After impressive growth over the past few years, ONEOK (OKE -1.51%) saw significant declines in earnings in the first and second quarters this year. The stock is down 65% so far this year. That has helped push its dividend yield up and while investors might be tempted by the yield that's at 13% as of this writing, there are a few key risks they need to be aware of.

The risks

ONEOK's biggest risk stems from the fact that its gas gathering and processing operations are exposed to fluctuations in production volumes and commodity prices due to its percent-of-proceeds, or POP, contracts. Under such contracts, ONEOK gathers gas on behalf of producer customers. The company then processes, transports, and sells gas and natural gas liquids in the markets. It remits an agreed-upon percentage of proceeds to the customer, while retaining the rest.

Image source: Getty Images.

Over the years, ONEOK has restructured its POP contracts to include a fee component. Though ONEOK's exposure to commodity prices is reduced in its contracts with a fee component, it is still exposed to price and volume fluctuations because ONEOK's fee and the amount it keeps under POP contracts may change if commodity prices change from thresholds specified in the contracts.

A steep fall in oil and gas production in the second quarter severely hit ONEOK's gas gathering and processing earnings for the quarter. What is more concerning is the U.S. Energy Information Administration's forecast for gas production in the U.S. to continue falling through February 2021. So ONEOK's gathering and processing earnings may continue to be under pressure for some time.

Further, a chunk of ONEOK's earnings comes from its "optimization and marketing" activity, through which the company works to maximize price differentials. For example, it transports NGLs from one market to another to capture the price differentials between the two markets. Squeezed differentials mean lower earnings for ONEOK, and this contributed to the huge drop in ONEOK's second-quarter earnings.

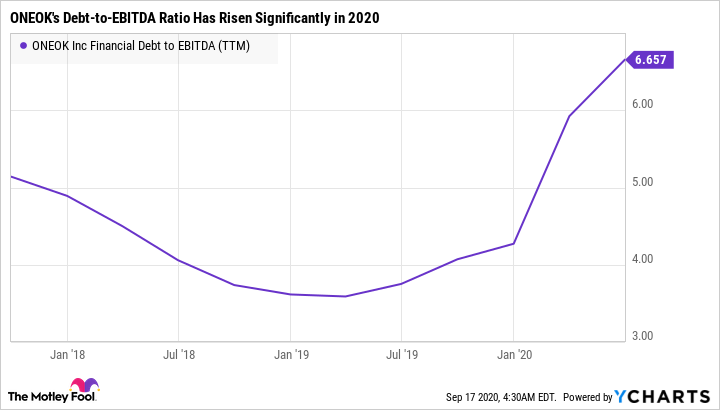

The fall in ONEOK's earnings surely came with more issues. For Q2, ONEOK generated less distributable cash flow than it paid in dividends. That resulted in its coverage ratio for the quarter falling to 0.78. Additionally, the company had to issue debt to meet its short-term obligations, resulting in elevated leverage levels.

OKE Financial Debt to EBITDA (TTM) data by YCharts

A coverage ratio below 1 and elevated leverage limit ONEOK's options if commodity markets remain pressured for long. If that happens, ONEOK may have to slash its payouts. However, all is not lost for the midstream operator.

ONEOK's strengths

While ONEOK's earnings are exposed to price and volume changes, the exposure is limited. In particular, ONEOK's natural gas pipelines segment's earnings are fully fee-based. Similarly, many of its contracts in the natural gas liquids segment are backed by volume commitments. Roughly 90% of the company's earnings are fee-based. ONEOK's customer base is diverse, and no single customer represents more than 10% of the company's revenue. All of these factors provide downside protection to ONEOK's earnings.

With respect to dividend coverage, though ONEOK's distributable free cash flow fell short of its dividends in the second quarter, the coverage is still slightly greater than 1 for the entire first half of 2020.

ONEOK has taken quick steps to conserve its cash. It has reduced 2020 capital spending by $900 million and plans to spend $300 million to $400 million in the second half of 2020 on capital projects. Total capital expenditures, including for maintenance and growth, for 2021 are expected to be between $300 million and $400 million. Another key positive for the company is recovering NGL volumes.

The verdict

ONEOK is unquestionably grappling with key issues, including challenging markets, high leverage, reduced earnings, and a dividend coverage ratio below 1. However, the company's earnings should improve as natural gas and NGL demand improves. The good thing is that the improvement in NGL volumes is already evident.

Still, the recovery -- in market conditions as well as ONEOK's leverage -- could be slow. More conservative investors may find better options elsewhere in the sector.