Up until the outbreak of the novel coronavirus, Enphase Energy's (ENPH 2.69%) stock was the envy of the solar industry. Even after the recent price drop, the stock is still up a staggering 2,720% over the past three years. Much of that success was sparked by a pivotal deal in 2018 that turned the fledgling solar power component manufacturer to a high-revenue growth business churning out record levels of profitability and free cash flow.

With its stock now down 35% from its high in late February, some investors may be looking at this as an opportunity to grab a high-growth business at a discount to what it was just a couple of months ago. So let's look at both sides of the investment thesis for Enphase energy to determine if this is a stock to buy and hold for years to come.

Image source: Getty Images.

The case for innovation, expanding markets, and newfound profitability

Enphase's management has done a splendid job over the past few years transforming the company into what we see today. It wasn't that long ago that Enphase was a one-trick pony that had an innovative solution for the solar industry: microinverters.

Solar panels produce DC power (think a battery, or the cigarette lighter in a car) that needs to be "inverted" into AC power (what comes out of your house sockets). A basic inverter isn't a novel device, but Enphase's microinverter is innovative because it converts power at the panel itself and is able to integrate with all of the panels in a system. Inversion at the panel level optimizes power output of the whole system and allows for better system diagnostics. If one panel isn't working well, you can go straight to that panel instead of testing or replacing the entire system.

Enphase's microinverters are a great solution for residential solar panel systems. With limited space on a roof, the power output of each panel is more important than a utility system where there are fewer space constraints. So it's not too surprising to see Enphase's revenue grow quickly over the past decade as the company rode the wave of residential solar panel system growth across North America and Europe.

The trouble throughout the earlier years was that Enphase was largely unprofitable. High research and development expenses and overhead meant little to no cash was coming in the door despite the astronomical sales growth.

ENPH Revenue (TTM) data by YCharts

The big turnaround started to happen in 2018, after the company acquired SunPower's (SPWR -8.41%) inverter business and became the sole supplier for microinverters to the solar panel manufacturer. It gave the company a major sales channel with higher margins. The chart above shows how that deal lead to a rapid expansion in revenue and its first positive operating margin quarters in its history.

The influx of cash is also giving Enphase the ability to expand its offerings. The company is rolling out energy storage, microinverters for commercial-scale solar systems, energy management software, and off-grid solar and storage packages for emerging markets. Management estimates that these new offerings will expand its addressable market from $3.3 billion in 2019 to $12.5 billion in 2022.

With a business that is now showing signs of accelerating sales, improving margins, and free cash flow to invest, the company looks like a markedly better business in which to invest than the one a few years ago that seemed like a cool technology with middling returns.

The case against: Fighting an uphill battle against the solar industry

What is equally impressive about Enphase's accomplishments over the past few years is that it has done all of this in an industry that hasn't been kind to investors over the years. The solar industry, as a whole, is viciously competitive, cyclical, and is a rapid race to the bottom of the commodity price curve.

Over the past decade, the mean levelized cost of energy for a solar panel system has decreased 89%, according to Lazard's most recent Levelized Cost of Energy Report. While that has been a boom for the growth of solar power installations energy produced, it has been murder on the income statements of the companies manufacturing the equipment. Companies are constantly needing to spend money on research and development as products they rolled out sometimes are recent as 18 months ago are nearly out of date. That also involves constantly retooling manufacturing facilities for these new products, all while needing to sell them at a lower cost per watt rate.

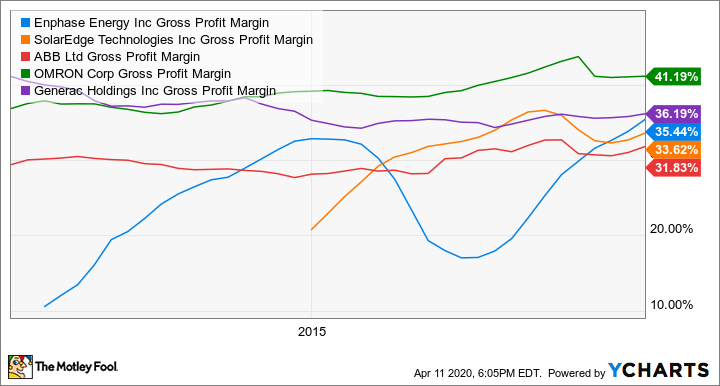

What's more, there are multiple players in this industry and the players in it can't command price premiums from things like brand recognition. The gross margins for Enphase and its competition all fall in the low-to-mid 30% range, so there is little ability to command prices to improve margins.

ENPH Gross Profit Margin data by YCharts

Were staying ahead of the competition in microinverters wasn't challenging enough, the company now has to fight that battle on another front with its battery storage options. While lithium-ion batteries are still considered an expensive storage option, the technology is following a similar cost trajectory as solar panels. Lazard's Levelized Cost of Storage Report over the past five years has noted a similar trend in the cost per megawatt hour for lithium-ion battery storage. So Enphase will have to continuously innovate to improve battery performance and not fall behind on the cost curve.

These challenges aren't unique to Enphase, though, as everyone in the solar industry has been constantly fighting against these headwinds. These headwinds have led to numerous companies rising and falling in this business, and is why the solar industry, in general, has led to horrible returns over the last decade. The Invesco Solar ETF (TAN 1.38%), of which Enphase is the third-largest holding and is more than 7% of the portfolio, has been absolutely demolished by the S&P 500.

So if you are betting on Enphase, you're betting on something that no solar company has been able to do: Generate solid returns through the ups and downs of the industry for years.

The verdict

You really have to give Enphase's management credit for the work it's done over the past few years. The deal with SunPower supercharged revenue and led to enough cost savings from manufacturing at scale to become solidly profitable for the first time in its history. The deal has also given it the opportunity -- and capital -- to pursue other growth markets.

The question is whether it can keep this up. For that to happen, its two key clients need to continue growing quickly. Of its 2019 revenue, 33% came from only two clients -- one of which is SunPower. Furthermore, it has to keep innovating on its current offerings because they, like every other solar product over the past decade, will probably be obsolete within three years or less. To satisfy that cash need, the company will need to capture a good-sized portion of that addressable market.

History hasn't been kind to solar companies and their respective shareholders, but Enphase's turnaround could be one of the few companies to break that mold. This recent economic pause caused by the novel coronavirus outbreak could be the test to see if the company can remain profitable through the ups and downs of a market cycle, or if its recent string of profitability can only occur under the most lucrative economic conditions.

If you're on the fence about buying Enphase, this will be a great time to sit back and see how it handles this situation. If there are signs that it's holding up well, then this could be a stock worth buying and holding in your portfolio.