What happened

Shares of Lumentum Holdings (LITE 1.10%) rose 17% in October 2019, according to data from S&P Global Market Intelligence. The former optical products division of JDS Uniphase spent most of the month tracking close to the overall market's ups and downs. That changed on Oct. 31, when a strong earnings report sent Lumentum's stock surging 14% higher over the next two days.

So what

Lumentum's sales rose 27% year over year in the first quarter of fiscal year 2020, landing at $450 million. The analyst consensus for this metric stopped at $448 million. On the bottom line, adjusted earnings increased by 9.9% to $1.44 per share. Here, your average analyst would have settled for $1.20 per share.

The midpoints of Lumentum's guidance for this period called for revenues near $445 million and adjusted earnings of approximately $1.19 per share. The results also exceeded those targets by a comfortable margin.

Looking ahead, Lumentum guided second-quarter sales to roughly $453 million and adjusted earnings to $1.28 per share. Here, the analyst consensus had pointed to earnings in the neighborhood of $1.10 per share on sales near $429 million.

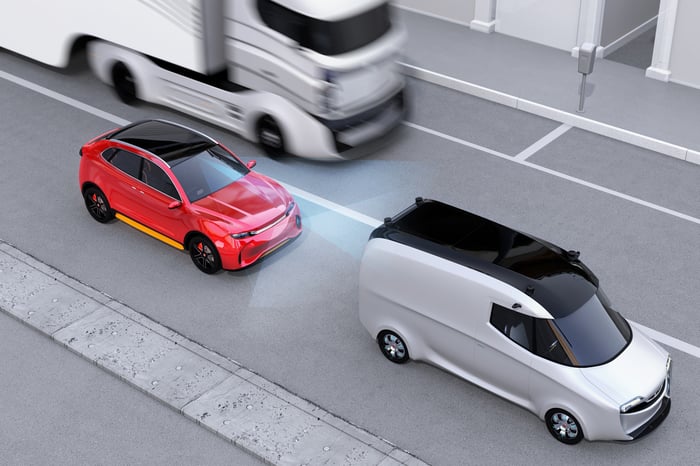

Lumentum's 3D sensors enable emergency braking systems and other self-driving features. Image source: Getty Images.

Now what

The company enjoyed a more profitable product mix in the first quarter, led by a rising interest in Lumentum's 3D sensing modules for both smartphones and self-driving cars. CEO Alan Lowe claimed that Lumentum is "winning a strong share in a larger market," which is a fantastic combination that drives both revenue growth and margin expansion. Check out our transcript for Lumentum's first-quarter earnings call to see executives diving into a much deeper discussion of these business trends.

It's no surprise to see Lumentum's shares soaring on the back of this powerful business report. With the shares trading at modest valuation ratios such as 14 times free cash flows and 12 times forward earnings, I see lots of room for further gains.