In a volatile market, investors often flock to the relative predictability of dividend stocks. Although these stocks aren't immune to the market's fluctuations, the payout can act as a stabilizing force. More important, payouts serve as an incentive for investors to hold the stock should the industry or the broader market turn downward.

These stocks are especially attractive when they can boast a long-term trend of increasing payouts. So many investors may turn to companies known for this -- particularly Dividend Aristocrats, stocks that have increased dividends annually for at least 25 years. Investors may also look to industries that remain steady regardless of economic cycles.

Stocks fitting these descriptions bring a high likelihood that they will maintain growth and dividend streaks that will continue for decades. Investors looking for such investments should consider Aflac (AFL -0.21%), PPL (PPL 1.58%), and Sysco (SYY -0.51%).

Image source: Getty Images.

Aflac

Many know Aflac best for its commercials with the duck mascot. But some 50 million people in the U.S. and Japan know it best as their insurance provider for accidents, short-term disability, and more, including coverage specifically geared toward cancer, critical illness, and intensive care.

And investors may know Aflac just as well for its dividend payout. The company passed its latest dividend increase in February, taking its streak of annual payout increases to 37 years. The dividend, which stands at $1.12 per share for this year, yields just over 3.1%. Moreover, the company benefits from a low payout ratio, which is the percentage of profit claimed by the dividend. With a payout ratio of about 27.4%, the company generates plenty of cash that it can devote to both the dividend and other activities.

Despite the available cash, investors should expect only slow and steady growth in the stock price. Aflac's stock has risen by only about 17% in the past five years without dividends. With a forward P/E of about 9 and a predicted five-year average earnings growth rate of 1.6% per year, it will probably not deliver much excitement. However, for investors who want to pay a low valuation and receive a relatively high dividend yield, Aflac's stock should fit the bill.

PPL

PPL provides electricity to customers in four U.S. states and the U.K. In Kentucky, the company also delivers natural gas. The company's footprint encompasses 36,000 square miles of service area and over 200,000 miles of distribution lines.

This business provides a steady stream of cash to pay its dividend. For 2020, the company is on track to pay out $1.66 per share, a yield of about 6.3%. At a payout ratio of around 67.5%, the dividend claims more than two-thirds of company profits. Moreover, while it is not a Dividend Aristocrat, the company's payout has trended consistently higher over the past 15 years.

This payout also remains the primary reason to buy PPL. Though the stock price has fluctuated for years, PPL stock has fallen by roughly 11% over the past five years without dividends. Moreover, analysts expect annual earnings growth for the next five years to come in at 0.5% per year. This gives investors few reasons to expect significant stock price appreciation, even with a forward P/E ratio of approximately 10. However, with a generous payout and the stable electric and natural gas businesses, PPL has positioned itself to offer a generous, growing income stream for years to come.

Sysco

Sysco is not a household name to most consumers, but that's not to say consumers have never come into contact with it. Sysco provides food for restaurants, cafeterias, and lodging facilities, a line of business that has delivered increasing payouts for decades.

The company began 2020 by delivering its 51st annual dividend increase. With the yearly payout now at $1.80 per share, the stock yields just under 3.4%, well above the five-year average yield of just over 2.4%. The payout ratio stands at about 63.4%.

Admittedly, the COVID-19 pandemic will hurt earnings this year. Still, despite that hiccup, analysts forecast average profit increases of 7.4% per year for the next five years.

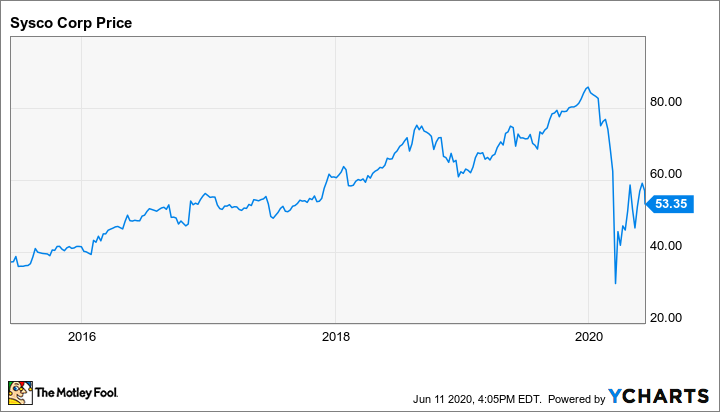

Under these conditions, the forward P/E ratio of around 24 might give some investors pause. However, the stock price increased by 46% over the past five years without dividends. Also, Sysco's stock has not fully recovered from the pandemic and trades at nearly 29% below the 52-week high.

This means in the short term, Sysco stock could rise as it continues to recover from an unusually sharp decline in the stock price. Moreover, as restaurants and businesses reopen, Sysco investors should expect the long-term stock and dividend trends to continue.