Back in April, Chinese video streaming company iQiyi (IQ -2.62%) was hit by allegations of fraud. Wolfpack Research and short-seller Muddy Waters, which spotted Luckin Coffee's fraudulent accounting before the regulators did, accused iQiyi of inflating its revenues by 27% to 44% in 2019.

Moreover, Wolfpack claimed iQiyi had inflated its revenues all the way back to 2015, long before its spin-off from Baidu (BIDU -0.56%) in 2018. That timeline seemingly implicated Baidu, which maintains a majority stake in iQiyi, and both stocks initially sank. Those troubles worsened in August, when iQiyi disclosed an SEC probe of its accounting practices.

Image source: Getty Images.

But in early October, iQiyi said it concluded an internal review and "did not uncover any evidence that would substantiate the allegations." The review was conducted by an independent audit committee with the assistance of professional advisors, including a top accounting firm which isn't iQiyi's auditor. It also said it will "continue to cooperate with the SEC."

iQiyi and Baidu aren't out of the woods yet, but the announcement lifted both stocks. Should investors assume the worst is over?

Did the short-sellers follow Muddy Waters' lead?

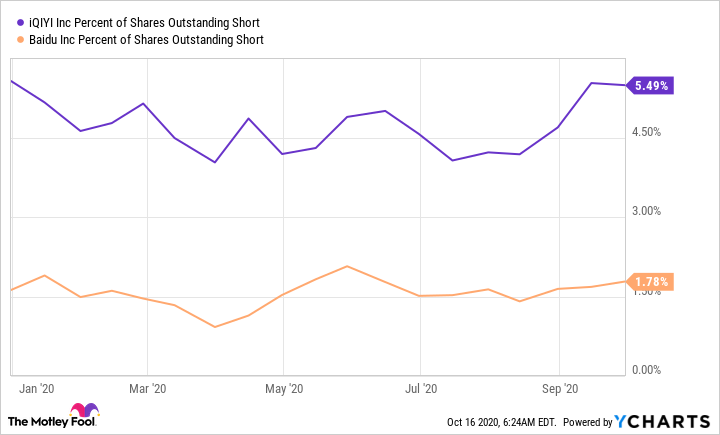

If we track the short interest in iQiyi and Baidu this year, we'll notice Wolfpack's report in April didn't attract a stampede of short-sellers to either stock, and the percentage of shorted shares remained fairly stable:

Source: YCharts

Shares of iQiyi and Baidu have also risen roughly 9% and 3%, respectively, this year. iQiyi likely repelled the short-seller attack for four reasons.

First, several high-profile analysts defended iQiyi against Wolfpack's report. Mizuho analyst James Lee claimed iQiyi's revenue recognition practices were in line with industry standards and the likelihood of fraud was low. Oppenheimer analyst Bo Pei also initiated bullish coverage on iQiyi with an "outperform" rating.

Second, Tencent (TCEHY 0.10%) reportedly approached Baidu with a takeover bid for iQiyi in June. The proposed buyout would have merged Tencent Video with iQiyi to create China's largest video streaming platform with over 200 million paid subscribers. Tencent, one of the largest tech companies in China, probably wouldn't have considered that deal if it thought iQiyi was generating fake revenues from fake users.

Third, iQiyi's core business improved in the second quarter. Its revenue grew 4% year over year to 7.4 billion yuan ($1.0 billion), its number of subscribers also rose 4% to 104.9 million, and its net loss narrowed from 2.3 billion yuan to 1.4 billion yuan ($204 million). Those growth rates weren't exceptional, but they allayed some concerns about iQiyi's sluggish growth in users and its widening net losses.

Lastly, iQiyi's tepid growth rates are a far cry from the triple-digit revenue growth rates Luckin Coffee was reporting before it went off the rails. In short, Luckin's numbers looked too good to be true, but iQiyi's numbers didn't.

What does this mean for Baidu?

Baidu generates most of its revenue from online ads, but revenues from that core business have declined year over year for five straight quarters. It blamed that contraction on the slowdown in the Chinese economy, the ongoing U.S.-China trade war, competition from rival platforms, COVID-19, and other macro factors.

As its advertising business withered, Baidu relied more heavily on its revenues from iQiyi, which accounted for 28% of its top line last quarter. iQiyi's growth offset Baidu's declining ad revenues, but its losses weighed down Baidu's margins.

Therefore, Baidu needs iQiyi to prop up its top-line growth until its higher-margin advertising business finally recovers. So if iQiyi's revenues were inflated, or Baidu is implicated in either covering up or turning a blind eye to iQiyi's accounting practices, the tech giant could be in serious trouble.

The conclusion of iQiyi's internal audit relieves some of that pressure, but neither company will be fully exonerated until the SEC concludes its probe.

The key takeaway

Baidu and iQiyi's troubles aren't over yet, but the conclusion of iQiyi's internal review should prevent short-sellers from launching another attack. For now, investors should focus on Baidu and iQiyi's other challenges in online advertising and streaming video instead of fretting over the potential outcome of the SEC probe.