What happened

Shares of Bed Bath & Beyond (BBBY) rose sharply on Tuesday after providing answers to investors' questions. Last week, the company reported results for the first quarter of 2020 that left investors wanting to know more.

Wall Street clearly liked what Bed Bath & Beyond had to say. The stock rose 9% for the day.

Image source: Getty Images.

So what

Bed Bath & Beyond was hit hard by the COVID-19 pandemic. It closed 90% of the company's stores, resulting in a significant reduction in sales. With limited revenue and ongoing expenses, it burned through $400 million in cash in March and April combined, before returning to cash-flow neutral in May.

Investors inundated the company with questions after it reported Q1 earnings, prompting management to release a special frequently asked questions presentation today. In it, management noted that sales trends in June looked promising. At reopened locations, comparable sales were positive -- impressive considering comp-sales struggled even prior to the pandemic, plummeting 5.6% in the fourth quarter of 2019.

Perhaps more importantly, Bed Bath & Beyond was cash-flow positive in June. This consumer-goods retailer has struggled in recent years and was just initiating a turnaround plan when the coronavirus hit. The plan includes closing hundreds of locations and reducing expenses to boost profits. But it'll take time to pull off.

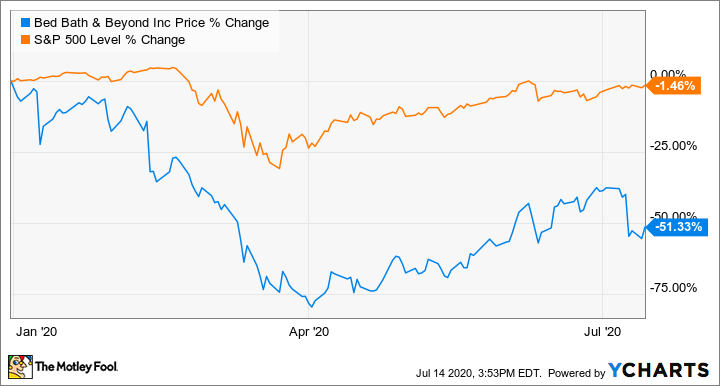

As long as it's cash-flow positive, it has time to work the plan. Investors bid the stock up as a result. However, it's still down sharply for 2020.

Now what

Other questions in today's presentation include potential asset sales, inventory reduction, and plans for growth. But Bed Bath & Beyond is deferring some of the details for now. It plans to hold an investor day in October to provide more detailed answers to these ongoing concerns.

When Bed Bath & Beyond does set the date for its investor day, shareholders should circle it on their calendars. Turnaround plans aren't easy to execute, and the details will be extremely relevant for those holding long-term.