If there's one lesson that 2020's market volatility has taught investors, it's this: No stock is 100% safe. That, however, doesn't mean that risk-averse people should stay away from equities. Investing in stocks remains one of the best paths to financial independence -- provided you choose them carefully.

Businesses that sell products and services for which demand is steady are typically less risky to invest in, but you should also be looking for companies with the financial fortitude and strong growth catalysts to generate truly meaningful returns even during challenging times. Here are three such low-risk stocks.

Make money from waste

Waste collection, disposal, and recycling are resilient businesses that are unlikely to hit the type of speed bumps that can derail a company's growth or stock price. Fluctuations in revenue and cash flows aren't a major cause for concern for such a business given its essential nature: Come rain or shine, we'll always produce trash. That's why investing in this industry is pretty low risk, and why Waste Management (WM -0.01%) is such a great stock to own.

It's incredibly difficult -- primarily in terms of regulatory requirements and start-up costs -- to set up and operate a landfill. With 249 of them, Waste Management's landfill network is the largest in the U.S. It's so big that even rivals pay "tipping fees" to use its sites. In addition, it has 124 landfill gas-to-energy conversion facilities and owns 145 natural-gas fueling stations. (It eats its own cooking too -- 62% of its fleet runs on natural gas.) And it's North America's largest recycler.

Image source: Getty Images.

Waste Management's financial prowess and capital allocation are equally impressive. In the past three years, the company generated $10.6 billion in cash from operations, 47% of which was reinvested into the business, and 11% of which was spent on acquisitions. All of the rest went directly into shareholders' pockets. Waste Management has increased its payouts for 17 consecutive years, and has plenty of room for further dividend growth given its free-cash-flow payout ratio of below 50%. The stock yields 1.9% currently.

Waste Management is already the largest player in the industry, but will be significantly bigger after it completes its $4.6 billion purchase of the fourth-largest solid waste company in the U.S., Advanced Disposal (ADSW). Its thirst to grow via acquisitions in a resilient industry and its consistent policy of rewarding shareholders with dividend growth make Waste Management a fantastic stock for investors with a low-risk profile.

This dividend stock could easily fetch you double-digit gains annually

Given how red hot the renewable energy space is, even risk-averse investors ought to be looking for opportunities in it. Among the more intriguing options here is a company that's both the world's largest pure-play integrated renewable energy producer and also one of its most diversified.

I'm talking about Brookfield Renewable Partners (BEP -2.52%) (BEPC -1.57%).

The recent acquisition of TerraForm Power has given Brookfield's solar and wind segments a huge boost. While hydroelectric power still comprises the bulk of its portfolio, the deal shrank its share to 64% -- wind farms and solar power installations provide the rest. The U.S. Energy Information Administration projects that these three sources of energy will be the fastest-growing sources worldwide through 2050. Today, Brookfield owns nearly 5,300 generating facilities with a total of 19,300 megawatts of capacity.

The ability to generate stable, high-quality cash flows from diverse sources in an attractive industry is a formidable feature. Brookfield also has a robust balance sheet and an incredible track record of rewarding shareholders: Its dividend grew at a compound annual rate of 6% between 2012 and 2020, contributing massively to investors' total stock returns over the period.

Going by Brookfield's long-term financial goals, the stock could easily hit new highs in the years to come: Management projects that funds from operations will grow by 6% to 11% annually, backed by a solid development pipeline, and anticipates boosting its dividend by 5% to 9%. With the stock now yielding 3.8%, investors in Brookfield Renewable can sit back and enjoy solid returns year after year.

A proven and powerful Dividend King

A company like Procter & Gamble (PG 0.08%) that owns not one but several ubiquitous multibillion-dollar brands can do fine things for its shareholders. Many of us use one or more of the consumer staples giant's products daily.

Around five years ago, P&G management realized the company had too many low-margin brands in its massive portfolio and decided to trim down. After some aggressive moves, P&G is back in the game today with 65 brands instead of 170, and most of the ones it kept are top-notch household names like Tide, Gillette, Pampers, Crest, and Vicks.

