What happened

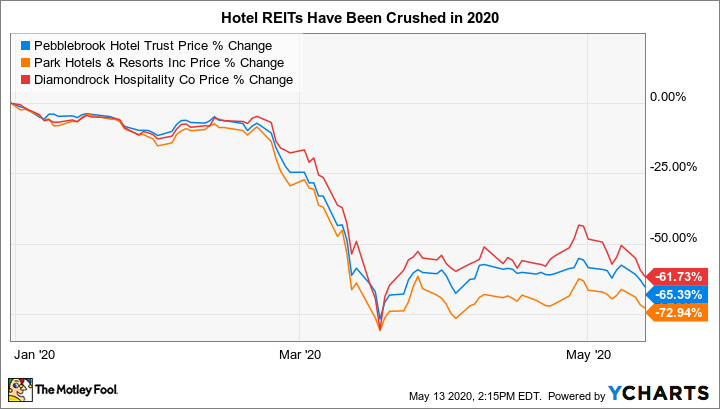

On May 13, hotel real estate investment trusts (REITs) Pebblebrook Hotel Trust (PEB 0.97%), DiamondRock Hospitality Trust (DRH 0.77%), and Park Hotels & Resorts (PK 0.36%) all fell 10% or more in the first half of trading. Although the declines came amid a broader sell-off on Wall Street, it's not at all surprising that investors would be increasingly worried about these hotel landlords.

So what

Each of these three hotel REITs had a difficult first quarter, as efforts to contain the spread of COVID-19 had a swift and direct impact on the performance of their properties. In reality, the social distancing and non-essential business closures mandated by the government only impacted a part of the first quarter. The real concern here among investors is that hotel REITs basically have lease lengths of one day and occupancy is highly sensitive to economic conditions. So when travel ground to a halt and entertainment venues closed their doors, hotel cancellations quickly followed. With the U.S. economy only just starting to reopen, and the pace expected to be very slow, the second quarter is also likely to be pretty painful for Pebblebrook, DiamondRock, and Park Hotels & Resorts.

Image source: Getty Images.

The pain, however, could linger for much longer than a quarter if the economy doesn't bounce back quickly. That story gets even worse if there's a recession, which would drag out the process of reopening after the coronavirus-spurred shutdowns. Unfortunately, a recession appears quite likely at this point given the steep drop in first-quarter 2020 GDP and the large increase in the unemployment rate in April. Even if these REITs had every hotel open, recessionary conditions would likely leave them with a lot of empty rooms.

That backdrop makes the Federal Reserve's recent comments all the more troubling. Indeed, the Fed has suggested that the government may have to step in even more aggressively than it already has to prop up the economy. That might be true, but the need to voice those concerns suggests the Fed is worried that it's running out of ammunition or simply lacks the proper tools to address all of the problems it's seeing. It's little wonder that investor concerns about hotels have been amped higher on the same day that the head of the Federal Reserve expressed his growing concerns.

But that's not the only headwind here. There have been upticks in COVID-19 cases in countries, like South Korea, that have started to reopen their economies. In South Korea specifically, there has been a rash of cases tied to nightclubs, which suggests that group settings may continue to be problematic. Note that conventions are a big business for many hotels.

Meanwhile, higher-end hotels often have bars and similar revenue-generating facilities built around guests coming together in one central location. There are very clear signs that suggest hotels aren't going to see a swift return to more normal operations. That includes U.S. healthcare experts stressing that the reopening process needs to be a measured process. Going too fast could risk a resurgence of the coronavirus. Although moving slowly may result in the best health outcome, it would lengthen the turnaround process for hotels.

Pebblebrook, DiamondRock, and Park Hotels & Resorts have worked to shore up their finances, with a focus on liquidity, but what they need most right now is more normal and reliable revenue coming in the doors. It increasingly looks like that won't be happening anytime soon.

Adding to the headwinds is that simply opening up a hotel doesn't mean that people will want to stay. There's a very real risk that social distancing lingers even after the government loosens guidelines, as people worried about catching COVID-19 choose to continue staying at home. Hotels will need to prove that their facilities are safe, which will increase operating costs, and perhaps offer discounted rates to lure customers through the door, which will pressure the top line. Bouncing back from the COVID-19 hit is not going to be an easy process.

Now what

There's no way to tell what the future holds, but investors are clearly envisioning a tough operating environment for hotel REITs. Given what is known today, that's not an unreasonable view of the future. Hotel REITs like Pebblebrook, DiamondRock, and Park Hotels & Resorts aren't appropriate for risk-averse investors. In fact, more days like this, that feature dramatic price swings driven by broader news events, are highly likely.