What happened

Shares of onshore U.S. exploration and production (E&P) company QEP Resources (QEP) fell as much as 17% on June 24. Peers Matador Resources (MTDR -0.20%) and Denbury Resources (DNR) both declined around 14%. By 3 p.m. Wall Street time, QEP and Denbury had recouped some of their losses, and were down 14% and 10%, respectively. Matador's shares, however, were still hovering near their lowest levels, off by nearly 14% for the day.

So what

The cause of the steep price declines at these oil and natural gas companies isn't hard to figure out -- energy prices fell sharply. West Texas Intermediate, the benchmark for U.S. oil, was off by around 6% late in the day. Since the financial results of all three of these E&P names are tied directly to the prices of the commodities they sell, the stocks logically declined. But that's just the top level here.

Image source: Getty Images.

The bigger picture that drove oil prices lower was related to COVID-19. Some history is relevant. Early in 2020, oil prices fell all the way to zero because of a massive supply/demand imbalance. There were multiple factors that led to the dislocation, but the really big hit came from the worldwide economic shutdowns enacted to slow the spread of the coronavirus. With economies at a standstill, demand for energy fell off a cliff and supply swamped demand to the point where drillers were, technically, paying customers to take their oil. Meanwhile, oil and natural gas, with nowhere to go, started to pile up in storage. It was a very bad situation and energy stocks across the board fell into a deep downturn.

Today, however, economies around the world are starting to reopen, which means demand is returning. The big question now is over the shape of the recovery as businesses start up again and consumers venture outdoors. The answer isn't exactly clear yet, but one thing is for sure -- the coronavirus is not going away. In fact, countries around the world are now seeing upticks in cases as they allow more movement and business activity. China, Europe, and the U.S. (notably, early reopening states like Florida and Nevada) are all experiencing increases in coronavirus cases.

There are fears that the economic progress that's been made may have to be slowed, halted, or even reversed. In other words, demand for energy commodities might not be as strong as investors had been hoping. Energy prices fell on that news, taking the shares of drillers QEP, Matador, and Denbury along with them.

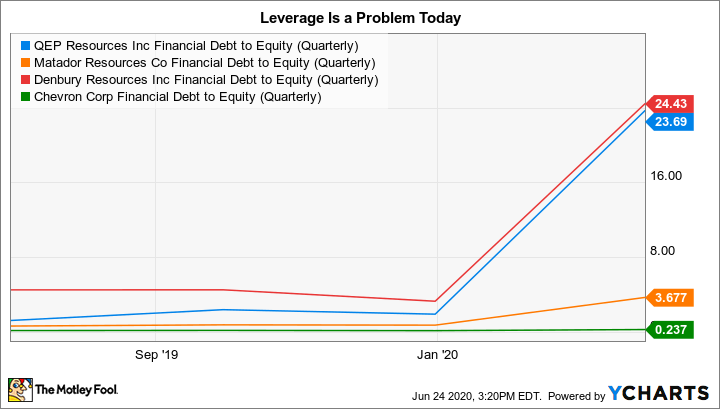

QEP Financial Debt to Equity (Quarterly) data by YCharts.

There's two lingering negatives from here. On the commodity front, all of the oil sitting in storage will be an overhang on the market until there's more demand or there's a more dramatic and sustained decline in production.

Second, and more company specific, a lot of E&P names have heavily leveraged balance sheets. That's certainly true for QEP and Matador, which both had financial debt-to-equity ratios of around 24 times at the end of the first quarter. But it's also true of Denbury, where that metric was a far lower 3.7 times. While that sounds much better, and it is, it's still high when you compare it to a company like Chevron, which has a financial debt-to-equity ratio of a touch under 0.25 times. While it's been difficult for financially strong giants like Chevron to navigate this downturn, it's that much harder for highly leveraged names like QEP, Matador, and, to a lesser degree, Denbury.

Now what

The COVID-19 health scare is far from over, and it will continue to have material repercussions throughout the global economy. Energy prices are just one example. That said, in times of crisis, a strong financial foundation can make all the difference. QEP, Matador, and Denbury are not working off of the strongest bases. Investors should expect heightened volatility to continue here, suggesting that only the most aggressive investors should be looking at this trio.