If you are a dyed-in-the-wool dividend investor, then you probably love to see a stock with a big yield. In fact, high-yield dividend stocks probably draw you like a moth to a flame. That's not a problem if you approach dividend investing with the proper care. If you don't, however, you might end up burned. Here are seven key facts to consider as you look at high-yield dividend stocks.

1. Yield is just one way to look at dividends

Dividends are great, representing a tangible return of value to shareholders. But there's a lot of information content in a dividend -- companies know dividend hikes are viewed as a sign of strength, while dividend cuts are not something Wall Street likes to see. So a company with a long history of increasing its dividends has been making a statement about its financial strength, and every new increase suggests that management sees a bright future ahead.

Image source: Getty Images

That's why investors need to pay close attention when a company with a long string of annual dividend increases decides to hit the pause button. It doesn't mean a dividend cut is imminent, but it should lead you to take a deeper look at what's going on. A high yield and a dividend streak that has just gone cold can be a warning sign that all may not be right. And don't give a pass to a company that has recently reduced its dividend but still has a high yield. You need to dig into the story, because it isn't uncommon for a company that reduces its dividend to a "more sustainable" level to end up reducing it again (or even eliminating it) if the business doesn't turn around as expected.

Midstream pipeline company Plains All American (PAA 0.58%) is a great example. After a long string of distribution increases, the limited partnership held the dividend steady for four quarters before cutting it roughly 20% in 2016. One year later the dividend was trimmed again, this time by 45%, because management's turnaround effort wasn't going as well as hoped. The total reduction was nearly 60%.

A high yield in many cases is a function of investor concern. If Wall Street is worried, you should be too. You may decide that a dividend is secure, but that's a decision to make after you've dug into the story a little bit.

2. Tool number 1: Payout ratio

One of the first tools an investor should check with a high-yield stock is its payout ratio. This compares the dividend to earnings, and gives an idea of how sustainable the dividend is. If the payout ratio is low (say 33% or below), the dividend should be pretty secure. A payout ratio between 33% and 66% is fairly normal and nothing to really worry about. But a payout ratio that gets past 66% starts to be a concern, and if the payout ratio tops 100%, there is a real risk of a dividend cut.

These are rough guides, since every industry is unique. For example, utilities with government-regulated monopolies to sell a vital product (like electricity) can often support higher payout ratios. Southern Company (SO 3.00%), one of the largest domestic utility companies, has paid over 70 years' worth of dividends at the same or higher level, and routinely has a payout ratio between 66% and 100%. But in general, a lower payout ratio is better, and higher numbers should trigger further research.

3. Tool number 2: Cash dividend payout ratio

Here's the interesting thing about the payout ratio: Dividends don't actually come from earnings, they come from cash flow. So a company can actually have a payout ratio of more than 100% for an extended period of time if it has the cash flow to support that payment. In 2017 and 2018, for example, Southern's payout ratio jumped over 100%. And real estate investment trusts (REITs) often pay out more than they earn -- by law they have to pay out at least 90% of their earnings, but they generally exceed this figure.

There are a couple of reasons why this could happen, but they boil down to the fact that earnings are really an accounting number. Things like depreciation and amortization reduce earnings for accounting reasons, but don't actually impact cash flow. That's why REITs with material depreciation expenses related to the properties they own can pay out more in dividends than they earn. In the case of Southern, one-time non-cash charges were the culprit, pushing earnings sharply lower even though the utility's cash flow remained strong. So if the payout ratio is kind of ugly, then your next stop should be the cash dividend payout ratio. This number compares dividends to cash flow to give a more accurate look at whether or not a dividend is sustainable. Lower percentages are, again, better.

4. Tool number 3: The balance sheet

If you have a concern about a company's dividend, however, don't stop with the two payout ratios. You also need to take a closer look at the company's balance sheet, which is the financial foundation underpinning the payout. There are a number of different things you can look at here (and none are exactly perfect), but one number that is quick and easy is the debt to equity ratio. This basically looks at the company's capital structure to see how much is made up of equity and how much debt. If debt is a big percentage of the pie, the company is considered highly leveraged. Lower is better, obviously, but anything above 1 should probably be looked at fairly closely.

Another tool that builds off the balance sheet, but is actually found on the income statement, is times interest earned. This number compares interest expenses to income to see how well a company is able to cover its interest expenses. So a company with a heavy debt load may be able to pay the associated interest expenses with ease, in which case its debt load isn't as troubling of an issue. However, as times interest earned approaches one, the risks rise. And a number below one is a clear sign of financial strain. A higher number is better here.

