It's been more than two decades since quantum computing was first developed, but Wall Street has started to warm up to the technology's long-term prospects. Several pure-play stocks went public in 2021 when investor sentiment was sky-high.

Quantum computing technology harnesses the power of quantum mechanics, utilizing effects like superposition -- the phenomenon that occurs at the subatomic scale in which objects have no clearly defined state. It's exciting because this field of research promises to accelerate computing speed by an order of magnitude greater than what's possible today.

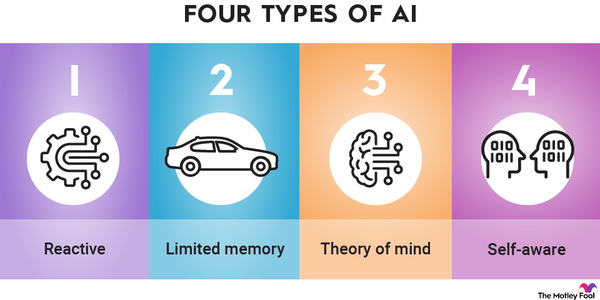

However, while quantum computing has made great strides in just a few years, the technology is still mostly in the research and development stage. Quantum computers are continually improving and becoming more affordable to develop, and the advent of cloud computing is making quantum technology even more accessible for researchers and software developers. Computing power needs are ballooning as the digital economy and artificial intelligence (AI) expand, with spending on global cloud computing alone predicted to rise to $1 trillion annually within the next decade. Quantum computing could emerge as a key technology by the end of the 2020s as the cloud and AI continue to develop rapidly.

Best quantum computing stocks

Best quantum computing stocks in 2023

Quantum computing pure-play companies are few. Some very tiny, high-risk businesses like D-Wave Quantum (QBTS 9.49%) and Rigetti Computing (RGTI 12.04%) went public early in the pandemic but are now approaching penny stock status. A number of companies creating software for quantum computers also exist, such as security software start-up Arqit Quantum (ARQQ 2.93%) and integrated hardware and software company Quantum Computing (QUBT 3.75%). A quantum computing ETF (exchange-traded fund) is also available to get more general exposure to this nascent industry.

Nevertheless, many larger tech businesses and semiconductor designers are increasing their activity in the quantum realm. Here are some top companies with a hand in the actual development of quantum computers:

| Company | Market Capitalization | Description |

|---|---|---|

| IonQ (NYSE:IONQ) | $4.0 billion | The first pure-play publicly traded quantum computing stock, which had its IPO via a special purpose acquisition company (SPAC) merger earlier this year. |

| Microsoft (NASDAQ:MSFT) | $2.5 trillion | The software giant with a hand in all things technology, including labs dedicated to developing quantum computers. |

| Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) | $1.7 trillion | The parent of Google also has a growing cloud computing segment and a large investment arm. |

| Nvidia (NASDAQ:NVDA) | $1.1 trillion | An emerging leader in semiconductor design and software for next-gen computing development. |

| Intel (NASDAQ:INTC) | $162 billion | The once long-time leader in the semiconductor industry, now attempting a grand comeback. |

| Honeywell (NASDAQ:HON) | $124 billion | An industrial conglomerate that developed its own quantum computer and is set to merge its quantum computer services with a quantum software start-up. |

| IBM (NYSE:IBM) | $135 billion | The legacy tech giant is now refocused on cloud computing needs, including a quantum computing segment. |

| FormFactor (NASDAQ:FORM) | $2.5 billion | A small semiconductor equipment company that makes cryogenic systems for quantum computers. |

1 - 2

1. IonQ

IonQ went public via a merger with the special purpose acquisition company (SPAC) dMY Technology Group III in 2021. IonQ is a start-up-stage quantum computing company, and it's the first quantum computing pure-play (all it does is quantum computing development) company to become publicly traded.

IonQ develops quantum computing hardware and is the first to have its computing systems available via all the major public cloud services. It plans to build a network of quantum computers accessible via the cloud and is targeting rapid growth in 2023 as researchers begin using its hardware at greater scale.

IonQ's orientation toward cloud computing is illustrated by its partnerships with Microsoft, Amazon's (AMZN -0.16%) Web Services (AWS), and Google Cloud. The Japanese telecommunications company and tech investor SoftBank Group (SFTBF -2.82%) also has invested in IonQ and is partnering with the company to bring quantum computing power to the many other tech companies in its portfolio. IonQ's most powerful computer, Aria, is now available via an Amazon AWS service.

IonQ generates little in the way of revenue right now and is not yet profitable. It will need to continue spending heavily to develop its products and business for at least a few more years. Investing in this start-up is a speculative play. The stock could be the most profitable way to invest in quantum computing if IonQ is successful, but investors should act with prudence, given that this is still a start-up business.

2. Microsoft

The software titan researches and develops all sorts of technology, and quantum computing technology is no exception. Quantum computers need special refrigeration, hardware designed at microscopic levels, and special software, all of which Microsoft is developing in its labs. Via its massive cloud platform Azure, Microsoft also offers access to quantum computing services for researchers.

Quantum computing tech probably won't be a significant driver of Microsoft's financial performance anytime soon. However, the company is nonetheless helping to develop the next generation of computing technology. Plus, Microsoft stock has been a winning investment for decades, and its importance in the software technology field will persist for a very long time.

3 - 4

3. Alphabet

Alphabet subsidiary Google, also the third-largest public cloud computing platform, has developed its own quantum computing chips branded as Sycamore. The tech behemoth is using quantum computing to advance its artificial intelligence (AI) software systems. It also spun off its quantum computing software unit into an independent startup called SandboxAQ in March 2022.

