to consider here is the choice. Needing to come up with around $1 billion, VEREIT didn't have a lot of easy options. Issuing debt, despite the historically low-interest rate environment, could have led to credit downgrades. After working hard to get back to an investment-grade (BBB) rating, VEREIT would be loath to see it slip away. Cost of capital is an important competitive issue for net lease REITs. Higher debt costs could have been a huge and lingering headwind to future growth plans.

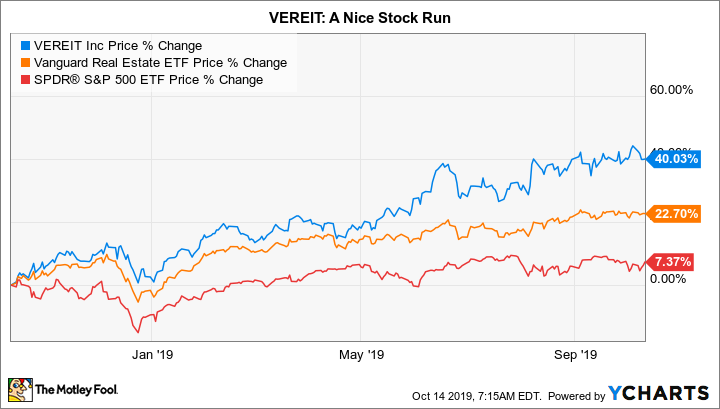

Meanwhile, the company's stock price was near its highest levels since the revelation of the accounting irregularity and up some 40% over the past year. For this reason alone, selling stock was probably the right call. And since the stock price hasn't fallen off a cliff, it would seem that Wall Street agrees with the choice VEREIT made here.

That said, there is an impact from selling so many shares. Based on the average share count from the end of the second quarter, the recent sale increased VEREIT's share count by roughly 9%. This is a notable level of dilution and does nothing to grow the business since all of the proceeds will be going toward the legal settlement. So while this is an overall positive reset, there are still significant implications.

Funds from operations (FFO) per share (essentially similar to earnings for an industrial company) will be lower because FFO will be spread across a greater number of shares. How much lower? Around 9%. This is basically the reverse of a company buying back stock, which has the effect of raising earnings by spreading net income across fewer shares.

Also, the company's dividend costs will go up because it is paying dividends on 9% more shares. The number is hardly trivial here. Based on the current quarterly rate, VEREIT's dividend is $0.55 per share annually. The new shares will require the REIT to pay out an additional $52 million or so in dividends each year. That said, VEREIT's FFO payout ratio was around 75% in the second quarter, which is fairly modest for a net lease REIT. For comparison, industry bellwether Realty Income's (O 0.52%) FFO payout ratio was closer to 85% in the second quarter.

VEREIT's more conservative payout ratio wasn't an accident. Management built in a margin of safety in anticipation of future legal costs. That said, the FFO payout ratio going forward is going to be notably higher, since FFO is going to fall at the same time that the overall dividend expense is going up. But it will probably be easier to dig out from this hole (by growing the business or buying back stock) than if the company had used debt, which would have involved financial restrictions (debt covenants) that would have made reducing leverage more difficult. Either way, VEREIT's costs would have risen, but issuing stock looks like the lesser of two evils.

A reset and what's next

Is this the best outcome? It's too soon to say. However, it is definitely not a bad outcome. VEREIT has managed to muddle through a very difficult period and come out the other side in one piece. In fact, it has emerged from this episode a better company than when it entered. The next step, however, is a big one: VEREIT has to start growing the business again.

Growing will require buying and building more properties than it sells. Over the short term, that will likely be funded with debt (the company has a roughly $2 billion revolving credit facility that should, after the stock sale, be close to fully available). So VEREIT may, in fact, be able to put this legal issue behind it and grow the portfolio at the same time. Only time will tell, of course, but growth is what investors need to be watching for now.

As soon as VEREIT can start growing again, it will be a much more attractive investment opportunity, and it will have more clearly put the negatives behind it. Those negatives, led by the legal concerns now being put to rest, have left it trading at a discount to other net lease REITs -- highlighted by a relatively high yield and below-peer price-to-adjusted-FFO ratio. If VEREIT can show that it is finally turning a corner, it could help to close the discount between this 5.6%-yielding-REIT and net lease competitors like Realty Income (3.4% yield) and W.P. Carey (4.5% yield). When all is said and done, dividend-focused investors may want to start looking at VEREIT again.