Kinder Morgan's (KMI 0.40%) aggressive use of leverage was a key reason why it chose to cut its dividend 75% in 2016. Management essentially had to make a choice between the dividend and spending on growth. With a heavy debt load, the final call was capital investment. The dividend cut was probably the right call for the company, which is again increasing its disbursement, but dividend investors weren't pleased at all.

5. Don't forget to look at the business

That brings us to the next big issue: business models. As hinted above, utilities can generally support higher payout ratios, and higher debt loads, because they are regulated monopolies selling vital products. But a company that's taken on a huge pile of debt to consummate a big merger is a different story. If the combination doesn't work out as hoped, the extra leverage could end up dooming the dividend.

There are a lot of complications that you need to consider. For example, a company that operates in a dying industry (think buggy whips at the extreme) or within an industry that is prone to volatility (like oil and natural gas drilling) or one that's highly cyclical (steel) requires you to think about dividend safety in a different way. Even companies in very stable industries need to be looked at carefully, since a competitor that's falling behind its peers may also end up cutting a dividend to free up cash for other purposes (such as investing in growth initiatives).

In other words, the sustainability of the dividend isn't the only thing you need to monitor. You also need to examine the sustainability of a company's business model. A weak business model is just as much of a risk to a dividend as a high payout ratio.

6. Dividend yield as a valuation tool

So, at this point, it should be clear that a high yield can be a warning sign of trouble. There are ways to assess the level of concern you should have, but you shouldn't ignore that a high yield is a sign from Wall Street that investors have concerns. That said, Wall Street also has a bad habit of going to extremes, often tossing the baby out with the bathwater. So a high yield can be a valuable signal that a stock is worth examining.

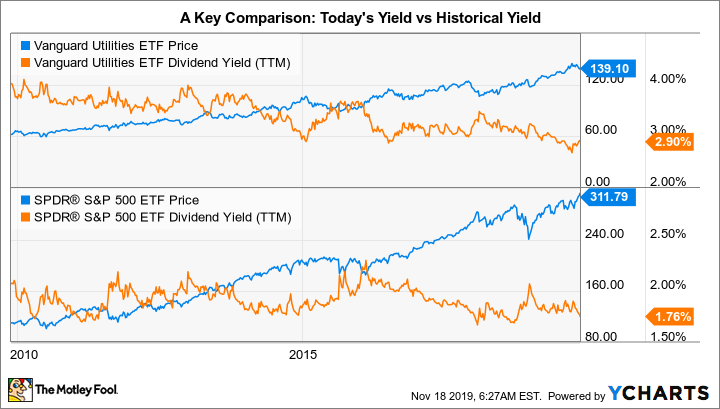

But don't get caught up on the absolute level of the yield -- take a look at the yield relative to the company's history. If, for example, a company's yield has trended in the 2% range and suddenly it's at 4%, it might be a good time to jump aboard. Clearly there's more to know (see points 1 through 5), but Wall Street has put a "for sale" sign on the stock. There may be a good reason for that, and maybe you're best off avoiding the name. But every so often "groupthink" gets the story wrong, and a great company goes on sale.

The flip side of this is also important. There are times when a company will have a high yield relative to the broader market, but one that is low relative to its own history. In this case, the stock might actually be expensive. In 2019, for example, the prices of utility stocks took off. The group as a whole still offered decent yields relative to the broader market, but a lot of individual names had low yields relative to their own histories. So despite boasting what looked like high yields, some utility stocks still weren't worth owning because they were actually expensively priced.

7. Don't forget dividend growth

High yields are great, but the buying power of a stagnant dividend will slowly be eroded by inflation. One of the best examples of this is the rising price of postage stamps. In the early 1980s you could send a letter for $0.15. Today, mailing that same letter would cost $0.55. A dollar that bought roughly six stamps with some change left over in 1980 would only get you one stamp in 2019 -- you'd actually need to add ten cents to get just two first-class stamps. Now imagine if your dividend never increased over that span. You would be in a world of pain every time you went to mail a letter!

While it may be great to buy a stock with a 9% yield today, you might actually be better off over the long-term if you buy a stock with a lower, more secure dividend (say 4% or 5%) that is growing. The key number here is inflation, which has grown about 3% a year on average over time. A dividend growing faster than that is good, anything lower requires more thought. It may be that you expect price appreciation to more than make up for a dividend that isn't growing. But if you are thinking that you'll just live off the income your portfolio generates, then dividend growth becomes increasingly important.

A high yield is just one piece of the puzzle

Perhaps the most important takeaway here is that a high yield is just one data point -- it shouldn't be the only thing you look at. There's a lot of information content in a yield, but not enough to make an investment decision. The seven facts here will help you dig more deeply into high-yield stocks so you can figure out if they belong in your portfolio or not.