Since late March, the stock market has performed like a Greek tragedy. Winners and losers have taken and exited the stage, all in dramatic fashion. First, it was the stay-at-home stocks -- companies that benefited from our need to quarantine and social distance. Those rocketed higher while shares of virtually any company that relied on a growing economy and in-person services or entertainment plummeted. But the recent run of upbeat news on the vaccine front changed all of that, at least somewhat. Occupants of downtrodden sectors like industrials, energy, financials, and retail have all rebounded strongly, taking center stage while many stay-at-home stocks shuffled meekly into the wings.

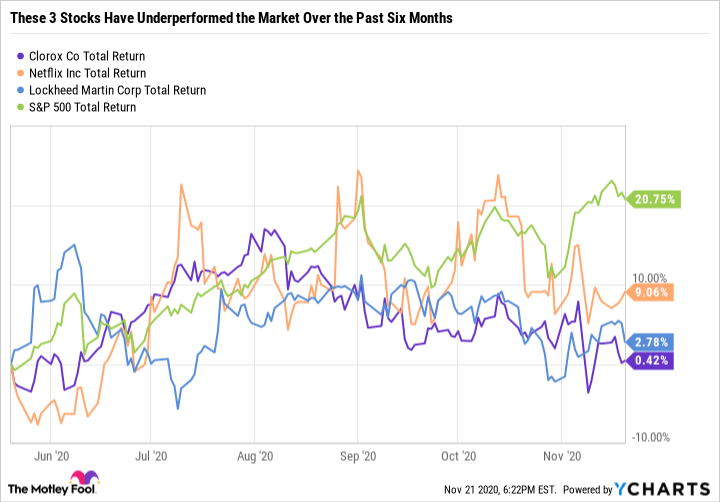

Amid all the chaos and uncertainty, though, it can be difficult to decipher which stocks are good buys now. These three well-known companies -- Clorox (CLX 1.38%), Netflix (NFLX 3.81%), and Lockheed Martin (LMT 0.01%) -- are from different sectors, but all have one thing in common. Wall Street seems to have forgotten about them. Here's why you shouldn't.

Image source: Getty Images.

1. Clorox

Consumer staple stocks are seen as go-to investments during times of uncertainty. Clorox generates steady results regardless of market cycles. It also distributes a sizable and growing dividend.

In the third quarter, its sales grew by 27% and it delivered a staggering 103% increase in diluted net earnings per share. High demand for everything from household cleaners to personal care products to water filtration has been boosting Clorox's short-term results. But the company still expects growth in the first half of 2021, albeit slower growth.

Though the company is generating more cash and making more money, its stock price today is almost exactly where it was six months ago. After a surge that lasted through early August, it has retreated.

CLX Total Return Level data by YCharts

Wall Street seems to be attributing Clorox's recent successes mostly to the coronavirus, but the company was doing well before this crisis too. Revenue, net income, and free cash flow (FCF) have been growing at good paces for more than five years; this company isn't solely relying on pandemic-driven tailwinds.

In July, Clorox raised its quarterly dividend from $1.06 per share to $1.11 per share. It now distributes about $140 million per quarter in dividends. It also reinstated its stock-buyback program and repurchased around $100 million in shares during the first quarter of its fiscal 2021, which ended Sept. 30. Management expects to return about $900 million to shareholders in its fiscal 2021, which would mean that the company expects to purchase another $240 million in shares by June 30, 2021. Given its short-term tailwinds, impressive performance and guidance, 43 consecutive years of dividend raises, and share buybacks, the company looks to be a good buy now.

2. Netflix

Netflix, too, was viewed as a business well-suited to the conditions created by the pandemic. With so many other leisure and entertainment options unavailable, people naturally gravitated toward its vast streaming video catalog. After growing its global paid memberships by 27% year over year in the second quarter, Netflix released somewhat disappointing third-quarter results. The company also guided for a deceleration in fourth-quarter subscriber growth, forecasting 6 million net additions compared to 8.8 million a year prior.

Despite that, Netflix is gradually becoming more profitable. The transition from hyper-growth to profitability is something that many investors have been hoping for as the company evolves from an entertainment industry disruptor into an established and mature industry leader.

NFLX Revenue (Quarterly) data by YCharts

The company just recorded its third straight quarter of positive FCF. It booked $2.2 billion in FCF for the first nine months of 2020 compared to negative FCF of $1.6 billion during the same period last year. The company is also posting record net income so far in 2020.

Netflix just raised its prices again. But so far, the pattern has been that once people sign up for the service, they tend to stick around. Investors should keep an eye on the company's retention numbers in the coming quarters to see if customers are put off by the higher prices. If they're mostly willing to accept them, Netflix's path to profitability will look easier.

Netflix is still an expensive stock, trading at price-to-FCF and price-to-earnings ratios far above the market average. However, a loyal subscriber base, pricing power, and higher FCF and profitability make it a worthy long-term investment.

3. Lockheed Martin

This leading defense stock has also been underperforming the market, but the company continues to post impressive results.

Lockheed Martin is now guiding for 2020 sales of $65.3 billion and earnings per share of $24.45, both of which are on the high end of its prior estimates. Its preliminary outlook for 2021 suggests at least $67 billion in sales and cash from operations of $7.8 billion, similar to 2020. Although the company's 2021 projections show little growth compared to 2020, the stock is trading at a significantly discounted P/E ratio. Lockheed Martin would have a P/E of just 15 if it hits its 2020 EPS goal compared to the market average of about 31.

Lockheed and the defense sector as a whole could be underperforming the market for a number of reasons. The first is uncertainty. The Biden administration may not be too keen on allocating additional funds toward defense, especially in 2021. Even Donald Trump's proposed Fiscal Year (FY) 2021 national security budget was less than the proposed FY 2020 budget. The proposed FY 2021 national security budget requests $740.5 billion of which $705.4 billion is expected to go to the Department of Defense (DoD) compared to $750 billion in total and $718.3 billion to the DoD in FY 2020.

Lockheed Martin has a few key advantages even in a lower budget environment. Air Domain remains the largest investment domain in the DoD budget, and topping the list is $11.4 billion for 79 of Lockheed's F-35 Joint Strike Fighters. Aside from sales to the U.S. government, the company has been investing heavily into its space business which management thinks could bring explosive growth. Lockheed also does business with countries aside from the U.S., like its recently announced proposal to the Swiss Government that includes up to 40 F-35A aircraft. There are more than 585 F-35s in service across 26 different military bases worldwide. Future business from the U.S. government and its allies tends to be planned in advance and spread out over years -- which Lockheed anticipates when it calculates its backlog. The company increased its backlog for the ninth consecutive quarter to a new record of $150.4 billion. The backlog makes orders and operating cash flow fairly predictable in the medium term.

Lockheed Martin's low valuation more than compensates for its projected slowdown in revenue and earnings growth next year. And at current share prices, its dividend yields 2.8%, which is higher than the S&P 500 average of 1.8%.

A worthy trio

Clorox, Netflix, and Lockheed Martin are attractive choices for folks looking for stocks to buy in this market. Their differences complement each other, making them a good basket as well. Clorox and Lockheed Martin are both dividend stocks with stable performance and reasonable valuations. Netflix is expensive, but has much more potential for growth. Its risks are easier to absorb when balanced in your portfolio by companies like Clorox and Lockheed Martin. Whether investing in all three or choosing your favorite, these look likely to prove solid long-term investments.