What happened

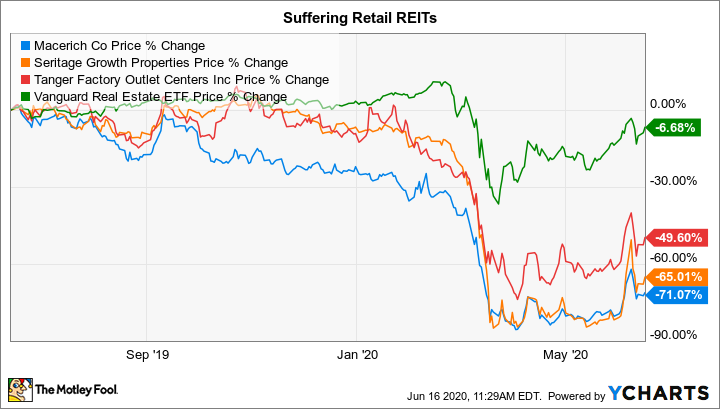

Shares of retail-focused real estate investment trust (REIT) Seritage Growth Properties (SRG) advanced nearly 17% at the open of trading on June 16. Enclosed mall specialist Macerich (MAC -1.06%) was close behind, with a gain of 16% in early trading. And outlet owner Tanger Factory Outlet Centers (SKT -0.38%) put in a good showing, too, with a stock price gain of nearly 15%. By 11:30 a.m. Wall Street time, though, all three had given back much of their advances, with each of the stocks up in the middle or high single digits.

So what

Broadly speaking, the big news today was that investors were upbeat about the outlook for the economy. That boosted stocks across the board. However, two bits of news that helped shift investors into an upbeat mood are of particular interest to the retail REITs here.

Image source: Getty Images.

Specifically, retail sales advanced a record-setting 17.7% in May. That's really just a recovery from the massive decline in April as the U.S. government, trying to slow the spread of COVID-19, forced nonessential businesses to shut down and asked citizens to practice social distancing. However, it was a much bigger improvement than most economists had been expecting. In fact, it was more than double the 7.7% gain that was being projected by some market watchers. So it is definitely good news and a sign that the U.S. consumer still loves to shop. That's great for retail landlords like Seritage, Macerich, and Tanger.

Then there was a positive update on a medication that appears to help people who have contracted the coronavirus. That's a far cry from a vaccine, but if the deadly nature of COVID-19 could be tamed, consumers would likely be much more willing to go out shopping. Once again, a big positive for the trio here. That said, these three retail landlords should not be viewed as interchangeable.

Seritage was spun off from now-bankrupt Sears Holdings so that cash-strapped retailer could raise some much-needed money. From day one, Seritage was focused on redeveloping its portfolio and reducing its exposure to troubled Sears and Kmart stores. The hope was that it would be able to take a slow and measured approach, but Sears' bankruptcy sped up the pace. And then COVID-19 complicated the timeline even more. Seritage was forced to eliminate its dividend and is basically relying on key lender Berkshire Hathaway's leniency to get through the COVID-19-related downturn. So far Berkshire has been amenable to supporting Seritage, but investors should go in fully aware that this is very much a turnaround situation.

Macerich, meanwhile, owns a highly targeted collection of malls (mostly of the enclosed variety). It recently cut its dividend from $0.75 per share per quarter to $0.50, a 33% decline. Only that's not quite the complete story, because $0.40 of the lowered payment is currently being paid with shares of stock. So for dividend investors who are relying on the income their portfolios generate, the cut was more like 85%. There's nothing particularly wrong with Macerich's properties (assuming that shoppers eventually come back), which tend to be well located and highly productive. The issue is that it has been working to revamp properties so they better match up with current consumer shopping habits, an effort that requires significant capital investment. It was muddling through this slow-moving process when the coronavirus hit. Suddenly Macerich's debt-heavy balance sheet became a pinch point, and it needed to do something to free up cash. The newly lowered dividend helps on that front, but investors should still keep a close eye on the plans the REIT has to update its malls. It's highly likely that the malls will survive, but Macerich's goal of revamping its portfolio got a lot more complicated because of COVID-19.

Of this trio, Tanger Factory Outlet Centers probably has the best-positioned portfolio. That's because its malls are almost all outdoor facilities, where airflow is better and consumers may not worry as much about getting too close to other shoppers. That said, the retailer suspended its dividend following the closure of nonessential businesses because of COVID-19. Only there's a key nuance here: Tanger cut the dividend because it quickly stepped in to offer tenants two months of no-questions-asked rent deferral. That goodwill gesture should go a long way to helping retailers deal with the downturn and support ongoing constructive relationships (note that other retail landlords are heading to court with key lessees). And, perhaps more important, Tanger was able to do this because it has a rock-solid balance sheet. In fact, it estimates that it could survive for as long as two years without collecting rent. With stores reopening again it won't have to do that, but it speaks to the REIT's relatively strong position here.

Now what

As the mood on Wall Street swings back and forth between upbeat and downbeat, stocks in the same sector will often move in tandem. Long-term investors, however, should really dig in and get to know each and every company they are considering adding to their portfolios. Yes, today's news is positive for Seritage, Macerich, and Tanger, but they are in vastly different financial positions and own very different assets.