It isn't easy finding a dividend yield of 4.6% in today's low-yield world, but that's exactly what you'll get when you buy STAG Industrial (STAG -1.69%). That's more than twice the dividend yield of the S&P 500 Index, and even better the payout has been increased for nine consecutive years. That's basically a dividend hike for every year of the real estate investment trust's (REIT) existence. But is that enough to add STAG to your portfolio? There's a lot more you need to know.

1. A focused portfolio

From day one, STAG has owned single-tenant industrial properties. Originally it worked largely in secondary markets, where competition from large players wasn't quite so intense. That gave the company an edge over typical mom-and-pop competitors that didn't have access to capital markets. As STAG grew in size, however, it started to move more into primary markets. However, it continues to avoid what it calls super-primary markets. Essentially, it is avoiding the markets like the New York City area in which competition is "super" fierce.

Image source: Getty Images

Another reason STAG likes prime and secondary markets is that they have historically performed nearly as well as the top markets. For example, over the past decade occupancy levels and rent growth for prime and secondary markets have been roughly similar to those of super-prime markets. STAG tends to be selective as well, preferring to buy only properties that are integral to a company's future business. So it believes it is buying the best properties in the most attractive markets.

Meanwhile, it spreads its bets across sectors and regions. Auto components is the largest sector at 13.5% of the portfolio, with no other industry larger than 10%. Philly, Chicago, and Greenville/Spartanburg (South Carolina) are its largest markets at roughly 9%, 8%, and 6%, respectively. No other market accounts for more than 5% of the portfolio. In total it owns roughly 400 properties across 38 states.

So while STAG is highly focused on the industrial space, it benefits from a fair amount of diversification within its portfolio. Still, you can't ignore the fact that it really does just one thing.

2. Rewarding investors

The REIT has increased its dividend annually for nine years. Since it only went public in 2011, that means a dividend hike every year. Clearly STAG takes returning cash to investors very seriously. Another interesting wrinkle here is that the dividend is paid monthly, so buying STAG is kind of like replacing a paycheck. Looking at the first three quarters of core funds from operations (FFO), STAG's payout ratio is around 80%. That's not unreasonable, and suggests that dividend is safe. (FFO for a REIT is similar to earnings for an industrial company.)

STAG Dividend Per Share (Annual) data by YCharts

That said, there is one small fly in the ointment here. While STAG has increased its dividend regularly, the size of those increases has been less than impressive. In the first few years of its existence the dividend expanded rapidly, but since 2015 the dividend hikes have been just a few cents a year. So while the annualized dividend growth over the past five years has been 3.9%, dividend growth over the past three years has been just 1.4%. The most recent increase was less than 1%. Recent increases have not been enough to keep up with inflation (historically about 3% a year), meaning that the buying power of the dividend has decreased in recent years. That is not an alluring attribute.

3. Not time tested

The fact that STAG has been public since 2011 is very important for anyone looking at the REIT. Since the last recession was the 2007 to 2009 downturn, this company has only operated in a growing economy. That means it has had the wind at its back for its entire existence, and has never had to muddle through a downturn. Industrial companies like the ones that STAG counts as tenants tend to be highly cyclical business. While STAG's purchasing approach is centered on buying integral properties and it has a solid 95% or so occupancy ratio today, there's really no history to give you a clue about what might happen to the REIT when the next downturn hits.

4. A pretty penny

The final issue to look at with STAG is valuation. Assuming that the final quarter is similar to the first three, Stagg's core FFO is likely to be around $1.82 per share, giving it a price to Core FFO ratio of roughly 16.5 based on recent stock prices. That isn't outlandish given that some REITs are trading with price to FFO ratios of more than 20 times.

However, a REIT is designed to pass income on to investors. So STAG is very specifically a dividend stock -- and dividend growth has been miserly.

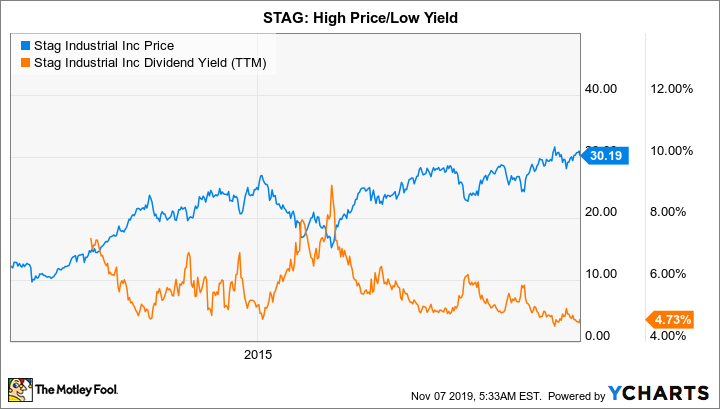

If you are buying STAG, you are most likely doing so for the yield. On the surface, 4.6% seems pretty attractive today, since it is well above the yield you'd get from an S&P 500 exchange traded fund. It's also notably above the roughly 3.1% or so that the average REIT pays, using Vanguard Real Estate Index ETF as the yardstick. However, STAG's yield also happens to be near the lowest levels in the company's history. That makes sense given that the stock price is also near all-time highs.

Simply put, STAG doesn't actually look all that cheap today. At best you could argue it is fully or fairly valued. Value-focused investors will probably not like what they see here.

Proceed with caution

If you are comfortable with paying the full rate for STAG to collect a 4.6% yield backed by a dividend that's growing below the historical rate of inflation, then it might be a buy. But that's probably not a great proposition for most investors today, especially given that the current economic upturn is among the longest on record and starting to show signs of slowing down. Now add in the fact that STAG has never actually lived through a downturn as a public company and the risk ratchets up a little bit. At this point most investors will probably be better served by keeping STAG on their wish lists.