What happened

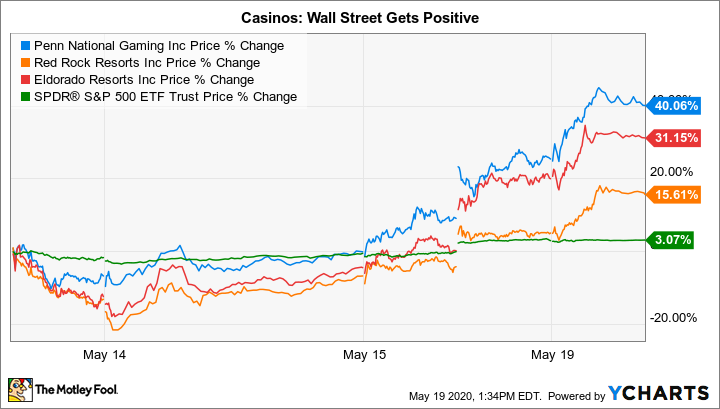

Shares of casino operator Penn National Gaming (PENN 3.35%) rose nearly 16% by midday Wall Street time on May 19. Red Rock Resorts (RRR -0.55%) jumped 12.8%. And Eldorado Resorts (ERI) advanced 12.5%. Although all three pulled back from those advances, they were up roughly 12%, 11%, and 10% at around 1:30 p.m. EDT. The uptick today was notable, but is really just a continuation of a trend over the previous week or so.

So what

The government's efforts to slow the spread of COVID-19 have involved asking people to practice social distancing and forcing the closure of non-essential businesses. This is a terrible set of circumstances for a casino operator to deal with. Casinos are, at their very core, places for people to congregate in large numbers so they can spend money on things that are non-essential. With facilities shutting down and customers staying home, the end of the first quarter was anything but kind to casino operators.

Image source: Getty Images.

Penn National Gaming's first-quarter sales fell roughly 13% year over year in the first quarter. Notably, the company's operations didn't shut down until mid-March, so the full hit from COVID-19 only impacted a small portion of the quarter. Write-offs left the company with a loss of $5.26 per share. Eldorado Resorts' top line declined even more, dropping roughly 25% in the first quarter compared to 2019. The casino operator's bottom line dipped deep into the red, as well, coming in at a loss of $2.25 per share because of one-time charges. Red Rock is set to release earnings after the close on May 19, but the news should be equally disappointing.

There was a bit of interesting information in the quarterly updates provided by both Penn National Gaming and Eldorado Resorts. Each of the casino operators made a point of highlighting that business was going really well in January and February. Penn National noted that it was putting up "record" results over that two-month span, and Eldorado said it had experienced a 6.6% revenue advance. These facts, while meant to show a positive, actually highlighted just how badly the companies were hit by the effort to contain COVID-19.

So when states began to reopen, investors started to get a little more upbeat about the casino operators and pushed the shares higher. When Moderna announced that it was having early success with a vaccine before the open on May 18, Wall Street got even more excited, again to the benefit of casino stocks. And, on top of that, key gambling markets have recently begun to open up again, with Red Rock starting to make plans for its Nevada operations to start up again. Eldorado, meanwhile, actually restarted its three Louisiana at noon on May 18. In other words, the worst may in fact be over in the casino sector. Moreover, if a vaccine can get to market quickly, the cleaning and social distancing protocols that will be put in place to facilitate the current round of reopenings may not be needed forever. That would mean normal operations would again be a possibility.

What's interesting here is that when Red Rock reports its first-quarter results after the close on May 19, investors probably won't be paying too much attention to how bad the first quarter was. Or even how much of an impact the second quarter will feel from the continuation of the closures. The big question on everyone's mind will be about the restart and what it might mean for the future. At this point the answer is unlikely to be "we're back to normal," but it's got to be better than "all of our facilities are shut indefinitely."

Now what

Although investors are getting more upbeat about the future for casino operators like Red Rock, Eldorado, and Penn National, they are still working through a very difficult time. Second-quarter results will probably end up being worse than the first, though they may wind up being the bottom of this downturn. The recovery, meanwhile, is likely to be slow and uneven regardless of whether or not there's a vaccine in the pipeline. That's doubly true if the effort to slow the coronavirus pushes the United States into a recession, which appears highly likely. Long-term investors should probably take a wait-and-see approach right now despite the improving news flow.