A stock market bubble is a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent. A company's valuation should be determined by its business fundamentals -- its profits, growth rate, and similar factors. In a bubble, speculation and euphoria take over.

The dot-com bubble of the late 1990s may be the most recent famous example of a stock market bubble. Tech stocks surged, fueled by high expectations for a new internet economy. When those expectations were not realized, almost all of the tech stocks that had gained value during the boom years plunged or the underlying companies went out of business entirely. Arguably, the collapse in high-growth tech stocks from 2021 to early 2022 was also evidence of a bubble.

Not every surge in stock prices is a sign of a bubble, however. Sometimes, large stock gains are justified by the companies' performances. For example, Amazon (AMZN 0.36%) stock has jumped in price by 1,760% in the past decade, but the company's earnings have increased even more during that time, and its competitive advantages have strengthened.

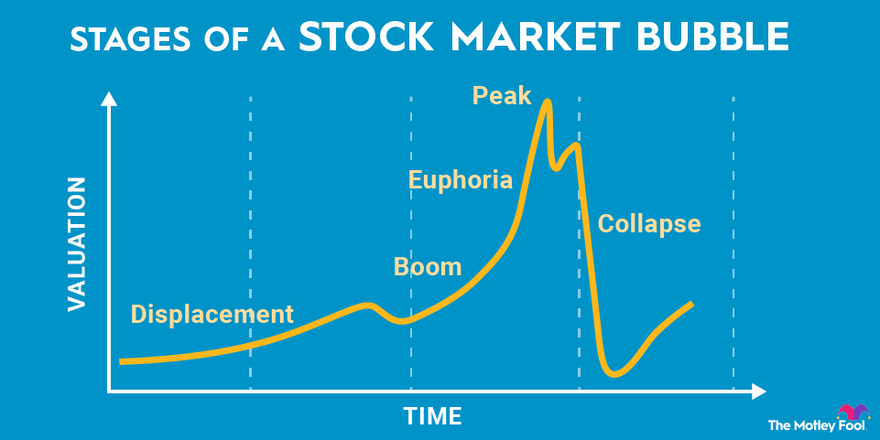

5 stages of a stock market bubble

All stock market bubbles eventually burst, meaning that stock prices suddenly and sharply decline. While any number of events can lead to a bubble bursting, stock market crashes often occur after a key source of credit dries up. A credit contraction was the main reason for the 2008 housing bubble bust, which triggered a global financial crisis.

Economists generally agree that there are five stages of an economic bubble:

- Displacement: This is a paradigm-shifting event. In the case of the housing bubble, this meant lower interest rates (thanks to looser monetary policy from the Federal Reserve Board), easier access to subprime mortgages, new mortgage derivatives from Wall Street, and the fact that U.S. real estate prices had not suffered a sustained, national decline in generations.

- Boom: This is the phase when asset prices begin increasing rapidly. Rising prices attract new investors (or homebuyers, in the case of a housing bubble), but it isn't yet clear that the rise in prices is unwarranted.

- Euphoria: This is the phase were investors tend to make irrational decisions under the assumption that the bubble will continue to inflate. Some people refer to this as the greater fool theory, which is the belief that there will always be someone willing to pay a higher price for an asset than you did. In the case of the housing market, unqualified homeowners were buying homes with the intention of flipping them and making easy money.

- Peak: Prices eventually top out, and the smart money begins to sell. Market sentiment starts to shift. In the housing bubble, this phase was harder to detect since housing prices aren't readily listed like stock prices. But there were signs that defaults were starting to rise and easy credit was going away.

- Collapse: Bubbles tend to leave many retail investors financially ruined, and the housing bubble bust was no different. Home prices fell nationally between 2006 and 2012, leaving homeowners underwater, bankrupt, and with their credit destroyed. Just as prices are overinflated at the peak of the bubble, they tend to be undervalued during the bust.

The reasons for the dot-com bubble burst are slightly more complicated. In this instance, the tech companies' performances didn't match investors' expectations. Many of the dot-com names that went bankrupt had flawed business models that made them incapable of turning a profit. In this bubble, the credit came from venture capitalists and other investors eager to pour money into any business with ".com" in its name. The dot-com companies' growth eventually slowed, profits didn't materialize, and tech stock prices plunged.

