Shopify (SHOP 0.23%) and Etsy (ETSY -0.86%) just posted their biggest quarters ever with the coronavirus pushing shoppers online. Stellar results have driven Etsy stock to all-time highs, and Shopify is also within 5% of its high watermark. With the pandemic changing many consumer shopping habits for good, which of these two stocks would be a better buy to take advantage of the long-term e-commerce trend? Let's find out.

Comparing key metrics

Since they were founded 15 years ago, these two e-commerce platforms have grown to multi-billion dollar annual revenue businesses. Shopify hosts more than one million merchants generating sales that have surpassed eBay to become the second-leading e-commerce platform in the U.S. (behind Amazon). But Etsy is no slouch as you can see below:

|

Metric |

Shopify |

Etsy |

|---|---|---|

|

Founded / year public |

2004 / 2015 |

2005 / 2015 |

|

Sellers |

Over one million |

3.1 million |

|

Trailing 12-month platform or marketplace sales |

$82.9 billion |

$6.9 billion |

|

Trailing 12-month revenue |

$2.1 billion |

$1.1 billion |

|

Three-year compound annual revenue growth rate (2016 to 2019) |

59% |

31% |

|

Q2 2020 revenue growth (year over year) |

97% |

137% |

|

Trailing 12-month net income (loss) |

($67 million) |

$155 million |

|

Cash and marketable securities |

$4.0 billion |

$1.0 billion |

|

Debt |

No debt |

$803 million |

Data source: Company filings and quarterly earnings reports. Table by author.

The case for Shopify

Shopify powers the back-office functions of e-commerce stores for both entrepreneurs and large enterprises. Merchants choose the platform to run their business, because they can highlight their brand and not get lost in a sea of sellers on sites like Amazon or eBay. With the coronavirus keeping shoppers at home, Shopify's merchants enjoyed record platform sales with stores of all sizes and geographies selling more products on average across the board. Shopify shares in the success of its merchants by taking a small cut of sales plus any optional services merchants employ such as payments or shipping.

One of the unique features of the Shopify platform is that it can appeal to the merchant just starting out with low-cost plans starting at $9 per month. For bigger customers, the Shopify Plus feature-rich offering can handle large, high-volume brands starting at a monthly rate of $2,000. This enterprise-level offering is so popular that it makes up 29% of the company's monthly recurring revenue.

Lastly, Shopify's ecosystem doesn't just benefit merchants, but it enables other businesses that support its online sellers. Its robust partner network consists of application builders, marketers, website designers, and other consultants who have established their own small businesses helping Shopify merchants be successful.

As its merchants sell more products, the company and its partners can invest more to improve the platform. These improvements make the platform more attractive for sellers, spinning its growth flywheel even faster.

Image source: Getty Images.

The case for Etsy

Etsy's marketplace has provided an easy way for talented artisans to grow their brand exposure, capture more customers, and increase sales. Starting a store on the marketplace is easy, and unlike Shopify, doesn't require a monthly subscription. Etsy generates about three-quarters of its revenue from its marketplace services, which are the fees to list, sell, and collect payments. It also makes money from other optional services such as advertising and shipping.

The company's mission is to "keep commerce human" and it does this by enabling its 60.3 million active buyers to discover unique items from its 3.1 million active sellers. Many sellers will even personalize an item for a buyer, making the shopping experience stand out even further.

The marketplace's largest category of goods is homewares and home furnishings, and its sellers moved $2 billion worth of goods in this category over the last 12 months. Apparel and beauty and personal care are also two of the top categories with growth rates of 59% and 187%, respectively, in the second quarter. Together these three segments accounted for 40% of gross merchandise sales last quarter. As more of Etsy's shoppers look to the marketplace for everyday goods and not just that special occasion item, it will help fuel the marketplace's growth for years to come.

So which is the better buy?

These two companies are both high-quality operations, but their valuations present a stark contrast. Etsy's price-to-sales ratio seems expensive at 16.5, but that pales in comparison to Shopify, which trades at over 60 times trailing 12-month revenue. Is Shopify really worth such a premium over Etsy? For perspective, I compared these two in April 2017, when Shopify's price-to-sales ratio was about fives times that of the craft marketplace.

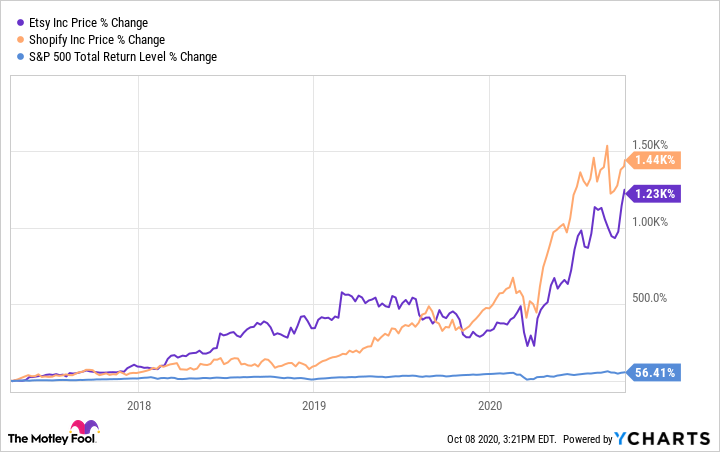

Etsy and Shopify stock prices versus the S&P 500 from April 10, 2017, through Oct. 8, 2020. Data by YCharts.

The above chart shows that both stocks have been amazing market beaters since I wrote that previous article, but Shopify won out, even with its premium valuation. Could it happen again?

Maybe.

I don't think you can go wrong with either of these e-commerce platforms. But if Shopify's lofty valuation and lack of profits scare you away, Etsy is a great way to play the growing e-commerce trend. But Shopify's platform is well-suited to the individual entrepreneur and larger enterprise customers, which makes its addressable market much bigger, giving this behind-the-scenes platform a long runway of growth, even at its rich valuation.

Whether you choose to buy one or both stocks, these proven winners should continue to deliver market-beating returns long term.