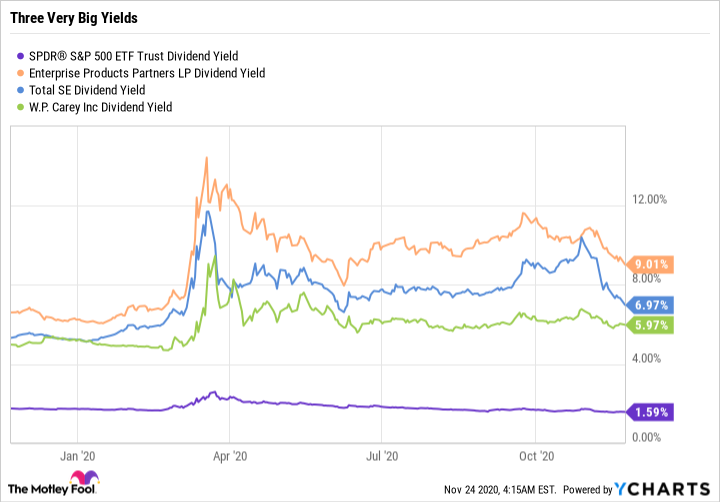

With the S&P 500 Index yielding less than 2%, it can be hard to find stocks offering generous dividends. But if you are willing to think a little outside the box you can find yields of 5% and more from companies that don't get as much investor attention as they deserve. For example, real estate investment trust (REIT) W.P. Carey (WPC 0.27%), integrated energy giant Total (TTE -0.32%), and midstream mammoth Enterprise Products Partners (EPD 0.48%) are big dividend payers that investors seem to have forgotten about. Here's a quick rundown on each.

1. A well diversified landlord

W.P. Carey is a net-lease real estate investment trust, which means it owns single-tenant properties, and the tenants pay most of the operating costs of the properties they occupy. It's a fairly low-risk approach in the sector. However, W.P. Carey takes things a step further by diversifying its portfolio across the industrial (24% of rents), warehouse (23%), office (23), retail (17%), and self storage (5%) sectors, with a fairly large "other" category making up the rest. In addition, it generates around 37% of its rents from outside the United States (largely Europe). Diversification has been just as good for this REIT's portfolio as it is for yours: Its rent collection rates have remained in the high-90% range throughout the coronavirus pandemic, even as some peers saw their collections fall into the 50% space.

Image source: Getty Images.

The REIT's approach has led to an impressive 23-year streak of annual dividend increases that dates all the way back to its 1998 initial public offering. And it has increased its dividend each quarter in 2020, despite the COVID-19 headwinds. With a yield of 6%, W.P. Carey is offering a fairly generous income opportunity compared to peers like Realty Income, which has a yield of 4.6%. There's some concern in the market that W.P. Carey's foreign exposure is a risk, but, based on the REIT's rent collection rates in 2020, that hasn't proven to be a major issue. All in all, this is a well-run landlord with a great history and a still-generous yield.

2. Slowly getting green

France's Total is one of the largest integrated oil majors in the world. It does everything from drill for oil and natural gas to processing it to selling energy products to end customers. The stock's current yield is a huge 7.4%.

There are two things to note here. First, the oil industry is deeply out of favor because the economic shutdowns used to slow the spread of the coronavirus have resulted in a deeply out-of-balance supply/demand equation in the energy patch. That will likely work itself out over time (like such imbalances have every time before), and the company has stated repeatedly that it can sustain its dividend as long as oil averages in the $40-per-barrel range. And oil's been holding in that range lately.

SPY Dividend Yield data by YCharts

Second, and longer-term, oil is slowly being displaced by cleaner energy sources. But Total is already working on that, with a history of investing in electric and clean-energy assets. In fact, it has now laid out a plan to grow its "electrons" business from 5% of its sales in 2019 to 15% by 2030. In other words, it's ready for the near-term troubles (low oil prices) and preparing for a long-term future in which oil is less important. While investors are focused on the impact of COVID-19 on supply and demand, you can collect a fat yield from an energy giant that has positioned itself to survive no matter what happens.

3. A more focused bet

The last name, master limited partnership Enterprise Products Partners, requires a stronger stomach than the two others. This midstream giant owns a large and diversified collection of North American energy pipeline, storage, transportation, and processing assets. It would be virtually impossible to replicate what it owns.

However, with the energy sector facing a supply glut, investors are worried that Enterprise's business is no longer as well positioned as it once was. Indeed, after more than a decade of quarterly distribution increases, the partnership chose to stop quarterly hikes this year. That said, its annual increase streak is an impressive 23 years and counting, and it covered its distribution by a very healthy 1.6 times through the first nine months of 2020, so there's no reason to hit the panic button just yet.

That said, growth used to be driven by building new energy infrastructure. That expansion path has likely ground to a halt thanks to the coronavirus and the ongoing shift toward clean energy alternatives. But don't count this giant out, because it has the size and financial strength to be an industry consolidator. In the meantime, while you wait for the current energy upheaval to play out, you can collect a huge 9.3% yield.

Time for a deep dive

There's no such thing as a free lunch on Wall Street, as the saying goes. So you need to tread carefully when looking at high yields and be very selective. W.P. Carey, Total, and Enterprise all have "warts" that have spooked some investors. However, they look like relatively minor issues when you step back and examine the big picture. If you are looking for fat yields to add to your portfolio today, you should take the time to get to know these names. If you do, it's likely that one, or more, will end up in your portfolio.