As one of the world's largest pharmaceutical companies, AstraZeneca (AZN 0.28%) competes in a broad array of disease markets, producing medicines in the oncology, immunology, and cardiovascular segments, just to name a few. AstraZeneca is also one of the world's most prolific drug innovators, claiming 21 different regulatory approvals for its pipeline projects last year alone. What's more, the company is profitable, posting steady revenue growth year over year, and is engaged in a high-profile effort to develop a coronavirus vaccine.

Nonetheless, investors considering AstraZeneca's stock may have reservations about the company's $22.12 billion in debt, which far outweighs its $1.57 billion in trailing free cash flow, as well as its $6.11 billion in cash on hand. Others may be hesitant to invest in a mature company that's reliant on costly, continuous, and highly risky research and development (R&D) projects. Related worries include that AstraZeneca won't be able to grow as rapidly as a smaller company would, and it may not outperform the market. Let's take a peek at AstraZeneca's core activities to see how they might impact its stock price over the next year or so.

Image source: Getty Images.

Research and development: AstraZeneca's bread and butter

AstraZeneca has 166 potential treatments currently in clinical trials, nine of which are wholly new therapy candidates, not a new combination of previously developed drugs. Many of the company's programs are in the final phase of clinical trials, meaning that it may be within one or two years of obtaining regulatory approval and achieving commercialization. In particular, AstraZeneca's leading oncology drugs like Lynparza, Enhertu, Calquence, and Imfinzi are approved to treat several different cancers and patient populations, but ongoing development efforts in the final phase of clinical trials will expand their treatment potential into new indications. These efforts will create new streams of revenue from older products, supporting the company's earnings while keeping investors interested.

Its early stage pipeline is also overflowing with candidates for conditions like Alzheimer's disease, opioid use disorder, asthma, and rheumatoid arthritis (RA). In particular, the market for Alzheimer's disease therapeutics is estimated to grow at a compound annual growth rate of 4.6% and reach $12.4 billion in the next six years, so it's feasible that AstraZeneca will earn several billion in new revenue if it can capture a significant market share. RA could also become a profitable segment for the company; the global market is expected to reach $33.95 billion by 2025, up from $23.8 billion in 2017.

The pharma stock is hard at work on a coronavirus vaccine

The company's efforts to develop a coronavirus vaccine candidate have drawn a tremendous amount of attention from the general public and investors. AstraZeneca's candidate is currently in the final phase of its clinical trials, and many experts view it as the most promising. Overall, the vaccine project has been highly favorable for AstraZeneca's stock price, causing its stock to rally rapidly from the March crash and exceed its prior level by late April.In terms of the vaccine's future prospects, it's probable that an experienced pharma company like AstraZeneca has the organizational capabilities to profitably produce its vaccine at scale , and its ongoing research collaboration with Oxford University also bodes well for the vaccine's scientific merit. The U.S. and the U.K. have each purchased 400 million doses, which AstraZeneca has already started to distribute since September.

But AstraZeneca's vaccine trial hasn't proceeded without bumps in the road. The trial was paused for an investigation after a patient enrolled in the trial developed a serious illness. The results of the investigation allowed the trial to proceed shortly thereafter, but some trial locations like the U.S. took significantly longer to return to normal operations, slightly reducing AstraZeneca's chances of receiving approval for sale before its competitors.

Expect growth, but don't bet the farm

In my view, AstraZeneca's demonstrated mastery of the drug development process makes it a sound investment for the long term despite its substantial debt load. But it's important to keep in mind that each individual project that obtains regulatory approval and reaches the market has minimal impact on the company's bottom line -- AstraZeneca's trailing-12-month revenue of $25.7 billion is just too massive to be rocked by one new drug's sales. While new medicines are the largest drivers of growth for the company, in the first half of this year, its 13 newest drugs only yielded incremental revenue of $2 billion more than the same half in 2019, accounting for an 11% increase.

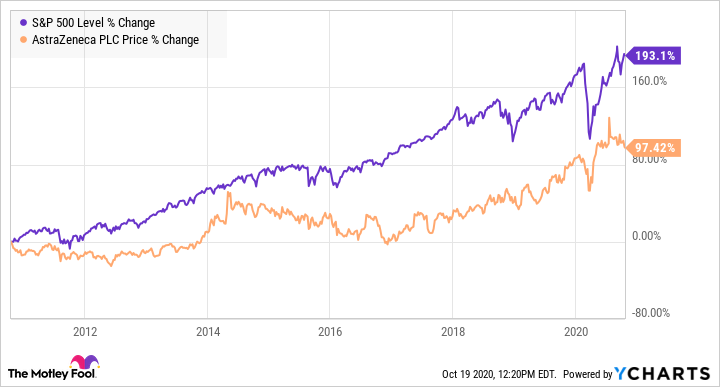

For investors, this means that the benefit of positive news about the company's coronavirus vaccine candidate may have a larger impact on the stock than the actual earnings contributed by the vaccine's eventual revenue. Either way, I expect its shares will continue to rise, and it's possible that AstraZeneca outperforms the market over the next five years. But if AstraZeneca's coronavirus vaccine enters a stacked competitive market or is more expensive to produce and distribute than anticipated, don't be too surprised if it takes a year or two for the company to begin beating the market once again.