Electric-car stocks have taken off like a bolt of lighting in recent months.

Shares of manufacturers including Tesla (TSLA -1.92%), Nikola (NKLA -2.44%), NIO (NIO -5.00%), and Workhorse (WKHS 5.84%) have all at least tripled since the beginning of the year, and have delivered even bigger gains to those savvy enough to get in during the market crash in March.

Tesla, now the most valuable carmaker in the world, has led the sector higher, and its market cap around $300 billion dwarfs those of traditional auto stocks. A number of factors appear to be pushing Tesla and its peers higher. An excitement around increasing vehicle deliveries, even during the pandemic, a global push toward renewable energy, and bullish momentum across much of the stock market has lifted the sector to new heights.

But is the recent growth really sustainable, or is this just a euphoria-driven bubble inflated during one of the most precarious times for the global economy since the Great Depression? While the EV revolution could just be getting started, investors should be aware of what happened with similar revolutionary technologies in the auto sectors in recent years. Keep reading to see two sobering stories.

Image source: Tesla.

1. Natural gas fuels

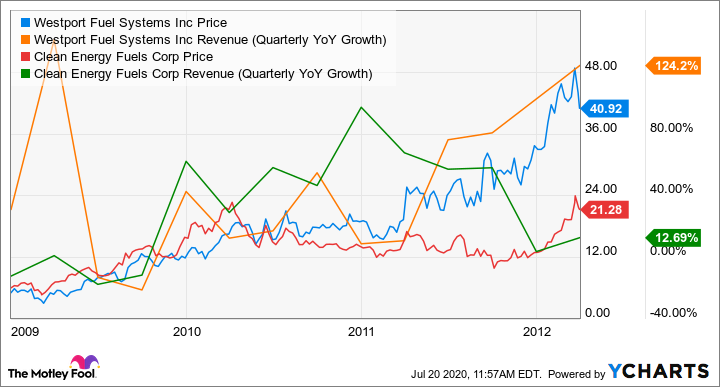

Natural gas prices plunged in the aftermath of the 2008-09 Great Recession as the fracking boom in the U.S. led to a surge in supply. Industry operators began to see natural gas fuels as an alternative to gasoline and diesel. Natural gas fueling stations, primarily designed to service municipal vehicles like buses and sanitation trucks, as well as some long-haul trucks, began popping up around the country, led by innovators like Clean Energy Fuels (CLNE -0.89%). The T. Boone Pickens-led company owned a network of natural gas fueling stations, and business was booming in the early 2010s. The same was true for Westport Fuel Systems (WPRT 1.06%), a maker of natural gas engines for trucks. As the chart below shows, both stocks soared from the depths of the financial crisis through the spring of 2012 as natural gas prices fell to $2/mmBTU (million British thermal units).

However, March of 2012 would prove to be the peak for both stocks as natural gas prices began to rebound, doubling over the next 18 months. Additionally, hopes for Congress to pass legislation encouraging alternative fuels, then known as the NAT GAS Act, never materialized. The recovery in natural gas prices, which were unsustainable for producers at below $2/mmBTU, killed the momentum in the sector. Here's what's happened to those two stocks since.

The natural gas revolution fizzled and these stocks crumbled. Investors moved on, and EV stocks appear to be their latest fixation.

2. Self-driving cars

Just a few years ago, self-driving cars seemed to set to take over the world.

In 2016, Business Insider Intelligence and others predicted that there would be 10 million autonomous vehicles (AVs) on the road by 2020. Many foresaw a future where self-driving cars would be viable by this year, with the technology reshaping the way we live and work over the next decade. A number of automakers said they would have full-self-driving vehicles available by 2020.

Investors, agog at the potential in what Intel (INTC -2.40%) called a $7 trillion opportunity, pumped up Uber (UBER -2.94%) and Lyft (LYFT -3.35%) to high-flying IPOs. Intel acquired AV technology company Mobileye for $15.3 billion in 2017, and General Motors (GM -0.17%) saw the value of its Cruise AV soar to $19 billion thanks to multiple funding rounds from Softbank, the prolific start-up investor.

Tesla stock owes at least of part of its gains to the company's Autopilot technology, which CEO Elon Musk has often touted, and Morgan Stanley gave Alphabet's (GOOG -1.10%) (GOOGL -1.23%) Waymo, which is widely considered to be the leader in AV technology, a $175 billion valuation in 2018.

Compared to expectations just a few years ago, autonomous vehicles have been a clear disappointment. During a global pandemic that calls for automation of almost any kind, self-driving vehicles aren't even part of the conversation. The technology hasn't lived up to the hype, and, despite billions invested in lidar, sensors, cameras, and other technologies, as well as millions of autonomously driven road miles, the problems that need to be solved for AVs to be safely driven in standard conditions have proven to be more difficult than expected. A fatal accident involving an AV Uber hitting a pedestrian in March 2018 seemed to crystallize this, and delivered a substantial setback to Uber's self-driving ambitions as well as those of its peers.

By late 2018, it was becoming clear that the technology couldn't live up to the accelerated timetable so many had believed in. Waymo CEO John Krafcik said it would "take longer than you think" for EVs to be ubiquitous. Tesla's grand plans, including a cross-country AV trip, have also been delayed multiple times.

Morgan Stanley slashed its Waymo valuation from $175 billion to $105 billion in 2019, and this March, Waymo raised $2.25 billion at a valuation of $30 billion, effectively showing that the autonomous-vehicle revolution is still years away. You can assume the air has come out of similar self-driving technology valuations, including GM, Uber, and Lyft.

You say you want a revolution

Just because the natural gas revolution flopped and self-driving cars were overhyped, that doesn't mean electric vehicles won't go mainstream. Tesla has certainly made a viable product that's in high demand, and concerns about climate change are increasing.

However, these stocks have soared to such high valuations that the whole sector now seems priced for perfection, much like self-driving cars were a few years ago. Tesla's market cap alone exceeds that of GM, Ford, Fiat Chrysler, Honda, and Volkswagen combined, and Nikola's briefly topped that of Ford and Fiat Chrysler. The fate of natural gas fuels and self-driving cars should remind EV investors that it would only take a shift in market fundamentals or underestimated technological challenges for an unraveling in these stocks.

Alternatively, the potential election of Joe Biden as president could unlock further momentum for EVs in the U.S., and Europe seems poised to pass a $2 trillion coronavirus recovery package that would boost the renewable energy sector. China, which is both the world's largest car market and EV market, already has a number of EV-friendly policies in place. Meanwhile, the coronavirus pandemic is squeezing oil and gas companies, which may add to calls that the fossil fuel industry isn't sustainable, both on a financial and an environmental basis.

We'll learn more about the EV sector's potential when Tesla reports second-quarter earnings after hours on Wednesday. Look for Tesla and its peers to swing big one way or the other on the news, as investors have big expectations for the premium EV maker.