Don't invest in the trucking sector if you can't handle cyclicality, because the ups and downs in its end-markets are equally matched by the volatility of its stocks.

If you like the industry and stocks in it, such as engine maker Cummins and truck makers Navistar and PACCAR, then the best option is probably to buy and hold long term, riding out those inevitable down periods. That said, when buying into a cyclical stock, timing is obviously important -- no one wants to invest in a stock at a peak, and this sector looks set to decline in 2020.

In that context, let's take a look at what the latest set of earnings reports from major companies in the sector suggest about buying the stocks.

The light at the end of the tunnel for trucking stock earnings could come in 2021, but investors are likely to buy in ahead of it. Image source: Getty Images.

Valuations and cyclicality

As you can see in the chart below, the valuations of trucking stocks like Cummins and PACCAR tend to be far more volatile -- and usually lower -- than those of defensive stocks like Johnson & Johnson and Colgate-Palmolive.

CMI EV to EBIT (TTM) data by YCharts. EV = enterprise value (market cap + net debt). EBIT = earnings before interest and taxation.

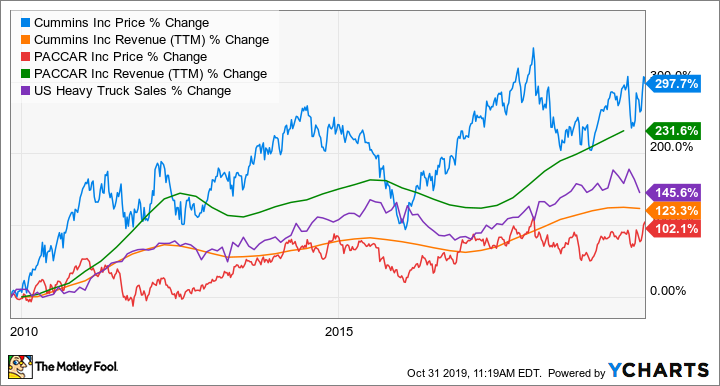

As the valuations fluctuate, so do the share prices, and as you can see in the next chart, the returns on investment one could get from Cummins, PACCAR and Navistar (excluded from these charts because it's had company-specific issues which added to its extreme volatility) were heavily dependent on when a shareholder bought in.

It's easy to see in hindsight that if you had purchased shares of Cummins and PACCAR at the start of 2016, you would now be up by 95% and 59%, compared to the S&P 500's return of 48% over the period; interestingly Johnson & Johnson and Colgate-Palmolive are only up 28% and 3% over that time.

How to buy cyclical stocks

Anyone who claims they can exactly predict the behavior of stock prices in the next cycle is a liar, but you can look at how stocks have traded during previous periods when conditions were similar to the current ones, and consider what followed them. One key variable in this sector is U.S. heavy truck sales, because they tend to correlate with trucking companies' revenue.

There are two interesting takeaways from the chart below, specifically regarding the periods at the start of 2013 and 2016, when the share prices of Cummins and PACCAR rose significantly even as truck sales had peaked and trucking stocks' revenue and earnings were continuing to decline.

Clearly, the market decided to buy in ahead of a bottoming in truck sales, and continued to buy the stocks even as their valuations rose for an extended period -- due to the combination of rising stock prices and deteriorating earnings.

If history is a guide then the time to buy trucking stocks is when revenue and earnings start to turn down -- something that a lot of investors will find counter-intuitive.

Is now a good time to buy trucking stocks?

Let's take a look at the current situation. As you can see below, a strong truck market in 2019 means 12-month trailing revenue still grew for all three of these companies in their latest quarters. However, truck industry production is set for a sharp decline in 2020, and that's likely to reduce revenue and earnings. Indeed, PACCAR expects Class 8 heavy-duty truck retail sales in the U.S. and Canada to decline from a range of 310,000 to 320,000 this year to between 230,000 and 260,000 in 2020. Navistar also predicts a sharp decline in industry production.

However, the big question is what will the industry look like in 2021? One forecast comes from a recent report from a leading trucking industry research company: "With a major trade caveat, our underlying view is that the economy will have slower growth but not recession, so the heavy duty truck market rebounds and enjoys three years of growth from 2021 to 2023," wrote ACT Research senior analyst Tim Denoyer.

That would be great news for trucking stocks, as it would indicate a return to revenue and earnings growth in 2021, and based on history, the market would start pricing in a recovery sometime in 2020. However, as noted above, the difficult bit is predicting the timing of the recovery in stock prices. It's impossible to know this, but we can know the current value of what we are buying.

|

Company |

Revenue Growth (TTM) |

Forecast Revenue Growth 2020 |

Forecast 2020 P/E Ratio |

|---|---|---|---|

|

Navistar (NAV) |

7% |

(8.4)% |

10.4 |

|

Cummins (CMI 0.02%) |

25.5% |

(7)% |

12.7 |

|

PACCAR (PCAR -1.87%) |

35.6% |

(15.3)% |

13.8 |

Data source: Company presentation. Analyst estimates. TTM: trailing-12-month.

Putting it all together

If Denoyer is right, and heavy-duty truck sales in the U.S. bounce in 2021 -- and the market starts to anticipate this -- then history suggests that trucking stock prices will rise. Moreover, the forecast 2020 valuations for Navistar, Cummins, and PACCAR make them look good values on a historical basis for companies that are set to enter up-cycles in 2021.

In short, don't worry too much about falling truck sales, trucking stock earnings, or the probability of rising valuations in 2020 -- we know all that is coming. Provided the economy doesn't fall into recession, and 2021 delivers a bounce in demand, then history suggests trucking stocks are a good value right now -- and are probably better bets than some defensive stocks.