Net lease real estate investment trust (REIT) VEREIT (VER) has been struggling under a cloud of uncertainty since late 2014. That was when an accounting scandal forced major changes, including a new management team, a portfolio makeover, and the temporary suspension of the dividend. With all of that behind the company, largely including the legal mess left over from the accounting revelation, VEREIT is basically a new company. But it's still cheap relative to peers. That's a reason for investors to buy -- but don't go in expecting another REIT to take advantage of that cheap valuation and acquire VEREIT. Here's why.

Making things better

You have to give credit to Glen Rufrano and the team he brought in to clean up the mess that was left behind following the 2014 accounting issues. A respected industry veteran, he set out clear and simple goals, including strengthening the balance sheet, streamlining the portfolio, and reinstating the dividend. The targets were public, so analysts and investors could monitor the progress. VEREIT achieved every one of its goals.

Image source: Getty Images

The only problem that Rufrano and his team couldn't easily solve was on the legal front. The accounting mess resulted in sizable lawsuits. Dealing with these required negotiations with outside investors and lawyers, and was simply an unpredictable process -- and one that had to be conducted largely in secret. The CEO provided updates as he could, but there was always an air of uncertainty around VEREIT's legal headwinds. And, thus, a headwind for the stock, which traded at a notable discount to peers.

In late 2019, however, VEREIT was able to announce that it had finally managed to resolve the majority of its legal conflicts. The price tag for the final settlement was big, at roughly $1 billion, but at least it was finally over. And, shortly after the agreement was announced, VEREIT issued new shares to help pay for the tab, quickly setting a new floor for the REIT.

Clearing the way for the future

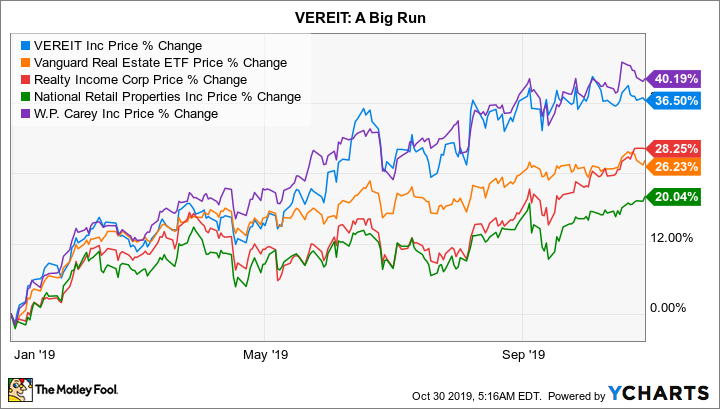

One thing that has been constant throughout the company's troubles is a discounted price relative to peers. VEREIT is one of the largest and most diversified publicly traded net lease REITs. And yet, even after a 35% advance in 2019, VEREIT still trades at a discount to net lease REITs like Realty Income (O 0.52%), National Retail Properties (NNN 0.44%), and W. P. Carey (WPC 0.27%).

Let's put some numbers on that, using VEREIT's second-quarter adjusted funds from operations (AFFO) -- which is like earnings for an industrial company -- as a run rate. Taking into account the new shares, it looks like the company can achieve AFFO of around $0.65 per share per year. Given recent prices, that puts the REIT's price to AFFO ratio at about 15 times. (The dividend, for those concerned, is still sound in this math, since at $0.55 a year the payout ratio remains sustainable at about 85% to 90%.)

Using the projected 2019 AFFO for Realty, National Retail, and Carey, they have price to AFFO ratios of roughly 24 times, 21 times, and 18 times, respectively. With a portfolio of nearly 4,000 properties, VEREIT's discounted price could make some investors think that it is an acquisition candidate. But it's just not that easy.

For starters, the size of VEREIT's portfolio means that an acquiring company would also need to be very large. That quickly whittles down the list of potential acquirers. Then there's the actual portfolio, which is spread across the retail, industrial, and office sectors. There are only a couple REITs that are both large enough and diversified enough to bother taking on VEREIT's portfolio.

Digging into that, National Retail is out because it focuses only on the retail sector. W. P. Carey has the diversification to take on VEREIT's portfolio, but with a $15 billion market cap, buying $10 billion market cap VEREIT would be a huge purchase. It's not likely Carey would take that on. That leaves $25 billion Realty Income, which could probably pull it off, but it would still be a massive acquisition. And while Realty has been spreading out into new areas lately, it isn't nearly as aggressive in its diversification efforts as VEREIT and Carey. Realty's management probably wouldn't want to take on VEREIT's mix of assets at the scale VEREIT has today. It's true that private equity could potentially step in here, but there's no way to predict such a move, and $10 billion is still a very big number.

Buy on its own merits

The upshot is that VEREIT looks relatively cheap today compared to some of its closest peers. And even after a big stock price advance in 2019 and the issuance of new shares, it looks like it will still offer a generous and sustainable 5.6% yield. Add in a diversified portfolio and the clearing legal clouds, and dividend investors might want to take a second look at the name.

But don't go in expecting it to be a buyout candidate with the idea of turning a quick profit on a special situation stock. There are just too many headwinds to an acquisition deal for that to be a high-probability event. This is a buy and hold investment as you wait for management to get VEREIT back into growth mode now that its past troubles are nearly behind it.