Over the last decade, Garmin (GRMN 1.07%) has seen its business transition from a primary focus on GPS navigation devices used in automobiles to a diverse mix of products serving end users in the fitness, outdoor, aviation, and marine markets.

That shift helped sales grow 12% in 2019 with higher-margin segments leading the way. Garmin's product lineup has continued to improve through investments in research and development (R&D), along with acquisitions. This has led to both top line growth and steady cash flows. Let's look at the evolution that has transformed Garmin into a reliable cash flow machine.

Fitness devices have helped contribute to Garmin's cash flow. Image source: Getty Images.

A business evolution

Garmin's business is now driven by its growth segments that resonate with recreational boaters, golfers, bikers, runners, and even pilots. Though it still aims to grow its business with automotive original equipment manufacturers (OEMs), that segment contines to have less impact on the company thanks to strong momentum in the other areas. The table below shows the stark change over the last several years and how it has led to a steady increase in operating income for the company.

| Metric | Fiscal 2019 | Fiscal 2017 | Fiscal 2015 |

|---|---|---|---|

| Operating income | $946 million | $669 million | $550 million |

| Free cash flow | $581 million | $521 million | $383 million |

| Auto segment* | 14.6% | 24.3% | 37.2% |

Data source: Garmin. *Percentage of total annual revenue. Table by author.

Margin expansion

In its most recent quarter, which ended on March 28, Garmin maintained the momentum it experienced in 2019 as revenue grew 12% year over year.

| Segment | Q1 2020 Sales Growth (Decline) YOY | Q1 2020 Gross Profit Margin |

|---|---|---|

| Fitness | 24% | 50% |

| Marine | 22% | 58% |

| Outdoor | 14% | 64% |

| Aviation | 10% | 74% |

| Auto | (17%) | 47% |

Data source: Garmin. YOY = year over year. Table by author.

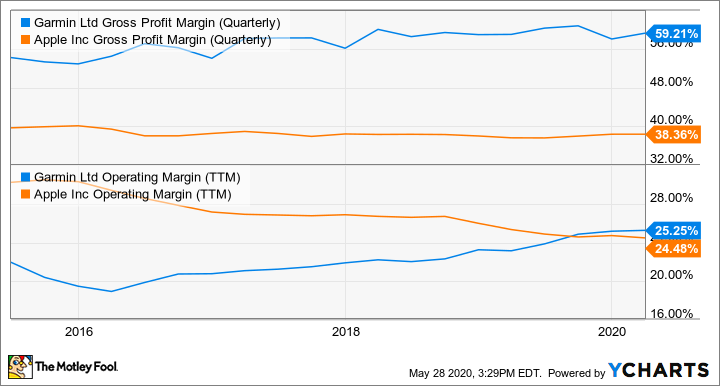

The most recent quarter represents a trend at Garmin throughout its business transition as the non-auto segments grow stronger. A comparison of margins with Apple, a well-known cash flow generator, tells the story.

Data by YCharts. TTM = trailing 12 months.

Where is the cash going?

Management believes in being fiscally conservative and maintaining a large cash cushion on the balance sheet. As of the end of the most recent quarter, the company had $1.4 billion in cash and equivalents and no debt.

On its first-quarter 2020 conference call, CEO Cliff Pemble addressed why it carries so much cash. "Our balance sheet provides stability to our investors through our commitment to an attractive dividend and allows us to invest for the future when others are pulling back," Pemble said. He pointed out that the company will not be immune to COVID-19 pandemic impacts as sales are expected to drop significantly in the second quarter. Maintaining a strong balance sheet protects businesses in times like these, he said.

But Garmin doesn't just sit on its cash. It has routinely been increasing R&D spending in the range of 10% to 15% for years, enabling it to continue improving and expanding its products. It has also made a few purchases, including the acquisition of indoor cycle company Tacx in 2019.

That purchase tapped into another growing trend and is already contributing to growth in the fitness segment. One of its big capital spending projects for 2020 is to build a new factory for Tacx. "We've not been able to supply all of the demand that we're seeing there," Pemble said.

Shareholders are not left out, either. The company pays a dividend that yields about 2.7% as of this writing. With a cash position this strong, and a stable funnel of free cash flow, investors should not only feel good about the resilient business but the growing payout.