If you're in your 30s with no retirement savings, then you probably don't need a lecture about the cost of delaying getting started with investing. Lots of people don't save money in their 20s, not because their spending habits are out of control, but because their entry-level salaries are relatively low. Plus, many are already struggling to repay student loans.

By age 30, you should have saved about $52,000, assuming you're earning a relatively average salary. This target number is based on the rule of thumb you should aim to have about one year's salary saved by the time you're entering your fourth decade. The median weekly earnings for a full-time worker between the ages of 25 and 34, according to the U.S. Bureau of Labor Statistics, is $1,042 as of the fourth quarter of 2023. That amounts to an annual salary of $54,184.

The good news is that, when you're only 30, you still have plenty of time on your side.

How much money has the average 30-year-old saved?

How much money has the average 30-year-old saved?

If you actually have $52,000 saved at age 30, congratulations! You're way ahead of your peers. According to the Federal Reserve's 2019 Survey of Consumer Finances, the median retirement account balance for people younger than 35 is $13,000. The median bank account balance for this same age group is $3,240, and the median net worth (assets minus liabilities) is $14,000.

Meanwhile, the survey found that just over 40% of people younger than 35 have student loan debt, with a median debt balance of $22,000. Nearly half are carrying credit card debt, with a median balance of $1,900.

6 ways to save more money at age 30

5 ways to save more money at age 30

At 30, you realistically still have three decades or more in the workforce, so don't be discouraged if you're behind on saving money. Follow these tips to get on track to achieve your financial goals:

1. Prioritize your emergency savings fund.

An emergency savings fund with the equivalent to 3-6 months of expenses is vital for financial security no matter how old you are. But it tends to become more important in your 30s versus your 20s because you're more likely to have kids and be a homeowner.

It may seem counterintuitive to have money parked in a savings account and earning interest of less than 1%. But having that money readily available helps you avoid liquidating your stock investments in a crisis. Raiding a retirement account early often results in taxes and penalties, and it may cause you to sell your holdings at a loss.

While you may be anxious to rid yourself of student loan debt, saving for your emergency fund comes first. Make only the minimum payments on your student loans until you have at least three months' worth of savings and then focus more on paying down your student debt.

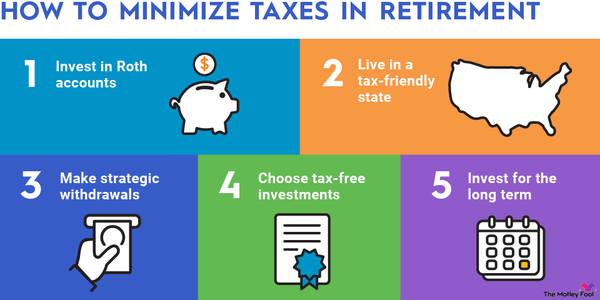

2. Contribute to both a 401(k) and a Roth IRA.

If your employer offers a retirement plan with matching contributions, make sure to contribute at least enough each year to receive the full company 401(k) match. You can play catch-up by contributing even more, and you can also contribute to an individual retirement account (IRA) if you have additional money available.

A Roth IRA is often a good choice because you forgo a tax break now, when your tax bracket may be lower, in exchange for tax-free income in retirement. Plus, you can withdraw your contributions (but not the earnings on those contributions) any time without paying tax or a penalty. For people younger than 50, the most you can contribute to an IRA in 2022 is $6,000. The limit increases to $6,500 in 2023.

If you're a freelancer, independent contractor, or small business owner, you can save for retirement using a combination of IRAs and retirement plans for self-employed people.

3. Treat paying off high-interest debt as an investment.

The decision to invest versus repay debt comes down to whether you're paying more in interest on the debt than you could expect to earn by investing. Considering that investing in an S&P 500 index fund yields an average annual return of about 8% to 10%, you should invest in your retirement fund to take advantage of your employer's 401(k) match and then tackle any debt with interest rates above this 8% to 10% range.

Interest Rate

The interest rates for credit cards are typically higher than the rates for student loans, which means credit card debt should be repaid first. The interest rates for private student loans are generally higher than the rates for federal student loans. Meanwhile, automatic forbearance for federal student loans has been extended into 2023. Since federal loans are not accumulating interest, consider putting the money normally reserved for those payments into your savings account or toward other debt.

If you have low-interest debt, like a mortgage, paying it in full around age 30 typically is not in your best financial interest. You're better off investing that money to benefit from compounding interest.

