What are dividend index funds? Let's take each word in reverse order. First, they're funds -- either mutual funds or exchange-traded funds (ETFs). Second, they attempt to track an index comprising multiple stocks. Third, they focus on stocks that pay dividends.

Just as dividend stocks aren't ideally suited for every investor, dividend index funds won't appeal to everyone. However, if you're primarily interested in obtaining steady income rather than high growth from your investments, these funds could be just what you're looking for -- and there's no stock-picking required.

Eight top dividend index funds

Eight top dividend index funds to buy

Here are eight dividend index funds, in alphabetical order, that have relatively low expense ratios but varying dividend yields and risk levels.

| Fund | Dividend Yield | Expense Ratio | Risk Level |

|---|---|---|---|

| Invesco S&P 500 High Dividend Low Volatility ETF (NYSEMKT:SPHD) | 4.31% | 0.30% | Average |

| iShares Core High Dividend ETF (NYSEMKT:HDV) | 3.39% | 0.08% | Below average |

| ProShares S&P 500 Dividend Aristocrats ETF (NYSEMKT:NOBL) | 2.04% | 0.35% | Below average |

| Schwab U.S. Dividend Equity ETF (NYSEMKT:SCHD) | 3.38% | 0.06% | Below average |

| Vanguard High Dividend Yield ETF (NYSEMKT:VYM) | 2.86% | 0.06% | Below average |

| Vanguard Dividend Appreciation ETF (NYSEMKT:VIG) | 1.80% | 0.06% | Below average |

| iShares Core Dividend Growth ETF (NYSEMKT:DGRO) | 2.33% | 0.08% | Below average |

| Vanguard Real Estate ETF (NYSEMKT:VNQ) | 4.06% | 0.12% | Average |

Funds 1 - 4

Funds 1 - 4

1. Invesco S&P 500 High Dividend Low Volatility ETF

This ETF tracks the S&P 500 Low Volatility High Dividend index. As the name indicates, it targets dividend stocks that historically haven't been very volatile but provide high dividend yields. The ETF includes 51 stocks, with its highest allocation to utility stocks and real estate stocks.

2. iShares Core High Dividend ETF

The iShares Core High Dividend ETF attempts to track an index comprising 75 U.S. stocks that pay relatively high dividends. Its top holdings include several energy stocks and big pharmaceutical stocks.

Exchange-Traded Fund (ETF)

3. ProShares S&P 500 Dividend Aristocrats ETF

This is the only ETF that exclusively tracks the performance of Dividend Aristocrats® -- S&P 500 members that have increased their dividends for at least 25 consecutive years. (Dividend Aristocrats® is a registered trademark of Standard & Poor’s Financial Services LLC.) As you might expect, these stocks tend to have lower risk levels. This ETF contains a minimum of 40 Dividend Aristocrat stocks; it currently tracks 67 companies.

4. Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF seeks to track the total return of the Dow Jones U.S. Dividend 100 index. This index focuses on U.S. stocks with high dividend yields and a strong track record of consistently paying dividends. Industrial stocks make up almost 18% of the ETF's holdings, followed by healthcare stocks, which account for 16.8%.

Funds 5 - 8

Funds 5 - 8

5. Vanguard High Dividend Yield ETF

This ETF attempts to track the performance of the FTSE High Dividend Yield index. The index includes only U.S. stocks with high dividend yields but excludes real estate investment trusts (REITs). The Vanguard High Dividend Yield ETF currently owns almost 450 stocks, with financial stocks representing almost 20% of its assets.

6. Vanguard Dividend Appreciation ETF

The Vanguard Dividend Appreciation ETF tracks the Nasdaq U.S. Dividend Achievers Select index, which consists of 315 companies that have increased their dividends over long periods. The idea is to include companies with a long track record of dividend growth, which speaks to superior capital management.

7. iShares Core Dividend Growth ETF

Similar to the Vanguard Dividend Appreciation ETF, the iShares Core Dividend Growth ETF seeks to replicate the performance of companies that have consistently increased their dividends. It tracks the Morningstar U.S. Dividend Growth index, which is almost 50% larger than the Nasdaq U.S. Dividend Achievers Select index. The ETF has 420 holdings.

8. Vanguard Real Estate ETF

The real estate world also has the potential to generate meaningful income through dividends. The Vanguard Real Estate ETF invests in REITs and companies that invest in office buildings, hotels, and various other properties. This ETF tracks the MSCI US Investable Market Real Estate 25/50 index, which comprises 158 companies.

What to look for in dividend index funds

What to look for in dividend index funds

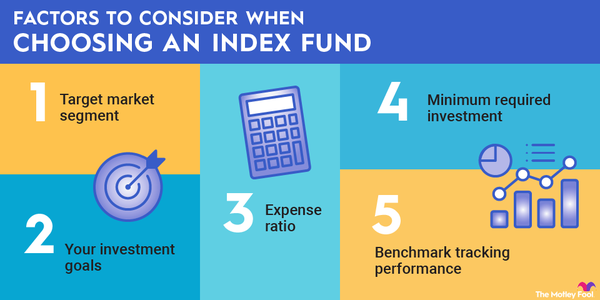

A good first step is to determine your overall asset allocation and, as a follow-up, the amount of money you have to invest in stocks and/or equity index funds. Once you've done the pre-work, you can visit any of the major online discount brokerages, such as Vanguard, Fidelity, or Charles Schwab, all of which offer free (or very low-cost) ETF trading.

