The effects of the COVID-19 pandemic have slammed most automakers' stocks. With factories closed for weeks, and the post-pandemic economy highly uncertain, investors have been very wary of these capital-intensive, low-margin businesses.

Of course, as in so many things automotive, Ferrari (RACE 1.13%) has been an exception. The world's most storied sports-car maker was trading at a high valuation before the pandemic, and it's trading at a high valuation now.

But is it a buy at that valuation? Or to put the question another way, is Ferrari's valuation justified? And can Ferrari, which has for years limited the production of its jewel-like sports cars to preserve its pricing power, really generate enough profit growth to be of interest to investors?

Let's take a look.

Many things have changed about Ferrari since its founding in 1947, but one thing hasn't: Its race-bred cars are still for the moneyed few. Image source: Ferrari.

It's true: Ferrari's stock is very expensive by automaker standards

Even before the COVID-19 pandemic scrambled the markets, Ferrari's valuation was exceptionally high by automotive standards. Generally speaking, big automakers trade with price-to-earnings ratios around 8 to 10 in good times, but Ferrari's was around 39 as of the end of 2019. (It's slightly higher now.)

On the one hand, that valuation seems crazy: All automakers, even Ferrari, are capital-intensive businesses with high fixed costs, old-school industrial companies that have never commanded big multiples from investors.

But on the other hand, Ferrari isn't like the big automakers. For one thing, the immense power of its brand (and the fact that supplies of Ferraris are always carefully limited) translates to immense pricing power — and operating profit margins that are far beyond the big automakers'.

Here's a chart that compares Ferrari's operating margin to several big automakers'. To keep the comparisons reasonably fair, the time period I used in all of the following charts is from the beginning of 2016, shortly after Ferrari's initial public offering, through the end of 2019, before the coronavirus outbreak.

F Operating Margin (TTM) data by YCharts.

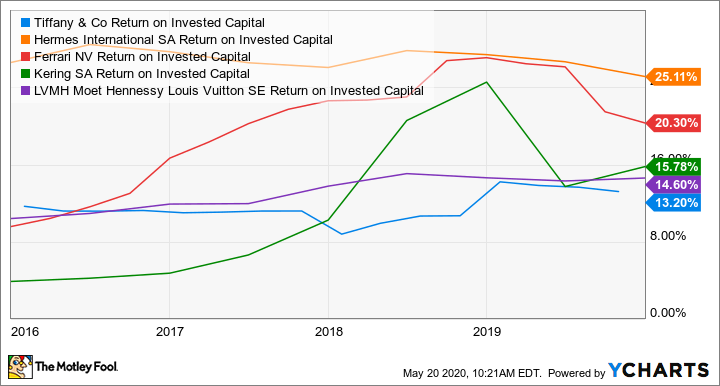

And while Ferrari is a capital-intensive business, its return on invested capital, or ROIC, is also far ahead of the others'.

F Return on Invested Capital data by YCharts.

Long story short: Ferrari isn't like other automakers. In fact, it might be best to think of it as a different kind of company, with a different peer group.

Ferrari's ticker symbol, "RACE," isn't just for show. In a typical year, about 15% of its revenue comes from Formula 1 racing and related activities. Image source: Ferrari.

Maybe Ferrari shouldn't be valued as an automaker

Former Ferrari CEO Sergio Marchionne used to argue that Ferrari's pricing power and profitability made it more like a luxury-goods company than like an automaker. Specifically, he argued that it deserved a valuation more like a successful luxury group's — say between 25 and 40 times earnings — than like a big automaker's.

Was he right? Let's take a look at how Ferrari's operating margin and ROIC compare to those of the big publicly traded luxury companies. Here are the operating margins, over the same time period as in the charts above.

PPRUF Operating Margin (TTM) data by YCharts.

And here's how Ferrari's ROIC compares.

TIF Return on Invested Capital data by YCharts.

I think it's fair to say that Marchionne had a point. At least for the sake of argument, we can set aside concerns about Ferrari's multiple for now. It's richly valued, but that valuation has some support.

That takes us to the next question: Does Ferrari have a profit-growth story?

Can Ferrari generate growth without diluting its brand?

When Ferrari first went public, in October of 2015, auto investors and Wall Street analysts weren't quite sure what to make of it. On the one hand, Ferrari's pricing power, high margins, and ROIC made it a great business. On the other hand, that pricing power came with a cost: For years, Ferrari has limited its annual production to preserve exclusivity — and without growth, Ferrari didn't seem like such a great investment.

But it turns out that Ferrari can generate — and has since generated — sales and profit growth over time without compromising the exclusivity of its brand. First, the growth of China's luxury market has been a boon to Ferrari, because it increased the global pool of eligible Ferrari buyers. As Ferrari's total orders have risen, it has been able to increase production (and thus sales) incrementally over time without diluting the brand.

Ferrari has also hit on a number of ways to generate more profit without selling (a lot) more cars. First, it found that it could raise prices on its regular models without losing sales. Second, perhaps taking inspiration from Hermès (HESA.F 0.52%) and its immensely profitable Birkin handbags, Ferrari has been offering very expensive, limited-production models to select groups of customers. (Think in terms of a few hundred cars, priced at well over $1 million each, with supply always well below demand.)

The limited-edition Ferrari Monza SP2 is essentially an 812 Superfast with a stripped-down roadster body and a huge price tag: Around $1.75 million, versus $335,000 for the regular 812. Much of the difference is profit. Image source: Ferrari.

Ferrari occasionally offered such models in the past, but it has stepped up the frequency as part of a profit-growth push initiated by Marchionne and continued by his successor, Louis Camilleri.

The current plan, under way since 2018, calls for new models in new-to-Ferrari market segments, including a couple that are specifically tailored to appeal to Chinese luxury buyers, as well as special versions of its regular production models to help keep buyer interest high over the models' lifecycles.

The goal of that plan, as originally presented, was to roughly double Ferrari's profit from 2017 levels by 2022. While the coronavirus pandemic might push that date off a bit — Ferrari expects to stay profitable in 2020, though profits will likely dip —

Ferrari should be able to maintain its growth trajectory as global markets recover.

Is Ferrari stock a buy?

Let's sum up what we've learned. It's true that Ferrari's stock is expensive relative to other automaker stocks, but it looks a lot less expensive when compared to luxury companies' valuations. And while the COVID-19 outbreak will set back Ferrari's profit-growth plan, it should be able to get back on track as the world recovers.

Long story short: You'll have to be patient, but — even at current prices, even amid the pandemic — Ferrari's stock looks pretty good.