What happened

Share of oil and gas royalty company Brigham Minerals (MNRL) are down 12.1% as of 12 p.m. EDT today. The drop comes after the company announced a secondary offering of its stock after the close of the market yesterday.

So what

Brigham announced it will be offering 4.36 million shares of its stock at a price of $8.20 per share. Unsurprisingly, today's stock drop means that its stock now trades at $8.19 per share at the time of this writing (what a coincidence).

Image source: Getty Images.

Secondary stock offerings can send mixed signals. On the one hand, they are bad because they mean each existing stockholder's stake in the company is diluted, meaning each has to divvy up a smaller portion of the profits. Conversely, secondary offerings can raise capital for a company to make acquisitions or fund growth in the business. So if a company is good at allocating capital, then a stock issuance could lead to enhanced growth down the road.

This is what makes this stock offering rather peculiar. As the press release states, this stock offering is being made by its stockholders, notably private equity firm Warburg Pincus. Brigham specifically states that "Brigham Minerals will not sell any shares of its common stock in the offering and will not receive any proceeds therefrom."

So shareholders will be diluted, but the company won't get any cash to reinvest.

Now what

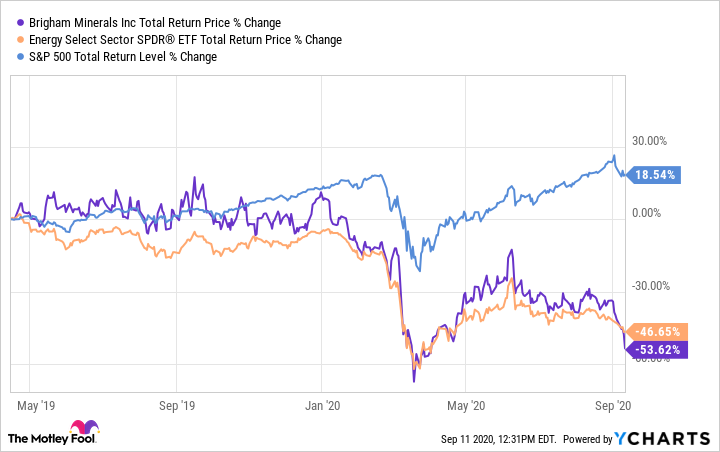

Anything related to oil and gas is going to be having a rough go of it lately, and Brigham Minerals is no exception. The company made its initial public offering a year and a half ago, and things haven't looked great since.

MNRL Total Return Price data by YCharts

The good news is that, as an owner of mineral royalties on certain tracts of land, it doesn't have to spend loads of money to maintain production. That said, its success is still intrinsically tied to the price of oil and gas and the companies drilling for it on its property. There aren't a lot of indicators that either of those things will be increasing any time soon.