The market's swift recovery over the last three months has pushed a lot of stocks higher year to date, despite the continuing COVID-19 pandemic and the potentially long-lasting economic fallout it has created. Despite that broader market boost, not every stock has recovered from losses.

A number of investing sectors have seen stocks drop and not recover because it's uncertain what the future will look like. But if there's an end in sight to the high COVID-19 risk, whether that's due to improved therapeutics or a vaccine, these stock sectors could come back fast.

I think malls, airlines, and entertainment could be the next stocks to jump if economic activity roars back later in 2020 and into 2021.

Image source: Getty Images.

1. Retail REITs: Malls have been hit hard

Mall real estate investment trusts (REITs) like Simon Property Group (SPG -0.68%) and Brookfield Property REIT (BPYU) have been hammered since shutdowns began in March and for good reason. The companies own malls that have been shut down for weeks and only partially reopened in some regions of the country. Those shutdowns have put enormous stress on tenants who may not be able to pay rent now or in the future.

There was certainly downside in spring and early summer, but it's now possible we're seeing some light at the end of the tunnel. Most malls are at least partially open across the country and retail sales are picking up again. That should help tenants to again generate revenues they need to pay rent, which is ultimately what drives these retail REITs and their dividends.

To add fuel to a recovery, Federal Reserve cuts on interest rates will help fund mall REIT operations without the burden of high-cost debt that many companies have taken on just to survive. For instance, Simon Property Group recently sold $2.0 billion of debt with a weighted average coupon rate of just 3.225%.

Simon Property's management also expects to pay a dividend of "at least $6 per share" in 2020, which would imply a dividend yield of nearly 10%.

Brookfield Property REIT is more diversified, but as the owner of the old GGP REIT's assets, it's also one of the biggest mall owners in the world. And when combined with office and hospitality assets, it has a lot riding on a quick recovery from COVID-19.

2. Boeing: Airline travel making a comeback

Shares of Boeing (BA -2.87%) have fallen more than 50% over the past year, in large part as a result of COVID-19 (but also partially due to fallout from the 737 Max scandal in 2019). Airline travel has plunged around the world and airlines are canceling orders for billions of dollars worth of aircraft. Since the pandemic began, Boeing has seen orders for at least 300 new aircraft canceled, accounting for tens of billions of dollars in potential revenue.

When COVID-19 is no longer a major risk for fliers, we could see airline travel return relatively quickly. That should also result in a flood of orders for Boeing aircraft, just like it saw pre-pandemic.

We don't know what a post-COVID world looks like, but I believe it will still include a lot of business and leisure travel. And with both consumers and businesses effectively shutting down travel the last few months, the recovery could be faster for airlines and Boeing than investors are expecting.

3. Restaurants: The return of dining and entertainment

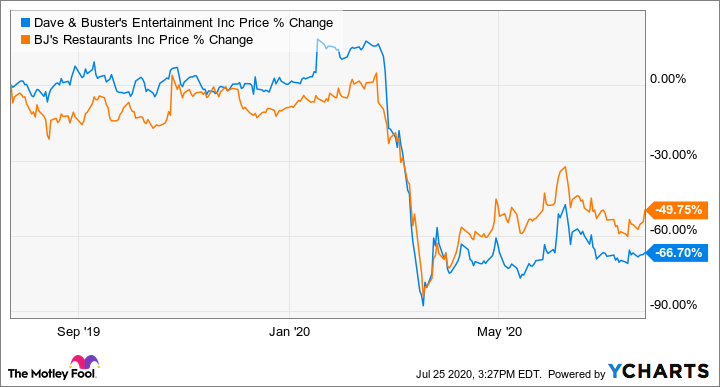

The pandemic has been nothing short of a disaster for sit-down restaurants and facilities that offer group entertainment. There are lots of companies that would benefit from the return to business as usual, but the two restaurant operators that could be helped most are Dave & Buster's (PLAY -4.99%) and BJ's Restaurants (BJRI 0.15%), which each had stocks trading down nearly 90% this year at one point.

Not only have these restaurant chains had to close for long periods of time, even where they're open, business isn't anywhere near what it used to be. Most restaurants can only operate at partial capacity across the U.S., and the large parties that often drive significant revenue for these locations has effectively been prohibited for the time being.

As much as COVID-19 restrictions hurt now, these companies may benefit disproportionately when it passes. Small restaurants and entertainment businesses are going out of business at a rapid clip, so those that can hang on will have access to a bigger slice of the food, beverage, and entertainment market when the pandemic is over. It may take a while to recover, but revenue and profits may be better than ever in a post-pandemic world for Dave & Buster's and BJ's Restaurants.

The post-pandemic world is coming -- someday

It may seem far off now, but the world will eventually move past the restrictions of the COVID-19 pandemic. And I think mall REITs, Boeing, and select restaurant companies could be big winners for investors now given how much their stocks have fallen. They just need to get through the pandemic to see the upside.