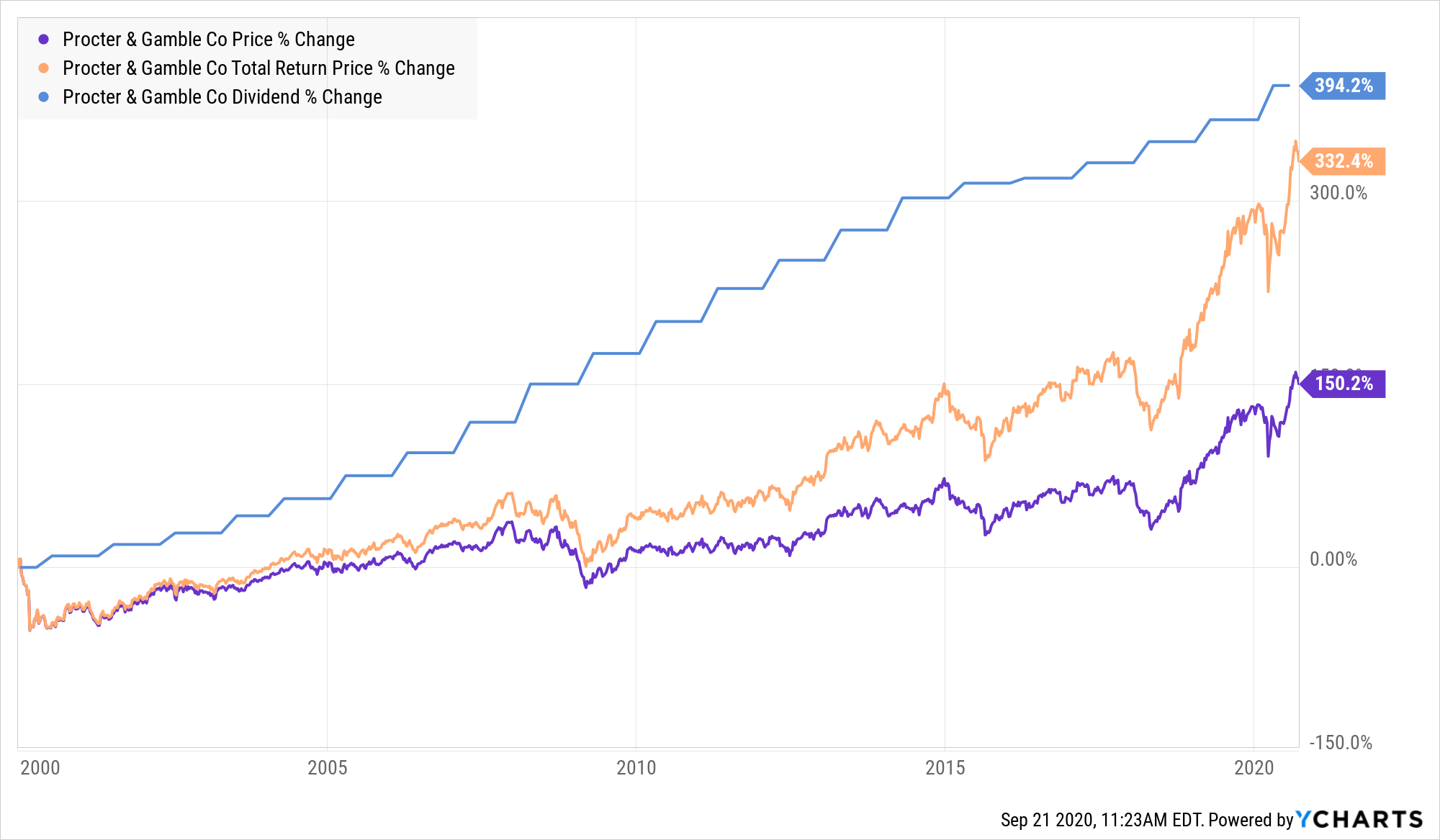

In the fiscal year that ended in June, P&G generated $71 billion in sales, with cash from operations of $17.4 billion, $15.2 billion of which was returned to shareholders in the form of dividends and share repurchases. Procter & Gamble is, in fact, a top Dividend King with a record of boosting its dividends annually for 64 consecutive years.

A leaner Procter & Gamble with a management intently focused on sales growth, cash generation, and margin expansion should be able to mint more money for itself and its shareholders. The stock may not grow as rapidly as some, but you can rest assured it'll keep its head above water and provide decent returns even in adversity, especially after factoring in dividend growth. P&G yields a respectable 2.3% currently.