Both Facebook (META 0.14%) and Pinterest (PINS 1.02%) represent communication stocks at two ends of the social media industry. One company dominates more generalized social media. The other occupies a niche in areas such as food, crafts, and fashion.

Nonetheless, they both depend on advertising for most of their revenue. Thus, given the effect of COVID-19, they face the same challenge of increased engagement combined with dramatically less ad revenue. Consequently, both companies have declined to provide forward guidance.

Facebook and Pinterest should see a recovery in ad revenue as people and businesses resume activity. Hence, investors should look to the future when deciding which stock offers a better buy right now.

Image source: Getty Images.

The case for Facebook

Facebook did not invent social media, but it has enjoyed the most success in the industry. The company's user base has grown to 2.6 billion monthly active users (MAUs). With about 7.8 billion people in the world, that means that approximately one-third of the world's population uses a Facebook-owned platform in a given month.

At some point, the company's dominant user base could lead to questions on where Facebook can find new growth. Consequently, Facebook has bought new apps over the years, such as Instagram and WhatsApp, to continue to attract growth.

Investors do not have to worry yet. For now, growth remains robust. Facebook boasts a market cap of over $605 billion and continues to increase its user base and revenue stream. In the most recent quarter, revenue moved higher by 17%, and profit rose by 102%. Though the rate of increase will probably slow, analysts expect earnings to rise by more than 16.4% per year over the next five years. With this level of growth, the current price-to-earnings (P/E) ratio of approximately 28.9 may seem reasonable even without available forward guidance. The price-to-sales (P/S) currently stands at just under 8.3.

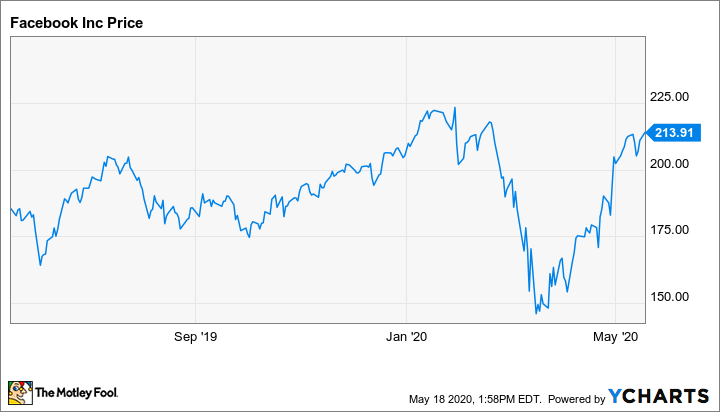

Facebook stock appears almost as robust. It lost more than one-third of its value in the stock sell-off of February and March. However, it has since recovered most of its losses. At just over $213 per share, it trades within 5% of the all-time high.

The reasons for pinning Pinterest stock

Unlike Facebook, Pinterest is more of a niche social media site. The company designed its site for the sharing and discovery of ideas. Users share this information visually through pins. They both pin ideas on their boards and explore pins on the boards of others.

Like Facebook, Pinterest derives revenue through ads. In this site's case, that comes through promoted pins. This strategy has succeeded in producing double-digit revenue growth.

Still, Pinterest exhibits both the benefits and the downsides of its much smaller size. For one, the company derives most of its revenue from one site. At a market cap of approximately $11 billion, it also remains a tiny fraction of Facebook's size.

Still, in the most recent quarter, the company increased its revenue by 35% year over year. Its net loss also increased by 241% over the same period to $141.2 million. However, with a P/S ratio of around 8.75, its sales multiple is only slightly higher than that of Facebook.

Other statistics point to massive growth as well. MAUs increased by 26% to 367 million. Despite falling earnings estimates due to COVID-19, analysts look for the company to turn profitable in 2021. Consensus earnings for next year currently stand at $0.16 per share.

Pinterest stock has recovered since falling as low as the $10-per-share range in March. Today's price of around $18.50 per share means that it has risen by more than 80% from the low. However, it still trades at a discount of approximately 50% from the $36.23 per share high of last August.

Facebook or Pinterest?

Whether an investor might choose Facebook or Pinterest probably comes down to comfort levels. For investors looking for both stability and growth, the company's relatively rapid growth and dominance in the social media industry make Facebook a more suitable choice.

However, those with a higher risk tolerance should probably choose Pinterest. Pinterest's P/S ratio is only slightly higher than that of Facebook. However, Pinterest delivers more rapid revenue growth and remains on track to become profitable next year despite COVID-19-related challenges. Also, Pinterest stock has only begun to recover its losses over the last year, whereas Facebook could achieve new record highs soon.

Moreover, like Twitter, Pinterest offers functionality that users cannot find on Facebook. This bodes well for Pinterest's competitive position. Furthermore, the experience with Alphabet's Google+ shows that even large, established players tend not to do well by building a competing site that offers similar features. Hence, Pinterest's competitive moat should remain safe.

Due to Pinterest's much smaller size and leadership in its niche, it offers more potential for growth. Hence, Pinterest looks like a more appropriate choice for all but the most conservative stockholders.