What happened

Shares of Dollar Tree (DLTR -1.23%) slipped 11.5% in March, according to data from S&P Global Market Intelligence. The bargain retailer's stock dipped early in the month after fourth-quarter results arrived with sales that fell short of expectations, and its share price moved lower as the broader market saw steep sell-offs related to the coronavirus pandemic.

Dollar Tree reported fourth-quarter earnings on March 4, delivering adjusted earnings per share of $1.79, topping the average analyst estimate of $1.76. But revenue of $6.32 billion for the period fell short of the average analyst call for $6.39 billion. Dollar Tree stock saw another pronounced drop at the end of the month after the company issued an update suspending its fiscal guidance for the current year due to the pandemic.

A Dollar Tree logistics center. Image source: Dollar Tree.

So what

Fourth-quarter results came with guidance for the current fiscal year and the added caveat that the targets did not account for potential coronavirus-related effects on supply chains and other aspects of the company's business. The company had been targeting low-single-digit growth in same-store sales for the year, revenue between $5.89 billion and $5.99 billion, and diluted EPS between $1 and $1.09. But management issued an update on March 31 withdrawing its previously published outlook.

Dollar Tree wasn't the only company in the discount-retail space to suspend guidance last month. Big Lots (BIG 6.71%) reported fourth-quarter earnings on Feb. 27 and issued guidance for the first-quarter and full-year that also wound up being suspended in relatively short order.

Big Lots had expected EPS between $0.30 and $0.45 in the first quarter and EPS between $3.20 and $3.40 for the full year. But management issued a press release on March 30 withdrawing those targets. The company indicated that it was seeing heightened demand for food and other essential products driving comps growth, but additional operating expenses and uncertainty surrounding the broader coronavirus situation prompted it to suspend its earnings targets.

While both Dollar Tree stock and Big Lots stock saw double-digit declines in March, their rival Dollar General (DG 0.82%) came out roughly flat through the month's trading.

Dollar General has been a top performer in the discount-retail space over the last year, and it benefited from strong fourth-quarter results and analyst upgrades last month. The company reported fourth-quarter earnings on March 12, delivering EPS of $2.10 on revenue of $7.16 billion, topping the average analyst estimates of $2.01 and $7.15 billion, respectively.

Dollar General also issued guidance for the current fiscal year calling for revenue growth between 7.5% and 8%, comps growth between 2.5% and 3%, and EPS growth of 11.5%. The retailer also distinguished itself from Big Lots and Dollar Tree by not subsequently pulling its guidance.

Dollar General has generally looked stronger than Dollar Tree and Big Lots over the last few years, and its most recent earnings report and guidance bolstered the thesis that the company is a cut above in the discount-retail industry.

Now what

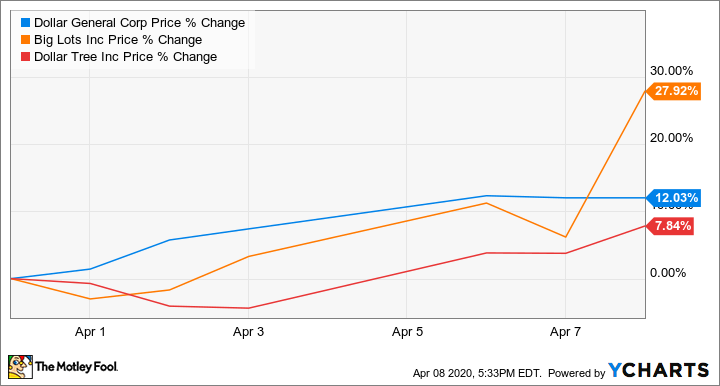

Discount-retail stocks have climbed early in April's trading, with gains at least partly driven by momentum for the broader market. Dollar Tree's gains have lagged behind those for Dollar General and Big Lots, but the stock is still up roughly 8% in the month's trading so far.

Shoppers may be more inclined to do business at bargain-priced retailers in the wake of economic pressures created by the pandemic, but investors can't take earnings resilience for granted. The potential for heightened expenses stemming from increased employee pay, new worker hires, and the implementation or expansion of services including curbside pickup could drag on profitability and offset potential sales gains.

Dollar Tree is scheduled to report first-quarter results on May 28, and the company is valued at roughly 16.5 times this year's expected earnings and 0.75 times expected sales.