Robinhood is a commission-free trading platform that is popular among millennials (the average age of a Robinhood user is 31). These investors, many of whom are newcomers to the investment world, tend to pick some high-quality stocks. Such brilliant companies as Amazon and Apple constantly feature on the list of the 100 most popular stocks on the platform.

But Robinhood investors also have their share of poor stock picks, just like the rest of us. Among these are cannabis companies HEXO (HEXO) and Cronos Group (CRON 5.08%). Both of these pot growers have serious problems, and investors (on Robinhood and elsewhere) had better stay away from them. Here's why.

1. HEXO

There are many reasons investors shouldn't purchase shares of HEXO. Here are two of the most pressing.

First, HEXO has resorted to dilutive forms of financing on too many occasions over the past year. The company issued new shares or convertible debentures (a type of debt instrument that can be converted to shares of a company's stock after a certain period) on at least five separate occasions in the past 12 months. Issuing new shares decreases the value of existing shares, which generally isn't good for shareholders.

Second, the pot grower risks getting delisted from the New York Stock Exchange (NYSE). This can happen if a company's share price sits below the $1 threshold for 30 consecutive trading days (HEXO's stock price is currently $0.76). Getting delisted doesn't happen automatically, and companies are typically given a chance to rectify the situation.

In May, HEXO announced it had received a warning from the NYSE about this problem; the marijuana company has until mid-December to fix it. Getting delisted from a major exchange and switching to an over-the-counter one is perceived as a major red flag. Institutional investors with big pockets would likely lose interest in HEXO if that were to happen, and it could affect the company's ability to raise capital.

HEXO could resort to a reverse stock split to avoid this outcome. This nifty trick is also seen in a bad light by investors, though, and would likely result in a sell-off. Whatever the company chooses to do, both problems mentioned above warrant skepticism. Investors would do well to shy away from this cannabis stock.

Image source: Getty Images.

2. Cronos

Toronto-based Cronos Group stands far behind some of its Canadian competitors in terms of revenue. During its second quarter, which ended June 30, the company reported net revenue of 9.9 million Canadian dollars ($7.5 million), a 29% increase versus the prior-year quarter. Meanwhile, Canopy Growth and Aphria (two of Cronos' peers in its domestic market) recorded net revenue of CA$152.2 million and CA$110.4 million, respectively, during their comparable periods.

Despite its comparatively meager sales figures, there is one reason Cronos might still be able to turn things around: its partnership with Altria. The tobacco giant acquired a 45% stake in Cronos Group for CA$2.4 billion in a transaction that closed in March 2019. This investment gave Cronos access to some much-needed cash, not to mention Altria's expertise. Cronos planned on making a serious dent in the vaping market thanks to some help from Altria.

Cronos CEO Mike Gorenstein said in an earnings conference call last year: "We know the vaporizer space is one of the fastest-growing and evolving categories, with many consumers migrating to this convenient, noncombustible consumption method. At the same time, the category remains in its infancy with few products that are specifically tailored for cannabinoids." The company even opened an R&D facility in Israel called Cronos Device Labs in May 2019 to develop state-of-the-art vaporizer products.

But Cronos faces at least two problems in this market. The first is competition. Aphria and Canopy are also active in the vaping segment; Aphria actually holds the leading market share in the Canadian province of Ontario, the largest by population. The vaping-related health scare that emerged last year has also somewhat hindered this segment, with the provinces of Quebec and Newfoundland & Labrador deciding to ban the sale of these products entirely.

These factors will make it significantly harder for Cronos Group to catch up to its peers in the cannabis market in terms of sales.

Here's a better option

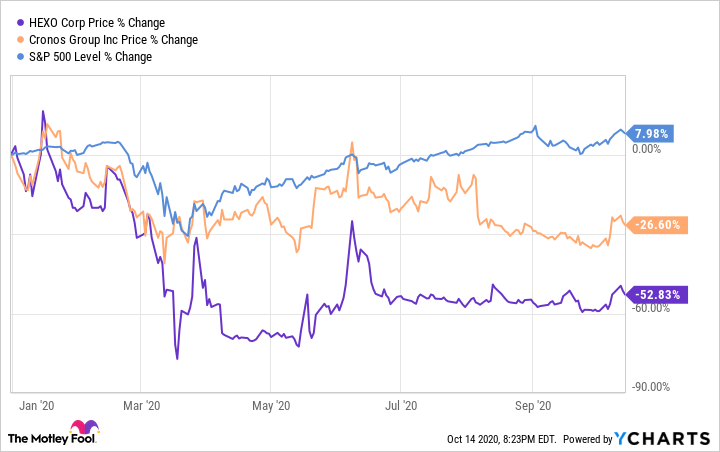

HEXO and Cronos Group have both performed poorly in the stock market so far this year. But the question isn't just whether they can rebound; rather, it is whether they have a good chance of outperforming the market and most other cannabis stocks from here on out. Given the issues explained here (and others), I believe there are much better options for investors looking to cash in on the cannabis industry.

In particular, Aphria looks like a much better buy than either Cronos or HEXO. Aphria's revenue is second to none in the Canadian market, where it holds a strong market share, and it is also making steady progress in Germany, one of the largest cannabis markets outside North America. Even Robinhood investors seem to recognize Aphria's superior prospects, which is why it is more popular than both HEXO and Cronos on the platform.