Canopy Growth (CGC 0.57%) and Aphria (APHA) are two heavyweights in the Canadian pot market. For a long time, cannabis investors saw Canopy Growth as the leader in the industry, but that just isn't the case anymore. At the very least, the company's got some tight competition not only from Aphria but also from U.S.-based pot stocks that are growing in size and gaining market share.

While Canopy Growth still has lots of potential, especially as it begins rolling out cannabis beverages, it's just not the value buy Aphria is. Here's a closer look at why Aphria is the better stock to buy today.

Aphria's generated much more in revenue

Aphria released its fourth-quarter and year-end results July 29. Its net revenue of 152.2 million Canadian dollars in Q4 was up 18% from the prior-year period and marked a 5% improvement from the third quarter. Canopy Growth released its Q4 results May 29 for the period ending March 31, and although they covered a different period than Aphria's most recent results (which went up until May 31), at just CA$107.9 million, they're still nowhere near their Ontario rival's tally. For the full year, Canopy Growth's top line came in at CA$398.8 million after excise taxes. That's also well short of Aphria's full-year tally of CA$543.3 million.

Image source: Getty Images.

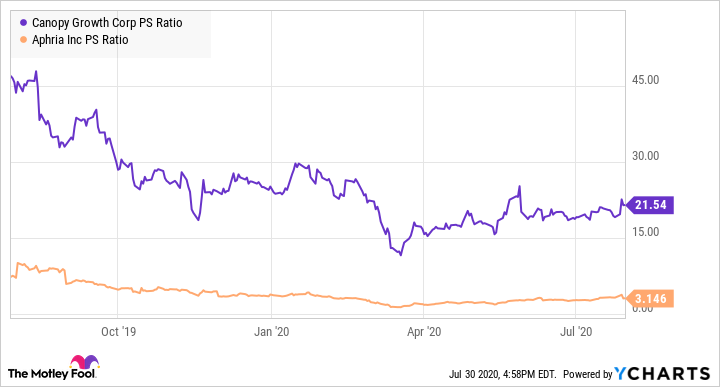

Despite generating 36% more revenue than Canopy Growth over a 12-month period, Aphria's market cap of $1.3 billion is less than one-fifth of the $6.9 billion valuation Canopy Growth has on the markets today. When looking at their respective price-to-sales (P/S) ratios, it's clear that Aphria is a much better value buy than Canopy Growth right now:

CGC PS Ratio data by YCharts

This discrepancy could be justifiable if Canopy Growth were expecting some significant growth this year, but that doesn't appear to be the case -- certainly not with a recession weighing on the Canadian economy and people losing their jobs. And although pot shops did see a surge in sales in March, the growth hasn't been explosive. In May, retail pot sales in Canada were just 2.6% higher than March's high.

In its year-end results, Canopy Growth even referred to the new fiscal 2021 year as a "transition year" as it works on changing its focus and aims to make progress toward breaking even.

That also leads me to another reason Aphria's a better value buy: Its bottom line is much stronger.

Aphria's normally profitable

Although Aphria recorded an operating loss of CA$98.8 million in its most recent quarter, it would've been close to breakeven if not for impairment charges of CA$64 million and other expenses, mainly to do with changes in fair value of investments and debentures, totaling CA$31.8 million. This was just the third time in its past eight quarterly results that Aphria incurred a net loss. The company did, however, report a positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) number for the fifth period in a row.

Canopy Growth's bottom line isn't nearly as strong as Aphria's. In its Q4 results, Canopy Growth incurred a net loss of CA$1.3 billion; even its adjusted EBITDA was negative CA$102 million. In each of the past four quarters, Canopy Growth has reported an adjusted EBITDA loss of at least CA$93 million. The company's new CEO, David Klein, who officially came over from Constellation Brands earlier this year, has his work cut out for him in trying to tighten up the pot producer's financials.

Its most recent loss wiped out Aphria's earnings over the trailing 12 months and, so it doesn't have a positive price-to-earnings multiple. Neither does Canopy Growth. But with profitability at least in reach for Aphria, it's still the better buy in that regard.

Why should cannabis investors care about valuation?

Cannabis investors may think valuations and ratios are for bank stocks and not the marijuana industry, where the focus is more on growth. However, if investors hadn't been paying such extravagant prices for pot stocks a year ago, they wouldn't have incurred such significant losses. Here's a look at how these two pot stocks performed over the past year compared with the benchmark Horizons Marijuana Life Sciences ETF (HMLSF 0.62%):

Aphria's done much better than Canopy Growth and the ETF, not least because the stock wasn't nearly as expensive last year:

CGC PS Ratio data by YCharts

Even at today's P/S multiple of more than 20, Canopy Growth's stock could continue to fall further in price. Valuation matters in every industry; it's just taken awhile for that reality to hit pot stocks. Cannabis investors can't afford to ignore high valuations anymore, which is why Aphria is a much better buy today than Canopy Growth.