Google's interest in better, faster, and smarter methods of computing stems from its leading role in internet search. The company is responsible for organizing massive amounts of digital data, and it can profit significantly by helping organizations of all types to leverage the power of that information. Quantum computing coupled with AI may provide a way for Google to improve the efficiency of large computing systems and is central to the company's efforts to innovate.

4. Nvidia

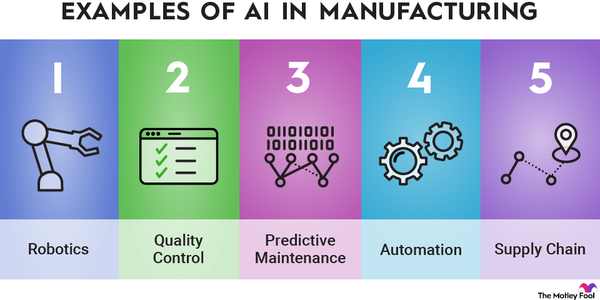

Nvidia has emerged as the global leader in advanced semiconductor designs, powering next-gen tech with its graphics processing units (GPUs) that accelerate computing power. Nvidia is helping develop quantum computers using its GPUs, retaining its leadership role in developing sophisticated circuitry design. The company is also a leader in AI and machine learning.

Nvidia is leveraging its software developed for GPUs to support the development of quantum computing. It has released cuQuantum, a software development kit designed to help software developers build workflows on quantum computing.

On the hardware side, Nvidia announced DGX Quantum in early 2023. This system pairs Nvidia's most advanced GPUs with quantum hardware developed by startup Quantum Machines and is made for researchers advancing quantum computing technology. Uses for Nvidia's quantum work are wide-ranging, from breakthroughs in jet engine efficiency to rapid drug and healthcare development.

Semiconductor

5 - 6

5. Intel

Intel lost its lead in the semiconductor industry. Third-party foundry Taiwan Semiconductor Manufacturing (TSM -0.24%) passed up Intel a few years ago, and numerous companies (including Nvidia) are valued far higher owing to their higher exposure to growth markets like GPUs for AI.

But Intel is mounting a comeback. One of its initiatives includes a quantum computing chip called Tunnel Falls. The silicon-based chip uses Intel's most advanced manufacturing processes, and is now available for the research community. Intel says it has partnered with numerous government and university research departments to test Tunnel Falls.

Quantum computing is not central to Intel's plan to regain dominance in the semiconductor industry. Still, it could become an important segment for the integrated chip design and manufacturing giant later on if research yields positive results.

6. Honeywell

Honeywell is best known as an industrial manufacturer that produces everything from aerospace equipment to advanced construction materials to medical devices. But Honeywell is also a technology firm, and its diverse work includes quantum computing.

Honeywell built its own quantum computer unit, which it spun off as a separate business and merged with start-up Cambridge Quantum Computing. The new standalone entity is called Quantinuum (which is now on its second-gen quantum computer). Honeywell remains a majority shareholder with a 54% ownership stake. It also supplies Quantinuum with hardware and software as it develops its quantum computing technology.

Quantinuum has been particularly focused on the development of new cybersecurity services and chemistry.

7 - 8

7. IBM

IBM is a legacy technology firm that is refocusing on cloud computing opportunities. It also has its own quantum computing chips and systems, which are available for commercial use via the company's IBM Quantum business unit. More than 210 research organizations and companies, ranging from financial services businesses to automakers to energy producers, use IBM's quantum computing services.

The company recently announced it struck a deal with government contractor Raytheon Technologies (RTX 0.82%) to develop AI and quantum computing for the aerospace, defense, and intelligence industries. The U.S. government will be a top customer of the research collaboration.

8. FormFactor

FormFactor is a small company that makes semiconductor manufacturing equipment. Its specialty is probe cards, which test silicon wafers and chips for defects. However, it also has a "Systems" business unit, which houses its cryogenic systems -- a key ingredient in building quantum computers and testing chips at the quantum level.

FormFactor's financial results will be primarily tied to the semiconductor manufacturing industry. But for investors looking for a way to bet early on the development of quantum computing, the stock is worth keeping an eye on since its cryogenic systems could be a big beneficiary if quantum computing eventually takes off.

Related investing topics

Should you invest?

Are quantum computing stocks a smart investment?

Quantum computing is still in the early stages of development, but plenty of research dollars are being funneled into this advanced tech. Quantum computing could eventually augment classic computers and dramatically accelerate technological developments in industries like healthcare, finance, and materials manufacturing. Although quantum computing pure-play stocks are scarce, investing in technology giants with quantum computing exposure could yield impressive returns in the decades ahead.

Quantum computing FAQs

What is the best stock for quantum computing?

There is no established leader in quantum computing at this point. Dozens of companies, including tech giants, are all researching the potential for quantum computing and experimenting with real-world uses. Developing quantum hardware that accurately makes computations and meets a reasonable return on investment thresholds is still ongoing.

Which company is leading in quantum computing?

Well-established tech giants appear to be making the most headway in quantum computing. This is likely to remain the case, given the billions of dollars needed to fund research of this emerging technology.

Can I invest in quantum computing?

Yes. Only a small handful of quantum computing pure-plays exist at this point, and they all lose money. However, investors who want a more balanced bet on the future of quantum computing can invest in the shares of tech giants.