4. Err on the side of taking risk.

At age 30, your retirement is decades away. You don't need to overly worry about a stock market crash because your portfolio's value would have plenty of time to recover.

It's essential to take on enough risk to generate strong returns, especially if you're starting late. Don't invest in a portfolio that gives you heart palpitations, but don't be overly conservative, either.

A portfolio that's mostly invested in stocks and with a small percentage invested in bonds is a great option for people in their 30s. One good guideline is the Rule of 110, which says that your stock allocation should be 110 minus your age. So, if you're 30, then you should own 80% stocks and 20% bonds.

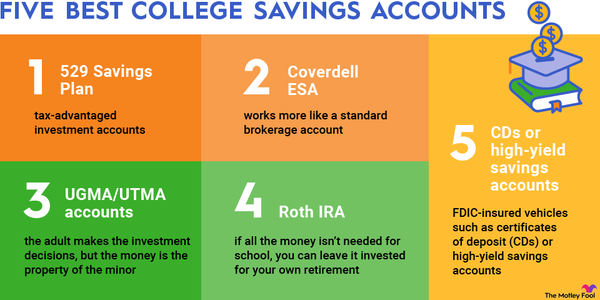

5. Save for your retirement before your kids' education.

If you have kids, don't make them your retirement plan. Focus on building your emergency fund and retirement savings before you put money toward their college funds.

Your children will have options for funding their education, including working part time, accepting financial aid in the form of scholarships and student loans, and choosing an affordable school. But your options for funding your own retirement are limited. Once your retirement investing plan is succeeding, you can start saving for your kids to attend college.

6. Save more as you earn more.

A lot of people spend their 20s living paycheck to paycheck. But if you've already received a few meaningful pay raises, then you may finally have some money to invest. As your pay increases, it's essential to increase your savings rate -- the percentage of your paycheck that you save -- every time you earn a raise. Your expenses should increase at a slower rate than your income. If you can commit to limiting lifestyle inflation and saving an increasing portion of your raises, then you can succeed at saving enough money for your later years.

Expert Q&A on Retirement

Expert Q&A on Retirement

Rita Assaf

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Rita Assaf: Coming out of the pandemic, we’ve actually seen some powerful signs that younger people are more optimistic and driven to save for the future, compared to older generations. In general, younger generations have had more exposure to workplace savings plans and we’ve seen a lot more democratization of investing. It’s now easier to get started to save and invest with mobile apps and access to information has spread as well as we see saving and investing topics in social media. Younger generations have also seen their parents and grandparents weather recessions and are much more aware of their financial life.

Additionally, younger generations are leading the way when it comes to taking action toward retirement saving, with the number of IRA account openings in Q3 2022 for Gen Z increasing by 83% when compared to Q3 2021 and the number of Millennial accounts increasing by 25%. Furthermore, Millennial Roth IRA accounts with a contribution increased by 5.8% year-to-date.

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Rita Assaf: Planning for retirement is the biggest goal we invest in throughout our lives. While it might seem daunting, it’s beneficial to start saving for retirement as early as you can to make sure your money has the greatest potential for growth over time. When thinking about retirement, it's important to set a goal and start saving early to maximize your efforts, as the growth potential of just one year’s contribution can have a significant impact on your retirement savings.

As a general rule, these are the three actions that can make the biggest impact on retirement readiness for those saving in their twenties or thirties:

- Save as much as you can: Young people today are 30 or more years away from retirement. At this point, your retirement plan should really be focused on determining how you are saving on a regular basis and what accounts those savings should be put into based on tax and investing considerations. To help determine that, Fidelity suggests aiming to save at least 15% of your pre-tax income each year, which includes any employer match, with a goal to save 10 times (10X) your pre-retirement income by age 67. Breaking this down by age, aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60.

- Increase contributions over time: If starting off saving 15% of more of your income isn’t possible, small increases over time can make a big difference. If you have access to a 401(k) with a company match, try to save to at least your company match level. If you don’t save to that level, it’s like leaving free money on the table. A great way to regularly increase your contributions to your retirement savings is to do it if and when you get a raise each year. Get in the habit of increasing your contribution rate by 1% each year until you get to the 15%.

- Review your asset mix: Getting your investment mix right—investing for growth— from the start, can make a big difference. You want to make sure your money is working for you and has potential for growth. Make sure you have the right mix of stocks, bonds and cash based on your how far you are from retirement, and how comfortable you are taking potential risk in your portfolio.