Investors tend to have a herd mentality. They'll move in a uniform direction following a particular strategy.

Sector rotation is when investors move their investment capital in unison from one industry to another as they anticipate a change in the cycle. Here's a closer look at sector rotation and strategies investors can use to capitalize on its occurrence.

Types of cycles that trigger sector rotations

Types of cycles that trigger sector rotations

Several different types of cycles can cause a sector rotation, including the economic cycle, the stock market cycle, and oversold and overbought cycles. Here's a closer look at each of these types of cycles and how they can trigger a sector rotation.

Economic cycles

The global economy moves in a cyclical pattern, known as the economic or business cycle, across the following four phases:

- Expansion: During the expansion phase — also called the mid-cycle phase — the economy grows as measured by increases in the Gross Domestic Product (GDP).

- Peak: A peak — also known as the late-cycle phase — occurs when the economy starts running out of steam, usually caused by higher levels of inflation that central banks try to tame by raising interest rates.

- Contraction: A contraction — also known as a recession —happens when trade and industrial activity declines, causing rising unemployment. Economists define a recession as a decline in GDP for two consecutive quarters.

- Trough: A trough represents the low point in the economic cycle — also known as the early cycle phase — as it shifts into a new expansion phase.

An economic cycle usually lasts several years. Historically, the economy goes through a complete business cycle every five years. The average expansion phase runs more than three years, and the typical recession lasts about a year and a half. However, economic cycles can be much longer. The expansion phase following the Great Recession of 2008 lasted more than a decade, while the shortest cycle in 1981-1982 lasted 18 months.

Market cycles

The stock market also runs through a four-phased cycle like the global economy. These phases are:

- The accumulation phase: This phase occurs at the bottom of a bear market. Investors begin to accumulate stock positions at what they view as attractive valuations. While the overall market sentiment is bearish, it's starting to shift from negative to neutral.

- The mark-up phase: The mark-up stage is also known as a bull market. This stage follows a period of relative calm in the market, with stocks steadily moving higher. The sentiment is increasingly positive, causing more investors to pile in and resulting in increasingly higher stock prices.

- The distribution phase: Traders who accumulated positions at more attractive valuations in earlier stages begin selling during the distribution phase as stock prices gain momentum. Stock prices often settle into a trading pattern, causing mixed sentiment among investors. The distribution phase occurs as the bull market runs out of steam and forms a market top.

- The mark-down phase: The mark-down phase is also known as a bear market. Stock prices decline sharply as investors cycle out of stocks.

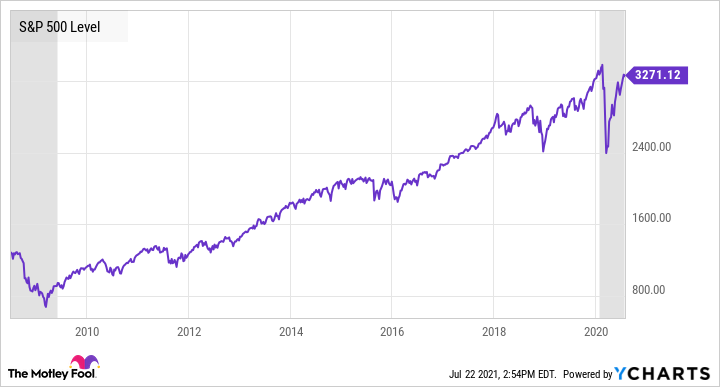

An example of a stock market cycle occurred following the Great Recession of 2008. The market bottomed in March 2009, which began the accumulation phase of the next cycle. The mark-up phase continued for several years before hitting the distribution stage in early 2020 as the COVID-19 pandemic roiled the stock market. A deep mark-down phase followed as stock prices plunged. However, by April 2020, the market bottomed, starting another accumulation phase.

Oversold and overbought cycles

Overbought and oversold are technical terms referring to phases where the market experiences a significant and consistent swing in one direction. An overbought market occurs when stocks — either as a whole or in a particular sector — move higher over an extended period without a notable pullback in prices. Conversely, an oversold market happens when stocks steadily decline without a rally. These terms suggest the market is due to reverse the current trend, causing investors to rotate into or out of an investment class or sector.

Sector rotation strategies

Sector rotation strategies

Sector rotation strategies aim to take advantage of the historical performances of specific industries during different phases of the cycle. For example, certain stock market sectors, including real estate, consumer discretionary, information technology, and communications services, are cyclical, meaning their businesses and stock prices tend to perform poorly during a recession. As such, investors will rotate out of those sectors into consumer staples, healthcare, and utilities because they typically deliver steadier results during an economic contraction.

Another sector rotation strategy happens during the accumulation and mark-up phases of the stock market. Investors will rotate into value stocks during the accumulation phase and then out of that sector and into growth stocks during the mark-up phase.

Related investing topics

How can investors take advantage of sector rotations?

How can investors take advantage of sector rotations?

Investors will experience many cycles during their lifetimes. Because of that, they shouldn't be overly concerned as these phases occur. However, investors who understand cycles can make better-informed decisions that can improve long-term investment returns. For example, they can moderate their investment activity during euphoric periods toward the end of a bull market run as the economy peaks and stocks head toward distribution and mark-down phases. That way, they have more cash to invest during the eventual economic trough and accumulation phase, enabling them to capture bigger returns over the long term.