Investing in stocks should be part of every retirement plan; it's one of the best ways to build wealth for your golden years. If you're approaching retirement and short of your savings goals, you need to put your money to work so you can live a comfortable retired life. Stocks can help you reach those goals quickly, provided you're invested in companies that have proven themselves in the past and are poised for future growth. Here are three top stocks that could add significantly to your retirement wealth.

A top growth utility stock you'd love to own

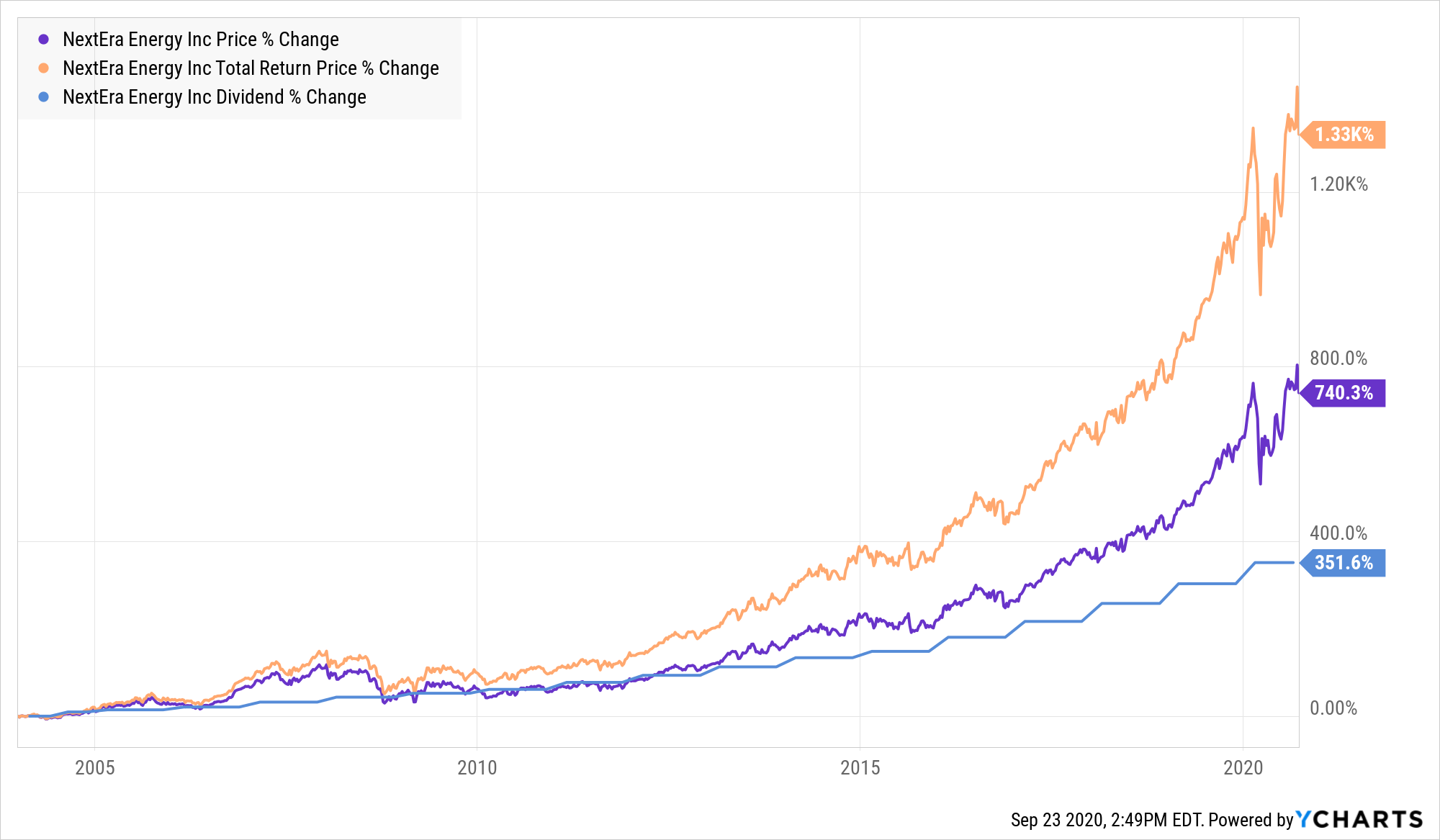

Utility stocks are almost always recommended for a retiree's portfolio, but the stock I've picked for you today isn't just any utility. It's a high-flying, high-dividend-paying stock with a business rooted deep in a trend that's shaking up the industry. That's NextEra Energy (NEE 0.54%) for you.

