What happened

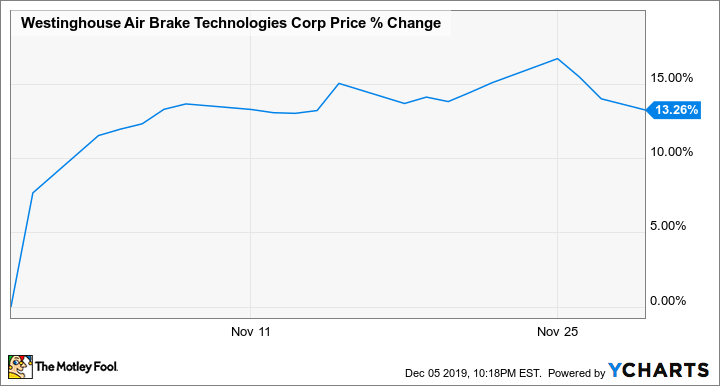

Shares of Wabtec (WAB -0.63%) gained about 13.3% in November, according to data provided by S&P Global Market Intelligence. Nearly the entire move higher occurred in the early days of the month, shortly after the company released better-than-expected quarterly earnings and upped the low end of its full-year guidance.

So what

Wabtec, short for Westinghouse Air Brake Technologies, posted third-quarter results on Oct. 31, and investors were pleased with what they saw. The railroad locomotive manufacturer reported steady progress integrating its massive merger with the transportation business of General Electric, and reported earnings of $1.03 per share, $0.02 better than expectations, despite missing the consensus revenue estimate by $70 million.

CEO Rafael Santana described "challenging conditions in the North American freight market," but said the company is having success offsetting that weakness via aftermarket, or spare part, sales and through cost controls, saying management has "strong confidence that we will exceed our synergy target of $250 million before 2022."

Image source: Getty Images.

Wabtec lowered its full-year revenue projection by $100 million to $8.2 billion, which is shy of the $8.28 billion estimate. But the company also sounded an optimistic tone on earnings, narrowing its full-year earnings estimate to $4.15 to $4.20 per share, from $4.10 to $4.20.

Now what

Santana and his team appear to be doing a good job of managing a large integration and dealing with the current environment, but the revenue pressure Wabtec's business experienced in the quarter is unlikely to fade anytime soon.

Railroads have been cutting back on spending in response to tariff wars and trade tensions that are slowing freight volumes. Wabtec also must deal with trends in the rail industry that are allowing railroads to do more with less equipment, potentially cutting into long-term demand for new locomotives.

Wabtec in buying the GE business is trying to stay out ahead of those trends by driving down costs and gaining economies of scale. It's the right long-term strategy, but the company will be challenged to stay ahead of those possible derailments in the quarters to come.