Again, Amazon offers a useful example here. In 2000, the Nasdaq Composite Index (NASDAQINDEX:^IXIC) peaked, seemingly because all the new internet companies, Amazon included, had exhausted the initial wave of investor demand. Tech stock prices tumbled as a result. The e-commerce company's revenue growth slowed from 169% in 1999 to just 13% in 2001, tracking with the market's boom and bust. Amazon's stock price declined by more than 90% from peak to trough in just two years.

Are we in a bubble right now?

It's rarely clear in real time if we're in a stock market bubble. Looking at the S&P 500 (SNPINDEX:^GSPC) as a whole, there isn't much evidence of a bubble. A broad-market index, the S&P 500 entered correction territory in late February 2022, meaning a decline of more than 10% from a recent peak in a bull market. A bubble, however, generally implies a much greater decline.

Still, there is evidence of a bubble in a subsector of stocks, especially for pandemic winners and other tech stocks. Zoom Video Communications (ZM -0.58%) fell more than 75% from its pandemic-era peak, Peloton (PTON -4.41%) was down nearly 90% at one point, and Wayfair (W -5.67%) dropped by two-thirds. In other words, the bubble in pandemic stocks and others, such as cloud computing stocks, seems to have burst.

There's reason to believe there's still a bubble in other subsectors such as electric vehicle (EV) stocks, many of which have perfect scenarios priced in. There's no obvious credit source fueling stock price increases in the current market environment, although there is evidence of a spike in retail stock trading since millions of Americans have recently opened accounts with Robinhood (HOOD 0.23%) and other retail trading platforms. Additionally, pandemic stimulus payments, enhanced unemployment benefits, and other government relief measures have helped to fuel a bubble.

Speculation is a key driver of any stock market bubble and a clear warning sign. Investors buy stocks not just because they believe their underlying values will rise but also because they believe the stock market will remain liquid, enabling them to easily sell their stocks at any time. During stock market bubbles, stock prices becomes divorced from the underlying business fundamentals yet continue to rise based on the assumption that speculators will continue to buy. A similar phenomenon seems to have occurred with Bitcoin (BTC -4.11%) and other cryptocurrencies since mid-2020 as their prices have also surged. When valuation metrics such as price-to-earnings ratios and price-to-sales ratios are well out of the historical range, that's evidence of a bubble.

Often the clearest sign of a stock market bubble is market sentiment, or how investors feel about the stock market. J.P. Morgan famously sold his stock holdings ahead of the Great Depression after a shoeshine boy asked him how he could buy stocks. Similarly, there were signs on social media platforms during much of the pandemic boom of euphoric sentiment in the market.

Related investing topics

How to protect your portfolio during a stock market bubble

The easiest way to preserve your portfolio's value during the bursting of a stock market bubble is to only hold stocks with strong business fundamentals. In the current environment, Target (TGT -1.4%) and Alphabet (GOOG -0.19%) (GOOGL -0.27%) offer good examples.

Easy come, easy go is the way of portfolio gains during market bubbles. Stock prices that have jumped for little "fundamental" reason can easily lose value if (and when) investor sentiment changes like it did for tech stocks in the late 1990s and pandemic stocks over the past year.

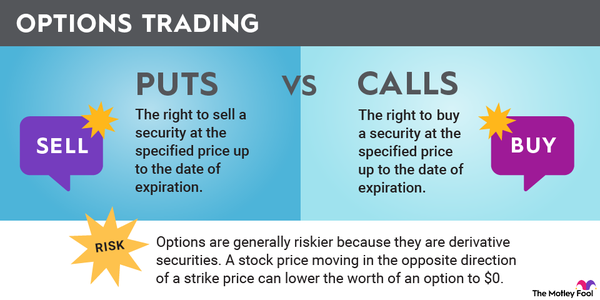

Another way to protect your portfolio during a stock market bubble is to buy put options, which enable you to sell stock at a pre-determined price within a certain time period. You may also use stop-loss orders, which instruct your broker to sell a stock once its price declines to a certain value. The disadvantages of these alternatives are that buying put options can be expensive, and stop-loss orders might be executed during only a modest market pullback rather than a bubble popping entirely. Timing the market, after all, is almost impossible.

The past two years have shown how unpredictable the stock market can be. There's no perfect way to insulate yourself from volatility in the stock market, and bubbles do occur from time to time. The best approach, and one of the easiest, is to buy shares in high-quality companies and hold them for the long term.