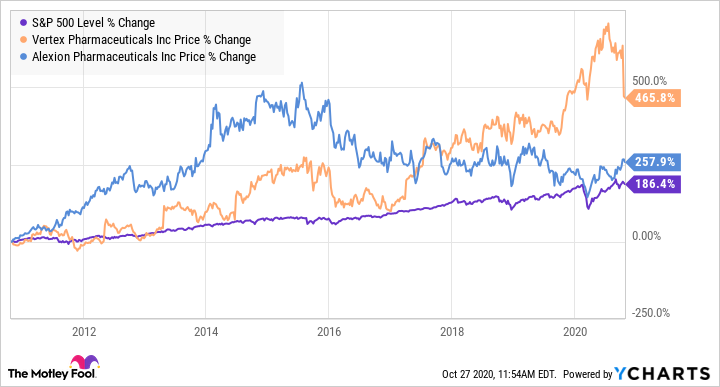

Vertex Pharmaceuticals (VRTX 1.25%) and Alexion Pharmaceuticals (ALXN) are two major competitors in the healthcare sector, both of whom focus on developing drugs for rare diseases like cystic fibrosis and myasthenia gravis. Each company is profitable, makes around $5.45 billion in trailing revenue, and is rapidly growing its quarterly revenue. Furthermore, the pair have outperformed the market over the last 10 years, and neither has much debt in comparison to their cash on hand.

Either Vertex or Alexion could be a favorable investment for the long term. But, between these two stocks, I think one of them has a slight edge, and it comes down to market penetration and diversification into new markets. Let's dive in and examine each stock in detail to see how they rate.

Image source: Getty Images.

Vertex continues to bet big on cystic fibrosis therapies

Vertex bases its business around treating cystic fibrosis (CF), for which it produces several different drugs. CF therapies earned Vertex more than $4 billion in 2019, and it expects to grow its revenue to nearly $6 billion this year. In its development pipeline, Vertex has a bevy of new CF therapies, including several combinations of already approved drugs. Between all of the options in its portfolio as well as its ongoing drug development, the company aims to reach 90% of all of the patients living with CF in the world by 2025.

Year over year, Vertex's revenue is growing by a shocking 62%. There's just one problem looming on the horizon: What happens when Vertex has met its goal of near-complete penetration of the market for CF therapies? Given that the company expects to hit this milestone in the next five years, it follows that its revenue growth is in danger of hitting a wall. With few patients left to reach with its products, Vertex simply won't have any more room to grow without a new innovative effort.

On that front, Vertex doesn't have any late-stage pipeline programs outside of cystic fibrosis, and its phase 2 pipeline for other rare diseases is far from being packed with projects. If Vertex becomes a victim of its own success in its primary market, its stock price may suffer when its rapid growth tapers off and shareholders are unimpressed with its stable and formidable base of CF revenue.

Alexion's diversified rare disease strategy keeps paying off

Alexion targets a handful of different rare diseases, and it has more late-stage pipeline projects than Vertex. In particular, its drug Soliris for paroxysmal nocturnal hemoglobinuria (PNH) is currently being investigated for its usefulness in pediatric myasthenia gravis, neuromyelitis, and Guillain-Barre syndrome. These three projects are currently in their final phase of clinical trials, which makes Alexion unlikely to fall victim to the same revenue drop-off that may be facing Vertex, even though it has already penetrated 70% of the market for PNH therapeutics. With its PNH market share, Alexion expects to earn $4.72 billion this year alone.

Soliris isn't the first drug that Alexion has used to demonstrate its flexibility in different rare disease areas. The company's drug Ultomiris is a newer and longer-lasting therapy for PNH, but it's also being investigated for its applicability in atypical hemolytic uremic syndrome, myasthenia gravis, neuromyelitis, severe COVID-19, and amyotrophic lateral sclerosis (ALS). In other words, Alexion is willing to develop multiple drugs to target the same rare disease, but diversification is a much larger strategic priority. In fact, via diversification, Alexion plans to quadruple its neurology segment revenue by 2025.

Which stock is the better buy?

While Alexion's year-over-year quarterly revenue growth of 20.1% doesn't come close to Vertex's, in the long run it's easy to envision how Alexion's revenue growth could remain consistently strong due to its constant expansion into new rare disease markets. Should Vertex penetrate the CF market so fully that it doesn't have any new customers to treat -- which is exactly what the company's leadership is planning to do in the near future -- the company's rapid revenue growth will end promptly, even if it maintains its revenue base.

Remedying this state of affairs won't be easy for Vertex, and it may need to acquire new pipeline projects to keep its development activities ongoing, especially if it hits unforeseen obstacles with the projects currently in its small pipeline. Thus, while I'm optimistic that Vertex will eventually tackle new markets as effectively as it has done with the CF market, I think that Alexion is the better stock to buy if you're investing for longer than the next few years.