With just about everyone who is still working doing so from home due to the COVID-19 outbreak, there has been a huge increase in the use of cloud services and online grocery orders. Alibaba (BABA 2.92%) and Amazon.com (AMZN -1.64%) are two of the top e-commerce and cloud service providers in the world.

Alibaba dominates China's e-commerce market, with 824 million users on mobile. The Chinese tech giant is also the leading cloud service provider in China with Alibaba Cloud.

Amazon is increasing its share of e-commerce in the U.S., as it becomes the go-to online store for people relatively new to buying things online. The company has over 150 million Amazon Prime members who enjoy free shipping and other services as part of a yearly subscription. Most of the company's profit, however, is generated from Amazon Web Services, which is helping organizations migrate their data systems from on-premise servers to the cloud.

Both companies were growing fast going into the coronavirus crisis, but the practice of social distancing will only make these companies stronger as more people adopt online shopping. We'll compare Alibaba and Amazon on financial fortitude, growth, and valuation to determine which stock is the better buy.

Image source: Getty Images.

Financial fortitude

In hard times, companies that have plenty of cash can weather the storm, while companies that are swamped with debt add an additional element of risk that you can avoid by investing in cash-rich companies like Alibaba and Amazon.

Both companies are cash machines, as noted by the high levels of free cash flow and the amount of cash on their balance sheets.

| Metric | Alibaba | Amazon |

|---|---|---|

| Revenue (TTM) | $70.6 billion | $280.5 billion |

| Free cash flow (TTM) | $28.7 billion | $21.7 billion |

| Cash | $51.1 billion | $55.0 billion |

| Debt | $17.5 billion | $23.4 billion |

Data source: YCharts. TTM = Trailing 12 month.

The main difference between the two is that Alibaba generates more free cash flow relative to revenue than Amazon. Free cash flow is an important profitability metric to watch, as it shows the actual cash that is left over for value-creating moves like dividends, share repurchases, and acquisitions after paying all expenses and reinvesting in the business for growth.

Overall, Alibaba has the advantage here.

Which company is growing faster?

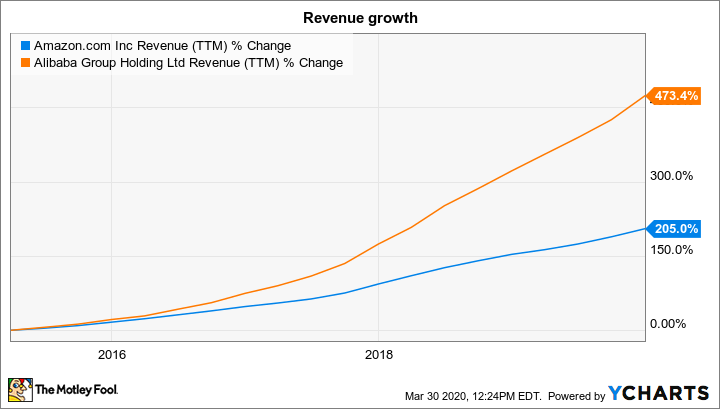

While Alibaba and Amazon have both been around for more than 20 years, both companies are still growing very fast, especially for companies of their size.

Alibaba posted revenue growth of 38% year over year in the recent quarter. It operates the popular Taobao and Tmall marketplaces in China. The Chinese tech giant is also investing outside of China with Lazada, which serves as Alibaba's e-commerce platform for Southeast Asia. Lazada's grocery arm, RedMart, experienced a surge in demand recently due to the COVID-19 pandemic.

Alibaba also operates the Freshippo supermarket chain, which is part of the New Retail initiative to bridge technology with the in-store shopping experience. In the recent quarter, Alibaba's New Retail businesses grew 128% year over year. Management said that Freshippo and Taoxianda's average basket size "increased significantly" as more people started shopping online for groceries amid the pandemic.

Alibaba Cloud continued to grow fast, up 62% year over year, bringing cloud revenue to 7% of Alibaba's total business. Cloud is the data intelligence backbone of Alibaba. All of the company's e-commerce businesses recently migrated their data systems over to the public cloud, which helped Alibaba power over 544,000 orders per second at peak demand last quarter.

Management believes the migration of its businesses over to the cloud will improve operating efficiency and encourage other businesses to adopt Alibaba Cloud for their cloud infrastructure.

AMZN Revenue (TTM) data by YCharts

Amazon saw its revenue increase by 21% year over year in the fourth quarter. While Amazon Web Services makes up only 12% of total revenue, it comprises about two-thirds of the company's operating profit. This is in contrast to Alibaba, where its commerce platform generates all the profit, with Alibaba Cloud and entertainment businesses (Alibaba Pictures, Alibaba Music, etc.), generating losses on the bottom line.

Growth at Amazon Web Services has decelerated in recent quarters, but it still looks strong at 34% year over year in the last quarter. Amazon Web Services is a large business at $35 billion in annual sales, and it is still adding new organizations across a range of industries.

Like Alibaba's commerce platform, Amazon has also experienced a spike in online orders for everyday essentials. Prime Pantry and Whole Foods Market have particularly gotten swamped with grocery deliveries. The company said it would hire 100,000 new workers to meet demand.

But other parts of both companies' retail businesses will likely suffer amid the weak economic backdrop. Amazon has said it will limit capacity for non-essential inventory in its warehouses to make more room for higher-priority items. Alibaba reported weakness in its local consumer services business, including restaurant ordering, in its last quarterly report.

Still, just as the SARS outbreak in 2003 helped accelerate e-commerce adoption in China, creating the most advanced digital society in the world, the same trend could happen in the U.S over the next decade, which might make this an ideal time to consider buying shares of Amazon.

However, the numbers are clear: Alibaba is the winner on growth right now.

Valuation

It's always important to check a stock's valuation before buying it, so here's how Alibaba and Amazon measure up.

| Metric | Alibaba | Amazon |

|---|---|---|

| P/E ratio | 20.3 | 85.5 |

| P/CFO per share | 17.5 | 25.7 |

| P/Sales | 7.1 | 3.53 |

| EV/EBIT | 17.0 | 58.7 |

Data source: YCharts. CFO = Cash from operations. EV/EBIT = Enterprise value-to-earnings before interest and taxes.

While Amazon's price-to-earnings (P/E) ratio looks high, the stock doesn't look as expensive on the basis of other metrics, like P/CFO and P/Sales. But across all measures of value, Alibaba looks like the best deal.

However, keep in mind that Alibaba is generally priced lower than Amazon because of the perceived risk of investing in China. The potential for greater regulation by the Chinese government, which can spring on investors at unpredictable times, is something investors must consider before buying shares of Alibaba.

That said, Alibaba's lower valuation already reflects this higher risk, but the regulatory wildcard might be enough for some investors to favor Amazon. Some analysts believe Amazon is undervalued based on the fast growth and high profit margins of Amazon Web Services.

Which is the better buy?

I personally own shares of Amazon and believe it's a good stock in which to park some money in this environment. But if you don't mind the added risk that comes with China stocks, Alibaba is a worthy growth stock to consider, too. It has a fortress-like balance sheet, it's growing faster, and the stock sports an attractive valuation relative to underlying growth.

The decision ultimately comes down to individual risk tolerance about investing in China. Excluding that risk, Alibaba is clearly the better buy based on growth and valuation.