Energy stocks have largely been out of favor for several years now. A global glut of oil and gas supply sent energy stocks reeling. The situation went from bad to worse because of demand destruction due to the COVID-19 pandemic. However, recent developments provide a glimmer of hope in this grim situation. Here are three reasons why it could be a great idea to consider energy stocks right now.

1. Supply demand dynamics

The double whammy of squeezed demand in an oversupplied market marred energy stocks in recent years. However, things now look upbeat on both fronts. The U.S. Energy Information Administration expects the global consumption of petroleum products to increase to 98.8 million barrels per day (bpd) in 2021. Though still lower than an average of 101.5 million bpd in 2019, the expected consumption in 2021 is significantly higher than the average of 92.9 million bpd in 2020. Of course, rising coronavirus cases in the U.S. and several European countries could delay the demand recovery.

Image source: Getty Images.

On the supply side, the EIA forecasts U.S. crude oil production to fall from 12.2 million bpd in 2019 to 11.4 million bpd in 2020. It expects average production of 11.1 million bpd in 2021. The expected fall in production is due to reduced drilling activity, which is not enough to offset declines from existing wells. The EIA expects activity and production to pick up in the second half of 2021.

Globally, the Organization of the Petroleum Exporting Countries (OPEC) and its partner countries are considering extending production cuts. The talks could surely fall through, but extending cuts seems to be a rational step considering the rising COVID-19 cases that are threatening to destroy the fragile demand recovery.

2. Longer-term outlook for oil and gas

Another factor that has driven investors away from energy stocks is the fear of renewable sources of energy replacing oil and gas as energy sources. Indeed, the share of renewable sources in global energy consumption is rising and is expected to continue doing so.

However, total energy needs are also expected to rise. This means that even though oil and gas may contribute lower in percentage terms to the global energy demand, their absolute use will still grow. The International Energy Agency foresees rising global oil demand well beyond 2040 under policies presently in effect.

Similarly, the U.S. EIA expects U.S. natural gas production to increase through 2050. It projects 1.9% per-year growth in natural gas production from 2020 to 2025. EIA's projections haven't been the most reliable indicators in recent years, but there is other evidence to support it. Growing global population and rising standards of living, especially in developing countries in Asia, are expected to drive energy demand higher. This will be met by a combination of various energy sources, with oil and gas continuing to play an important role.

3. Energy stocks are trading at attractive prices

Though energy stocks have rallied in November, they are still significantly off from their highs this year. Among the energy stocks, integrated oil giant Chevron (CVX 0.57%) looks attractive. The stock is off more than 20% from its high in 2020. Chevron's strong balance sheet and low production costs places the company well for an eventual recovery.

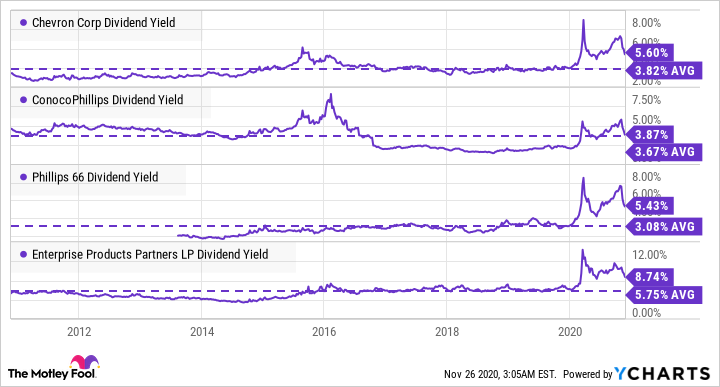

Another energy stock that looks attractive right now is refiner Phillips 66 (PSX 1.14%), which is off more than 40% from its highs in 2020. The fall in energy stock prices over the last few years have pushed their yields higher. Chevron and Phillips 66 both offer yields much higher than what they offered historically.

Similarly, upstream giant ConocoPhillips (COP 0.39%) and midstream master limited partnership Enterprise Products Partners (EPD -0.31%) are trading at yields higher than their historical average yields.

CVX Dividend Yield data by YCharts

Enterprise Products' conservative leverage and strong coverage make its above 8% yield compelling. Unlike Enterprise Products, ConocoPhillips is directly exposed to oil and gas prices and thus would benefit from any bullish movement in the prices of these commodities. The recent acquisition of Concho Resources strengthens ConocoPhillips' position as a low-cost producer in the Permian Basin.