NextEra Energy is the world's largest producer of wind and solar energy and among the largest in battery storage -- enviable positions to hold in the high-potential renewable energy space. The company's traditional utility business is just as big: NextEra provides electricity to more than 5 million customers in Florida.

It's wise to start building your retirement wealth on time, and prudently. Image source: Getty Images.

A rapidly growing asset base, stable earnings from its utility business, and a focus on costs through a shift to clean energy have sent NextEra's cash flows soaring over the years. Its dividends took off too, growing at a compound annual rate of 9.4% between 2004 and 2019. NextEra shares rallied more than tenfold during the period.

NextEra's latest financial goals should propel its shares going forward.

- NextEra is targeting annual capital investment of $12 billion to $14 billion through 2022.

- It aims to grow adjusted earnings per share by 6% to 8% over 2021's baseline in 2022 and 2023.

- It expects annual dividend growth of 10% through "at least" 2022.

The double-digit dividend growth should make up for the stock's small yield of 1.9%. Meanwhile, NextEra's upcoming stock split should make it more affordable for you in absolute price terms. With a market capitalization of nearly $135 billion, NextEra Energy is already the world's largest utility. Given its foothold in renewable energy and commitment to shareholders, this could just be the beginning of bigger things to come.

Health is wealth, really

Many know Johnson & Johnson (JNJ -0.69%) for its consumer products, but healthcare is its forte. In 2019, pharmaceuticals contributed nearly 50% and medical devices about one-third to the company's total sales in 2019. These figures are exactly why the stock should appeal to retirees -- healthcare, after all, is where the money lies.

Johnson & Johnson stock's stellar performance over the years -- which has persisted even through economic downcycles -- is largely attributable to its formidable portfolio of top-notch global brands. There's enormous opportunity in healthcare, and Johnson & Johnson is already the world's largest healthcare conglomerate. It didn't bag the top position by a fluke: The company serves more than 1 billion patients every day and 12 of its products or platforms generate $2 billion in sales each year.

Johnson & Johnson's cash flows have risen steadily over long periods of time, setting off a remarkable 58-year streak of consecutive annual dividend increases. That makes the stock a top Dividend King -- a stock that's raised its dividend for at least 50 consecutive years. See this chart to understand the kind of growth I'm talking about:

So could Johnson & Johnson shares replicate this success in the future? Most likely, I'd say, given the growth catalysts: Johnson & Johnson has a solid biotech pipeline, is about to acquire immunology specialist Momenta Pharmaceuticals in a $6.5 billion all-cash deal, and is among the top contenders in the race to develop a COVID-19 vaccine.

Simply buying and holding Johnson & Johnson shares and reinvesting dividends along the way could give your retirement portfolio a significant boost.

Cash in on cashless growth

Financial stocks are often considered risky, but not Mastercard (MA -0.07%). It runs a virtual duopoly in the payments processing field with Visa. While Mastercard is best known for credit cards, it doesn't issue cards itself -- rather, it facilitates payments on bank-issued cards and takes a fee each time. With 2.6 billion Mastercard branded cards in global circulation, those fees rack up sales and cash worth billions of dollars. No wonder, then, that Mastercard is a cash cow with operating margins above 50%.

The coronavirus outbreak and the ensuing lockdowns and global economic slowdown have hit Mastercard's gross dollar volume of purchases, revenue, and earnings, but it's a mere blip in a promising trend. Mastercard is benefiting from a worldwide catalyst as economies across the globe -- especially populous, cash-driven nations like India -- gradually shift to cashless modes of payments. E-commerce is a huge tailwind, and the COVID-19 pandemic could, in fact, provide a fillip to e-commerce as people are skipping their trips to brick-and-mortar stores and shopping online, even forcing many traditional businesses to set up online shops.

The war on cash is real, and to make the most of the booming trend, Mastercard has and is partnering with global names and fintech start-ups, expanding its suite of value-add services like analytics and cybersecurity, and innovating technologically advanced products to stay ahead in the game. All in all, Mastercard is a top growth stock to own to build your retirement wealth.