What happened

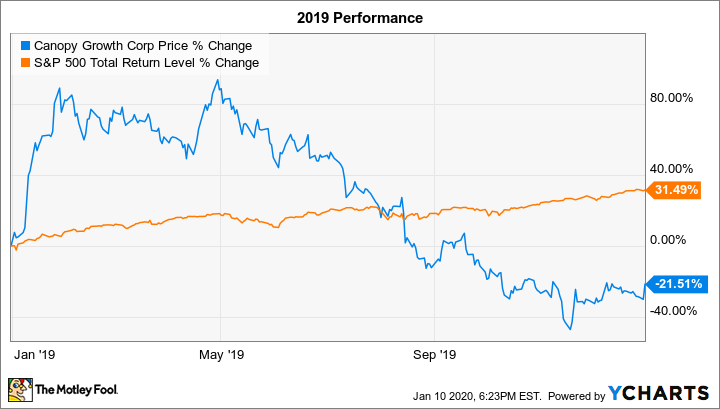

Shares of leading Canadian marijuana grower Canopy Growth (CGC 20.65%) declined 21.5% in 2019, according to data from S&P Global Market Intelligence. That might not sound so terrible, but when you consider that the S&P 500 returned 31.5% last year, that means Canopy stock underperformed the market by 53%.

In 2020, shares are down 2.6% through Jan. 10, compared with the S&P 500's 1.1% return.

Image source: Getty Images.

So what

Canopy Growth stock started 2019 on an incredibly strong note. By the end of April, it was up a whopping 88%, or almost five times the S&P 500's 18.3% return. Along with general bullishness in the cannabis space, here are the main company-specific catalysts that lit a fire under Canopy stock in the first four months of last year:

January: Shares soared 82.3% in January, with the biggest company-specific catalyst being Canopy's announcement early in the month that it planned to enter the U.S. hemp-derived cannabidiol (CBD) market. This market opened up on Jan. 1, 2019 when the United States legalized industrial hemp. Shares also got a boost mid-month when the company announced that it received a license from New York State to process hemp and produce products derived from it.

April: After gaining just 3.2% in February and falling 8.5% in March, Canopy stock jumped 16.5% in April. This rise was driven largely by the company's announcement that it was buying the rights to acquire Acreage Holdings (ACRGF), a U.S.-based cannabis producer. The "deal involves Canopy paying $300 million up front for the right to acquire Acreage for $3.4 billion, if and when the U.S. federal government legalizes marijuana," as I previously wrote.

Data by YCharts.

Canopy stock began its big 2019 slide in May. The drop was due to some company-specific news, along with market sentiment turning bearish in the cannabis realm. The negative sentiment is largely being driven by the Canadian legal marijuana market -- which opened (for dried flower and oils) in October 2018 -- growing more slowly than expected. There have been numerous kinks in the province-distribution system.

Throughout the year, Canopy disappointed investors with its quarterly revenue coming in lighter than expected and losses coming in larger than anticipated. Whether the company has been investing wisely for growth or spending like a drunken sailor is a matter of opinion. Canopy's partner, alcoholic beverage giant Constellation Brands (STZ 0.53%), which owns a 38% stake in Canopy, wasn't happy with the losses. In July, the company's co-founder Bruce Linton was fired from his position as co-CEO. That left Mark Zekulin as sole CEO, while Canopy searched for a new leader.

In early December, Canopy announced that Zekulin would step down on Dec. 20 and David Klein, currently CFO of Constellation Brands, would take the reigns on January 14.

Now what

Tomorrow starts the Klein era at Canopy Growth. Investors should get to hear from him next month. While Canopy hasn't yet set a date for the release of its third-quarter results for fiscal 2020, it should be about mid-February. Wall Street is expecting revenue growth of 24.6% year over year and the loss per share to widen by 26.3%.

Investors should expect early demand for "Cannabis 2.0" products to be discussed on the call. In October, Canada legalized products derived from marijuana, such as edibles, beverages, and vapes, and these products became available in December.