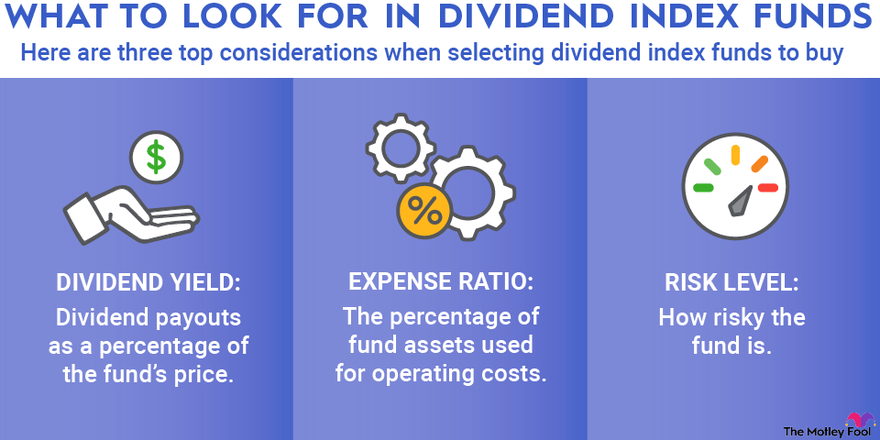

Here are three top considerations when selecting dividend index funds to buy:

- Dividend yield: Dividend payouts as a percentage of the fund's price.

- Expense ratio: The percentage of fund assets used for operating costs.

- Risk level: The riskiness of the fund.

To some extent, there's a trade-off between dividend yield and risk level. Generally speaking, higher yields are associated with higher risk, but higher expense ratios don't necessarily translate to higher dividend yields or lower risk levels.

It's also important to remember that dividend yield alone does not act as a perfect indicator of future performance. Focusing only on companies paying dividends leaves out many that derive their growth from price appreciation, such as those in big tech. Make sure you construct a diversified portfolio that covers a wide population of underlying firms with different capital strategies.

Dividend index funds are long-term investments

Dividend index funds are long-term investments

The stock market can be volatile in the short term. So, it's important to keep in mind that dividend index funds are meant to be held for the long run.

First, the longer you hold your index funds, the better performance you're likely to see. Longer holding periods lend themselves to more compounding, which enables your money to grow rapidly in later years.

Second, short-term market movements tend to be unreliable when it comes to successful investing. As we've seen this year, short-term market swings can be erratic both in direction and magnitude. However, longer-term investment horizons have reliably trended upward, especially when it comes to dividend-paying blue chip stocks.

Finally, longer holding periods also make your portfolio more tax-efficient. If you keep your dividend index funds for longer than a designated holding period, you'll be eligible for qualified dividends, which are taxed at a lower capital gains rate when earned.

If you do choose to allocate a portion of your portfolio to dividend index funds, know that short-term price movements are entirely normal. A long-term focus has historically been a preferable strategy.

Related index fund topics

Why invest in dividend index funds?

Why invest in dividend index funds?

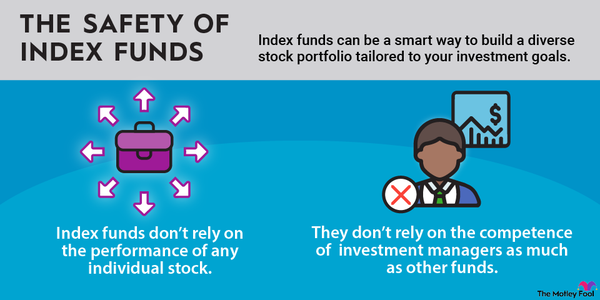

Dividend index funds will be most attractive to income-seeking investors. The top funds provide solid dividend yields and diversification across a wide range of stocks, which can be less risky than buying a smaller number of individual dividend stocks. View dividend index funds as part of a broadly diversified portfolio that considers your overall risk tolerance and return expectations.

Dividend index funds FAQs

Dividend index funds FAQs

Are there dividend-paying index funds?

Yes, there are several dividend-paying index funds for investors who prioritize steady income over high growth.

Do Vanguard index funds pay dividends?

A number of well-regarded Vanguard index funds pay dividends, including the Vanguard High Dividend Yield ETF, the Vanguard Dividend Appreciation ETF, and the Vanguard Real Estate ETF.

Are dividend index funds risky?

The level of risk associated with a dividend index fund depends on its holdings. It's crucial to check the holdings of any dividend index fund that you're considering to assess the risk of an investment.

Which dividend fund is best?

The best dividend funds depend on your risk tolerance. The Invesco S&P 500 High Dividend Low Volatility ETF has a 4.74% dividend yield, the highest among our recommendations, but its risk is average. Meanwhile, the iShares Core High Dividend ETF has a 4.09% dividend yield but an expense ratio of only 0.08%, much lower than the 0.3% ratio for the Invesco fund.