The global battle for commercial air superiority pits Boeing (BA -0.24%) against Airbus (EADSY), two global titans with portfolios of large and midsize jets that account for most global commercial aviation flying. The companies also each have a smaller, but significant, defense division that should serve as a counterweight when an eventual commercial slowdown occurs.

Pilots, airlines, and even passengers often have preferences when it comes to choosing between flying Boeing or Airbus jets. But which is the better option for investors? Here's a look at the two aerospace giants to determine which, if either, is the better buy today.

Boeing: Battling through headwinds

Boeing is a diverse U.S. aerospace and defense giant with more than $100 billion in annual sales and a product lineup that includes space, military aircraft, helicopters, and even submarines, to go along with its stable of commercial aircraft. The company enjoys a multiyear commercial order backlog, and a series of important contract wins in the last 18 months has helped revitalize its defense unit.

But all of those reasons for optimism have been overshadowed of late by a pair of fatal crashes that led to the grounding of Boeing's new 737 MAX. Boeing has continued to manufacture the planes during the post-crash investigation, in part to keep its supply chain healthy, and is likely to face billions in losses as it compensates customers for the delays and expenses related to getting the growing backlog of jets ready for flight.

Boeing's Dreamliner 787-10. Image source: Boeing.

The investigation into what happened to the 737 MAX has revealed embarrassing details about how Boeing handled the certification process, adding to criticism of a company that has also in recent years faced a public rebuke by the Pentagon. Boeing is juggling multiple issues besides the 737 MAX, including testing setbacks with its planned 777X jet and troubles with its long-delayed refueling tanker.

Boeing hopes to have the 737 MAX back in service by early 2020, but the company's timeline is in danger of further slippage. Regulators are unlikely to move quickly toward recertification, and even after regulators give the plane the all clear to fly again, there is likely to be intense scrutiny on new deliveries that have been sitting parked for months, which will slow the delivery timetable.

At best the 737 MAX program is back at its pre-accident pace by mid-year 2020, but Boeing seems unlikely to follow through with its planned production boost from 42 frames per month to 52, and eventually 57, as quickly as it would have hoped. So even if the 737 MAX does end up the commercial hit that it was expected to be prior to the crashes, the payoff for investors is likely to drag into 2021 at least, and potentially into 2022.

Airbus: Ready for takeoff

Airbus, with sales of $60 billion, is an amalgamation of European aerospace companies cobbled together in the early 1970s to better compete against U.S. giants. The company, once known as European Aeronautic Defence and Space, took the Airbus name in 2017 and is today publicly traded, but remnants of its legacy structure remain.

The German, French, and Spanish governments together own more than 25% of the stock through state-owned holding companies, and politicians have historically used their ownership to block or influence corporate actions like potential mergers or restructurings.

Airbus' A330neo widebody jet. Image source: Airbus.

Airbus arguably has the more complete lineup of commercial aircraft, thanks in part to its 2017 acquisition of a controlling stake in Bombardier's CSeries jet family, and the company boasts a larger backlog than Boeing. But it has also has been plagued by production problems that have caused it to miss delivery targets and burn cash. Some of the fault lies with suppliers, including United Technologies' Pratt & Whitney engines, but Airbus has also been delayed due to internal design changes and backed-up assembly lines.

Airbus' $11 billion defense business has historically been more of an afterthought than the Boeing Defense unit. Airbus Defence has a steady stream of revenue-generating contracts but appears to lack an innovative new potential platform that could move the needle in years to come.

The case for Airbus over Boeing is built around Airbus' more mature product line, which doesn't have the same risks as the 737 MAX and the 777X, and which should be a cash machine over the next few years. Between now and 2022, much of the cash that is generated from the Airbus backlog should fall straight to the bottom line at a time when Boeing is focused on research and development and compensation for 737 MAX issues.

And the better buy is...

Although there is the threat of new commercial aerospace competition coming from China, for the foreseeable future Boeing and Airbus largely enjoy a lucrative duopoly in airplane sales with a viable moat given how capital intensive and technically demanding this industry is. This is not a winner-take-all sort of competition, and I believe both Boeing and Airbus will be around for years to come, and shares of both should appreciate over time.

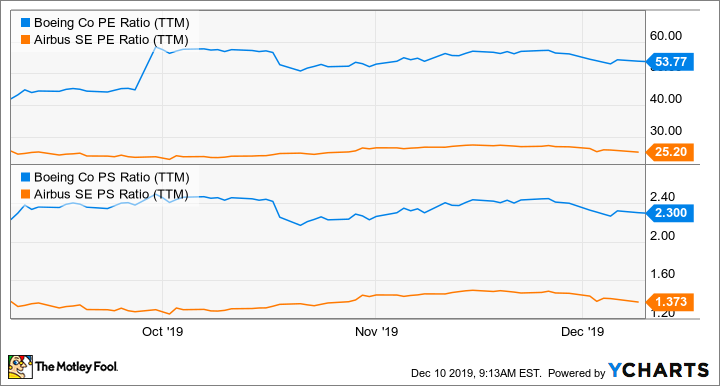

The question of which to buy now is best answered based on an investor's time horizon. Airbus over the next three to five years seems poised to outperform Boeing based on the expected expansion of free cash flow as it ramps up deliveries, which should help it to narrow a valuation gap that currently has Airbus shares trading at less than half Boeing's multiple to earnings and about 40% below Boeing's multiple to sales. Boeing, meanwhile, is likely to be mired down in 737 MAX issues well into 2021 and faces elevated R&D spending for the 777 and a potential 757 replacement.

Boeing vs. Airbus data by YCharts.

Government ownership risk has historically been responsible for some of Airbus' discount and remains a worry. But the company under recently retired CEO Tom Enders made great strides in reducing political meddling. Investors should watch closely to see if new CEO Guillaume Faury is able to continue Enders push for independence.

Over a longer time horizon, it's hard not to be impressed by the breadth of Boeing's portfolio, and the company's outsize exposure to the massive U.S. defense and space markets. Boeing is likely the better bet for a true "buy and forget about it" investment with a multidecade time frame, but I'm worried the next few years could be rocky for this aerospace titan.