What happened

Shares of Cyprus-based online payment services company Qiwi (QIWI 9.88%) jumped 12% in early trading Wednesday and remain up a healthy 8% as of 12:30 p.m. EDT.

Why? That's trickier to answer than to ask.

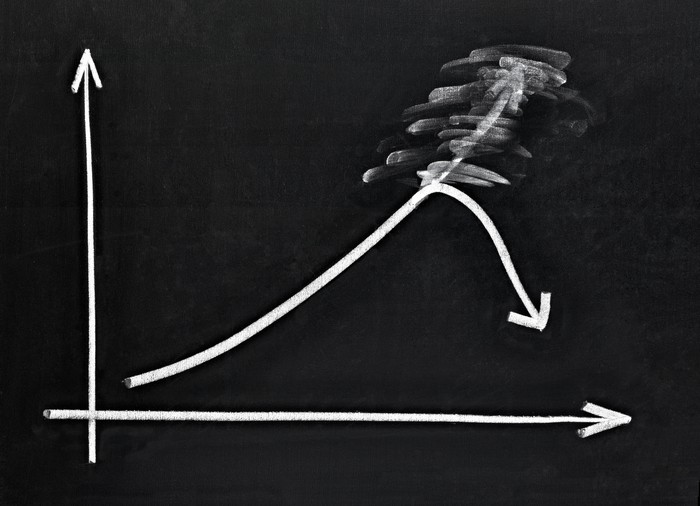

Qiwi, you see, reported "preliminary financial results" in the middle of the trading day yesterday. When these results came out, they at first arrested a decline in Qiwi shares (which had been falling before the news emerged), and sparked an explosion in the stock's price. But that explosion flamed out quickly, the stock fell right back down again, ending the session with a 10% loss.

Image source: Getty Images.

So what

Today, investors appear to be having second (or third, or perhaps even fourth) thoughts about whether Qiwi's news was good or not. So which is it? Let's take a look.

Heading into Q2, analysts who follow Qiwi had forecast it would suffer a rather significant decline in profits -- down about 33% in fact, to $0.33 per share -- and that net revenue for the quarter would be about $5.18 billion.

In yesterday's release, Qiwi didn't say precisely how much it thinks it earned in the quarter. It did say, however, that "total net revenue" grew at least 17.8%, and perhaps as much as 23.3% (so about 21% at the midpoint), and that "adjusted EBITDA" seems to have grown 34% or so -- not shrunk.

That's the good news. The bad news is that Qiwi cautioned that its revenue growth in the quarter "was primarily driven by the significant one-off increase in Rocketbank segment net revenue driven by the measures we took as part of the Rocketbank wind-down process, including the termination of the Rocketbank loyalty program, which used to substantially increase the cost of revenue of the Rocketbank segment." Since Rocketbank is winding down, that's revenue Qiwi shareholders can't expect to see again in the future.

In other words, the news yesterday was good -- but the good news won't last.

Now what

That news, and commentary on the news, tallies well with investors' initial enthusiasm for the stock -- and with the immediate waning of that enthusiasm once the import of Qiwi's comments sank in. Today, investors are feeling more optimistic, however, perhaps figuring that even if the Rocketbank revenue can't be counted on in the future, Qiwi's numbers still look at least a little better than what analysts had been predicting.

And at a not-unreasonable 17 times trailing earnings, they seem to think that when all's said and done, Qiwi stock is cheap enough to gamble on things getting better.