It would be a mammoth understatement to say that the past two months have been challenging for airline stocks. America's two largest airlines by market capitalization, Southwest Airlines (LUV -0.91%) and Delta Air Lines (DAL 0.43%) have watched their share prices tumble as the number of people traveling by air has dropped precipitously. According to the Transportation Security Administration, daily U.S. passenger numbers have fallen to less than 5% of their levels a year ago.

Yet while the S&P 500 has regained 13% in April due to optimism that U.S. companies broadly will be able to survive and recover from the impact of the COVID-19 pandemic, shares of Southwest and Delta have sunk back down to near their 5-year lows.

Strong fundamentals and customer loyalty make Southwest and Delta, in my opinion, the two best U.S. airlines. And given the unprecedented predicament airlines find themselves in, it's worth taking a closer look at whether either can survive this crisis, and if so, which one is better positioned for a comeback.

Image Source: Getty Images.

Industry headwinds

There are several headwinds facing airlines at the moment. First, the industry is likely to be one of the last to fully recover from the pandemic shutdown.

On the existential side, companies are adapting to a "new normal" of working from home and communicating via streaming video meetings. That widespread adoption of virtual meetings could lead to a paradigm shift that reduces the desire for face-to-face business meetings. The fewer in-person meetings, site visits, plant visits, industry conferences, etc., there are, the less revenue there will be for the airline industry.

Warren Buffet was long an opponent of investing in airlines, but a few years ago, he began to see value in the industry. In 2016, he bought stakes in Southwest, Delta, and two other airlines, and added 5 million shares to his Delta position in 2019. But in early April, he sold large portions of his Southwest and Delta holdings.

One silver lining is that current low oil prices mean lower jet fuel prices, but many airlines hedge their jet fuel purchase, so oil would have to remain low for some time for the airline industry to see a significant benefit.

Southwest Airlines

Last year was a great demonstration of how solid management and a great balance sheet can help a company manage through rough times. "This is our 49th year and there, at least in my experience, there is no more remarkable year than 2019," said Southwest CEO Gary Kelly.

Southwest was still able to deliver record earnings per share of $4.27 despite the fact that the Boeing (BA -0.76%) 737 MAX groundings persisted through nearly 10 months of 2019 and cost the airline $828 million in operating income. Southwest's entire fleet is comprised of Boeing aircraft and it has more 737 MAX planes in its fleet than any other airline.

Southwest has a history of financial strength and a reputation for maintaining a rock-solid balance sheet. Its fundamentals, consistent performance, and low P/E ratio have historically made it a premier value stock.

Though there were a number of airline bankruptcies in the early and mid-2000s, including United Airlines (UAL 0.17%) and Delta Air Lines, followed by American Airlines (AAL -2.06%) in 2011, Southwest has remained profitable for 46 consecutive years.

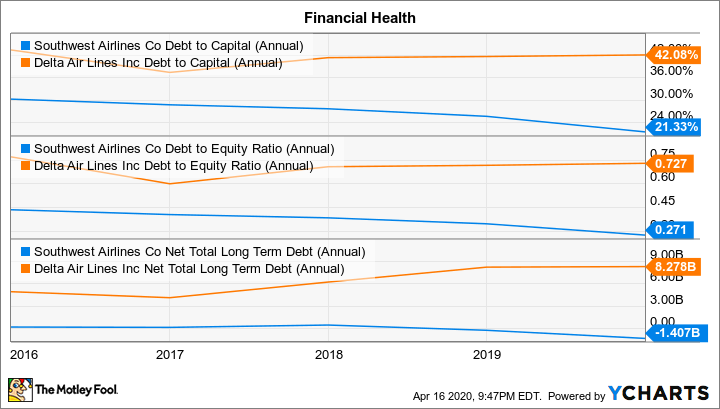

Despite its struggles in 2019, Southwest entered 2020 with the healthiest balance sheet among the six major U.S. airlines -- the lowest debt-to-capital ratio, the second-lowest debt-to-equity ratio, and the lowest total net long-term debt. That strength compared to Delta in this regard is more important than ever, as it gives Southwest more liquidity and flexibility with which to weather the present storm.

LUV Debt to Capital (Annual) data by YCharts

However, Southwest's financial position has deteriorated in the past few months, and the full extent of that regression won't be known until the company reports earnings on April 23. In the meantime, Southwest's April 14 bailout agreement with the U.S. government should provide it with the liquidity it needs during the next few months.

"Southwest will receive the funding support necessary to protect the jobs of its more than 60,000 Employees through at least September 30, 2020, with the fundamental goal to maintain the carrier's unprecedented 49-year history absent a single involuntary furlough," the company said in a press release.

Southwest will receive disbursements of more than $3.2 billion -- $2.3 billion in grants to support payroll, and $1 billion in unsecured low-interest rate loans, all backed by warrants that would dilute Southwest shares if exercised.

Southwest has reduced its planned flight activity by more than 40% for the period from May 3 to June 5 and nearly 50% from June 6 to June 27.

Delta Air Lines

Delta Air Lines just completed a banner decade full of record-breaking results and improving economics. It did an impressive job of shedding its image as a stodgy legacy airline with mediocre customer service and gaining a reputation as an efficient operator with an attractive frequent-flyer program.

In the past five years, Delta raised its dividend by nearly 350%, the largest increase among the major U.S. airlines. Both on a percentage basis and in terms of absolute values, Delta grew its net income and free cash flow (FCF) more than Southwest, United, or American Airlines over the past three years. In short, Delta was the elite cash-cow of the industry.

DAL Net Income (TTM) data by YCharts

However, though its financial picture is decent, it's inferior to that of Southwest, which leaves it more susceptible to the economic ramifications of the COVID-19 pandemic. In an April 3 memo to employees, CEO Ed Bastian stated that "Delta is burning more than $60 million in cash every day, we know we still haven't seen the bottom."

The airline's April flight schedule is now "80 percent smaller than originally planned, with 115,000 flights canceled," he said. Bastian also noted that the company forecasts its second-quarter revenue will decline by 90% as the full brunt of the economic shutdown hits the industry.

Given that Delta was in worse financial shape than Southwest, it shouldn't be surprising that it took more aid from the government bailout. "The agreement with [the] Treasury includes $5.4 billion from the payroll support program. The payment includes an unsecured 10-year low-interest loan of $1.6 billion, and Delta will provide the government with warrants to acquire about 1 percent of Delta stock at $24.39 per share over five years," the company said.

The winner

Southwest's track record of earnings growth and capital discipline and Delta's successful turnaround into an elite cash-flow and profit-generating machine are part of what made each of them top-tier players in their industry.

While you could argue Delta would be the better buy under normal circumstances, the coronavirus pandemic has discounted the value of airline's operational efficiencies and amplified the importance of financial strength. For that reason, Southwest is the better buy. The airline's strong operations and undisputedly best financials make it the ideal way to play a long-term rebound in the airline industry. However, paradigm shifts that reduce business travel and encourage remote conferencing, as well as a gradual and painful opening of the U.S. economy will mean Southwest's rebound will take some time.

With the right amount of patience, Southwest looks like a compelling investment.