When investors think about buying shares in a steel company, the first thing to acknowledge is the cyclical nature of the business, and accordingly, how the stocks themselves will reflect those cycles.

But once a decision is made to invest in the sector, businesses with long-term growth prospects and low-cost production should be at the top of your list. Steel Dynamics (STLD -1.62%) is one of those businesses.

Image source: Getty Images

The business of the steel business

Steelmaking, processing, and finishing is a capital intensive business with high fixed costs. Two top steelmakers in the U.S. have recently announced greenfield expansion plans. Steel Dynamics is planning a new sheet mill in Texas for an investment estimated at $1.9 billion, while Nucor (NUE -6.96%) has announced a new plate mill in Kentucky, estimating that investment at $1.35 billion.

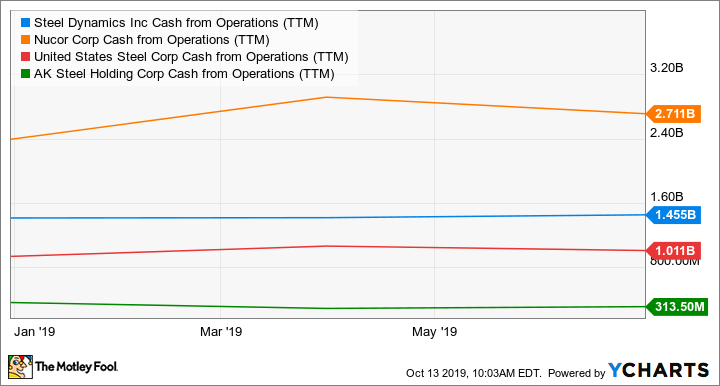

Operating steel mills is costly as well. Input materials such as scrap, iron ore, or other types of iron units -- plus the massive amount of energy required to make steel -- make the low-cost producers such as Steel Dynamics and Nucor best able to produce cash flow for continued growth. The chart below compares the trailing 12-month cash from operations this year for the leading U.S. producers.

Data by YCharts.

Expansion continues

With steel prices falling this year, results for the producers have also been following suit. For example, third-quarter revenue for Steel Dynamics decreased 22% year over year, while operating income fell 57%. However, investors must keep in mind that 2018 was a record year for steel makers. Commenting on this year's performance, CFO Theresa Wagler stated back in July:

To take this moment to level set, our financial results are quite strong. They're just lower relative to our record high 2018 results. And as we discuss our business this morning, you'll find we are constructive concerning underlying steel demand and optimistic concerning our unique earnings catalyst.

The optimism regarding future earnings catalysts comes from the expanding operations at the company. Strong continued cash flows allow management to pursue growth plans.

For example, Steel Dynamics continues to ramp up production at its Heartland flat-rolled facility, which it acquired in June 2018. Also in 2018, the company completed its acquisition of a previously closed rolling mill from Kentucky Electric Steel, which adds a new internal customer to allow more production from the upstream steel mill assets. In March 2019, it acquired a 75% interest in United Steel Supply, which gives it an expanded supply chain for its value-added painted Galvalume sheet products. It also recently completed expansions at both its Roanoke Bar and Structural and Rail divisions.

What comes next

Big future plans include a new galvanizing line at the Columbus, MS facility as well as the previously mentioned greenfield Texas plant. The new galvanizing line in Columbus will begin production in 2020 and be the third at the facility, bringing the total for the company to ten galvanizing lines located throughout the eastern half of the United States.

The massive new investment in Texas will have "Next Generation" steel-making capabilities. It will include downstream galvanizing and paint line operations, serving a new market for the company as it eyes business to the west and south. Steel Dynamics estimates that 30% of the production will be sent to Mexico, where management estimates flat roll steel consumption has increased by about 40% from 2013 to 2018.

A focus of the newest technologies will be the high-strength market for automotive and energy customers, with capabilities out to 84 inches wide, which will make it the worlds largest thin slab facility. This will increase steel-making capacity for Steel Dynamics by 25%. CEO Mark Millett said in the third quarter earnings release, "This facility is designed to have product size and quality capabilities beyond that of existing electric-arc-furnace flat roll steel producers, competing even more effectively with the integrated steel model and foreign competition."

Whether to invest

For investors, of course, all of this expansion only matters if it turns into growing profits for the company. Being such a cyclical industry, the focus should be on whether a steel company's growth brings higher earnings highs as well as higher lows, throughout the business cycle. Steel Dynamics, along with Nucor, has the cost structure and company culture that has resulted in many successful projects.

Keep an eye on both company's expansion projects as they come online to see whether returns grow relative to their position in the business cycle. If that comes to pass, investing in the growing steel companies should result in long-term returns for that portion of your portfolio.