The term "on sale" seems like an oxymoron when the market is pushing toward all-time highs again. And yet you can find many stocks on the bargain rack today -- you just need to venture into out-of-favor sectors. One of the most downtrodden areas is energy, which is home to Chevron (CVX 0.21%) and Enterprise Products Partners (EPD 0.16%). Both have incredible dividend records that income investors will love, and much, much more. Here's why these two dividends stocks are worth buying while they are on sale today.

The global energy giant

Oil prices are painfully low today, thanks largely to the demand decline surrounding the global shutdowns used to slow the spread of COVID-19. That's terrible news for a company like Chevron, one of the world's largest international energy majors, because oil prices are the main driver of top- and bottom-line performance. To put a number on how bad, the company's adjusted earnings came in at a loss of $1.59 per share in the second quarter, or nearly $3 billion. But this company doesn't think in quarters -- it thinks in decades.

Image source: Getty Images

One important takeaway from this long-term view is that Chevron has already recognized the volatility inherent to the energy business. That's why it has one of the strongest balance sheets in its peer group, with a debt to equity ratio of roughly 0.25 times. Financially speaking, it is probably the best-positioned energy major in the world today. It also has modest investment plans, which help reduce the need for capital spending, even as it benefits from past spending efforts. That, too, helps set it apart at a time when the entire energy industry is reeling, and will help ensure that Chevron muddles through this downturn in one piece.

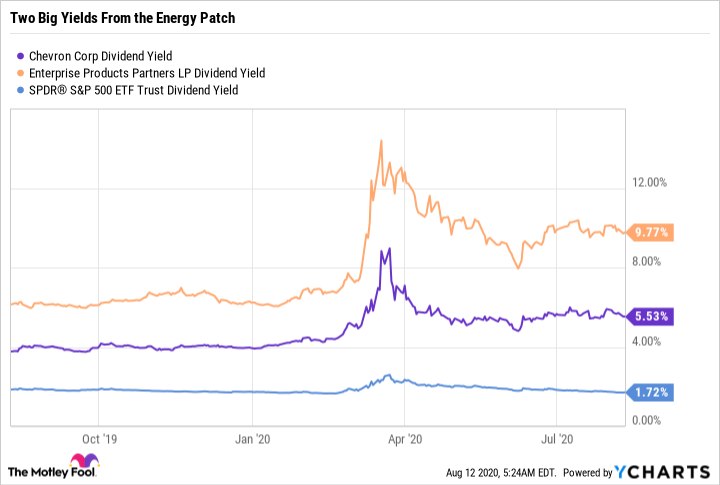

The long-term focus and conservative business approach, meanwhile, help explain how Chevron has managed to increase its dividend annually for 33 consecutive years. Given that the current yield of 5.7% is near the highest levels seen over at least the last 20 years, dividend investors with a long-term focus might want to take a look at Chevron before demand for oil recovers from the COVID-19 drop.

The domestic midstream giant

If oil price volatility is a bit too much for you, then there's still another energy option you can look at: Enterprise Products Partners. This master-limited partnership is focused on the midstream space, which helps process and move oil, natural gas, and the products they get turned into. This is largely a fee-based business, with Enterprise being paid for the use of its assets. With roughly 85% of the partnership's gross margin tied to fees, the prices of the commodities in its system aren't the main drivers of performance -- demand is.

CVX Dividend Yield data by YCharts

That said, demand is relatively weak today, as energy companies pull back in the face of low oil prices. And yet Enterprise has hardly skipped a beat. In the second quarter, the partnership covered its distribution by 1.6 times. Historically speaking, 1.2 times is considered strong in the midstream sector. Meanwhile, Enterprise's debt to EBITDA ratio of roughly 3.7 times is toward the low end of the industry, just where it always tends to be. There doesn't appear to be much reason to worry about this $40-billion-market-cap midstream giant making it through this downturn, or about its ability to keep rewarding investors with distributions.

The energy downturn will likely slow Enterprise's growth for a bit, since demand for new pipelines and processing facilities could wane along with industry-wide spending. But with a yield of 9.7% backed by 23 years of annual distribution increases, there's still a whole lot to love here.

You can do it

It takes fortitude to go against the grain on Wall Street. However, if you are looking for lofty dividend yields today, that's one of the best ways to find investment opportunities. The trick is to stick with the best names in out-of-favor sectors. In energy, that includes Chevron and Enterprise. Do a deep dive and you're likely to find that one or both ends up in your portfolio.