The commercial aviation industry has obviously taken a major hit from the COVID-19 pandemic and it appears that getting back to 2019 levels is going to be a multi-year event. That said, every stock has its price, and it's no surprise that value investors have been buying airline stocks with an aim of playing the recovery. However, from a historical perspective, it makes more sense to buy the commercial aviation suppliers, like Raytheon Technologies (RTX -0.18%), Honeywell (HON 0.30%), or Heico (HEI 2.71%). Here's why.

The airline industry has been good for debtholders and equipment suppliers

Companies exist to generate returns for equity investors, but first they are obliged to pay back debtholders. That's a key point to understand with airline stocks, because historically speaking, the airline industry has been good for bondholders, but until recently, not so good for equity holders.

Image source: Getty Images.

A look at airline industry profitability and return on invested capital over the years tends to confirm the view the International Air Transport Association (IATA) expressed in a report: "On average, during previous business cycles, the airline industry has been able to generate enough revenue to pay its suppliers' bills and service its debt." However, it's only in recent years that "equity owners have been rewarded adequately for risking their capital in some regions but not all of them" according to the report.

Debtholders are seen as willing to lend to airlines because if it all goes wrong, the physical assets of the airlines (mainly the planes) can be sold off in order to pay the creditors first, while the shareholders are the last in line to be paid.

On a historical basis, the big winners from the airline industry have been the debtholders and the aviation suppliers. In fact, it was only in 2015 that the worldwide airline industry started to generate the adequate return on investment necessary to cover their cost of capital -- around 2013 if you are just looking at airlines in North America.

Before and after 2013

With the theory explanation out of the way, here are some specific stock names. Heico, Honeywell, and Raytheon Technologies' Pratt & Whitney and Collins Aerospace businesses are three suppliers who have done well over time.

First, here's a look at the stock prices of aerospace suppliers Heico, TransDigm (another pure play aerospace company) and Honeywell in the years before 2013. As you can see below, Heico and TransDigm -- highly acquisitive companies that can be looked at as geared plays on commercial aviation -- massively outperformed the airline stocks. Honeywell is a diversified industrial company with aerospace is its biggest single industry vertical.

Data by YCharts

Second, here is a chart of stock prices since 2013, which shows how well, absolutely and relatively, airline stocks have performed since then.

Data by YCharts

The key question, then, is whether the possible future costs, lower passenger numbers, and the financial constraints on the incumbent airlines will lead to more of a pre-2013 or a post-2013 outcome for the listed airlines?

Three supplier stocks to look at

Frankly, the question asked above is very difficult to answer, but the good news is you may not need to even try. Instead of buying airline stocks, you can simply buy their suppliers.

It's very hard to tell how profitable airlines will be in the future, or which ones will win out, particularly as so much depends on government decision-making. For example, the travel restrictions have been put in place by governments. In addition, regulators may well force airlines to carry additional costs related to safety concerns, including drastic measures like leaving middle seats empty.

A plane being serviced. Image source: Getty Images.

On the other hand, it's clear that the suppliers generated good returns in both periods, so they look like a safer bet than the airlines. In addition, history suggests capital will flow into the industry in order support air travel and demand for equipment.

Of the three companies mentioned above, Heico is the one whose stock price has the most exposure to the aerospace market. Around half of its sales come from non-commercial aerospace markets, but its hefty valuation can only be justified if you are confident in a recovery in all its end markets over the long term.

That said, Heico's management claims it only has 2% of the market for engine and aircraft replacement parts, so it has an opportunity to grow by gaining market share, even in a sluggish end market.

Data by YCharts

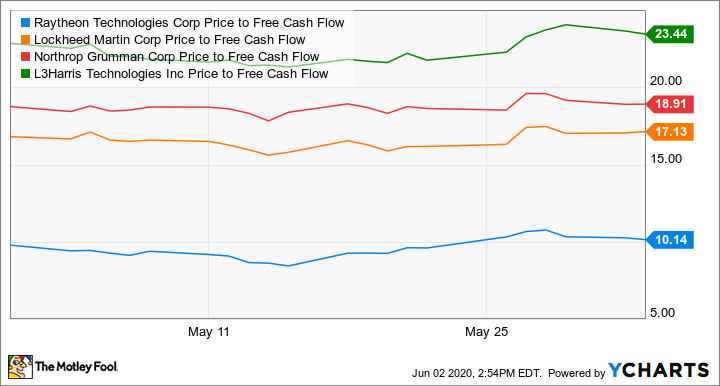

Raytheon Technologies actually generates 55% of its revenue from military sources (nearly all of it from the former Raytheon Company businesses) and despite the recent rise there's a good case for arguing that the market is undervaluing its commercial aerospace businesses (Pratt & Whitney and Collins Aerospace from the former United Technologies). A comparison with its defense peers suggests the market may well be taking an overly pessimistic view of its commercial aerospace prospects.

Data by YCharts

Diversified industrial Honeywell is probably the best option for more cautious investors who still want some exposure to aviation. The aerospace segment was responsible for 45% of segment profit in 2019, but around 40% of its aerospace revenue actually comes from defense and space markets.

Honeywell has plenty of other industrial businesses that can support the company -- warehouse automation, building technologies than can create healthy buildings, and process automation etc. -- while investors wait for a pick up in the commercial aviation market.

All told, Raytheon and Honeywell look like good values, and Heico is worth a look for aerospace bulls. They can all do well, even if the currently listed airlines might not be as profitable as they've been in recent years.