Boeing (BA -2.87%) was flying through turbulence well before the novel coronavirus outbreak, underperforming the S&P 500 by more than 28 percentage points in 2019 due to the fatal crashes and subsequent grounding of the 737 MAX airplane.

Any hope of a quick recovery in 2020 has been dashed by the health crisis, which has crippled demand for travel and caused airlines to rethink their near-term growth plans. Boeing shares have lost more than 50% of their value in the last month, performing far worse than the broader market during a period of heavy selling.

BA vs. S&P 500 year to date data by YCharts

Boeing shares are cheaper now than they have been in three years. But does that make the company a buy?

A tough situation is about to get worse

The investigation into what happened to the 737 MAX has led to a string of embarrassing revelations about Boeing's culture, but through it all, bulls have taken comfort in the plane's impressive 4,300-plus strong order backlog and the airline industry's seemingly insatiable demand for new planes.

Commercial aerospace has traditionally been a highly cyclical business, and in some parts of the market, it appears the cycle has peaked. Boeing even before the outbreak had planned to reduce production of its 787 Dreamliner to 10 per month in 2021 from 12 per month this year.

Boeing 787 Dreamliner in flight. Image source; Boeing.

Demand for smaller, single-aisle planes like the 737 has held up better, but COVID-19 could put an end to that. Airlines are aggressively cutting back flights and taking planes out of service, with Delta Air Lines alone grounding up to 300 planes.

It's way too soon to know how long those planes will be out of service, but if travel does not rebound quickly airlines are likely to turn conservative on new plane purchases. Southwest Airlines, one of the largest MAX customers with 310 planes on order, conceded it will keep its options open on delivery as the crisis unfolds.

Boeing reported negative net orders in February, with 46 cancellations and only 18 gross orders.

It seems unlikely demand for the 737 MAX will collapse, but a program that prior to the grounding was supposed to be a multi-year cash cow for Boeing is slowly turning into a nightmare. Even a small downturn in demand could cause Boeing to never hit the monthly production rates for the plane that it had once envisioned, which in turn would mean the plane will never be as profitable for the company as analysts had once assumed.

Can Boeing fly straight?

The 737 MAX is by no means Boeing's only black eye. The company's defense unit, which generates just 25% of total sales but is still large enough to rank it among the top U.S. defense contractors, has been plagued by issues with its refueling tanker, leading to more than $2 billion in charges and a rare public rebuke from Pentagon officials.

Boeing has also run into setbacks in the development of its new 777X, a technological marvel but with an uncertain market opportunity.

The company has credibility issues all over its portfolio. Boeing's board took a step to right the ship late last year when it fired CEO Dennis Muilenburg, but his replacement, David Calhoun, has been on the board since 2009 and is hardly an outsider.

Calhoun has taken some initial steps to try to revamp how Boeing does business, but the fear is the institutional rot is so deep that it could be a long time before Boeing's culture improves. At the very least, investors should be wary about culture issues at Boeing, given the company's recent track record.

It's cheaper, but not on sale

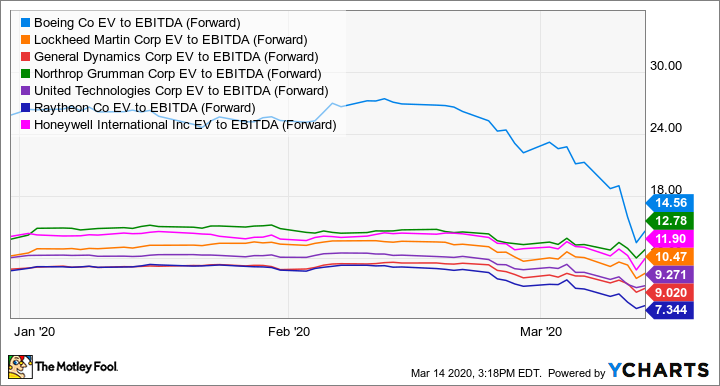

For all of its issues and the dramatic decline in share price in recent weeks, Boeing is not a particularly cheap stock. The company's enterprise value is 14.56 times expected earnings, well above the multiples of other large industrials with a significant aerospace business.

Aerospace EV to EBITDA (Forward) data by YCharts

Boeing has historically traded at a premium because of the strength and diversity of its businesses, but at this moment the company's reliance on commercial aerospace makes it even more vulnerable to additional weakness than many of those defense and industrial-focused peers.

Travel demand is not going to permanently evaporate, and thanks to its duopoly with Airbus, Boeing is going to soak up a lot of revenue in years to come to meet that demand. It's possible to see a future where the 737 MAX has returned to the skies, airlines are again in expansion-mode, and Calhoun has put his stamp on the company's culture such that internal processes begin running more smoothly.

Nevertheless, it is hard to imagine all of that happening overnight. Given the uncertainty, the long-term nature of some of the risks to the company, and the numerous other aerospace stocks with more attractive stories to tell that have also fallen in recent weeks, there's no reason to buy into Boeing right now.

Boeing shares are lower, but the stock is not yet a bargain.