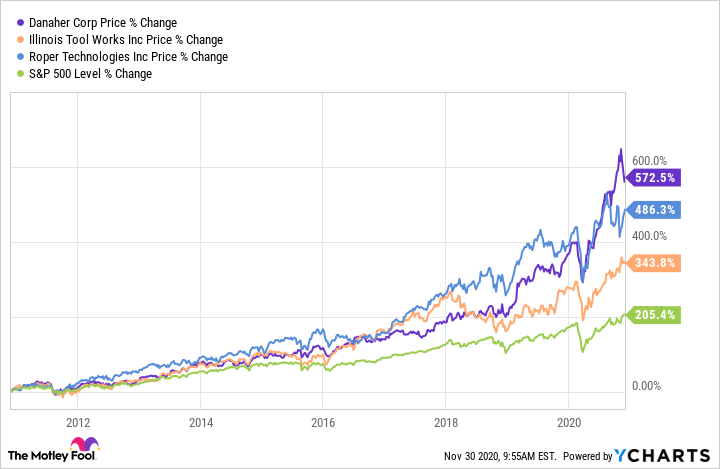

If anyone has doubts about the importance of management in determining stock returns, read on. Danaher (DHR 7.21%), Illinois Tool Works (ITW 0.27%), and Roper Technologies (ROP 0.10%) have all generated stellar returns for investors thanks to management teams that have successfully carried out their business plans, and the good news is there could be more to come. Here's the how and why.

Danaher: Continuous improvement

Danaher investors owe the company's board a round of applause. Larry Culp's 2001-2014 tenure as CEO proved highly successful, as was that of his successor, Tom Joyce, from 2014 to 2020. In essence, the Danaher story is one of relentless application of a set of business principles that management calls the Danaher Business System, or DBS.

Data source: YCharts

In a nutshell, the DBS approach combines a customer-centric approach with continuous improvement of management techniques. Danaher has made a series of transformative acquisitions over the decades and then raised revenue and margin with them. Examples include Beckman Coulter (diagnostics and life sciences) in 2011, Pall (life sciences) in 2015, and Cepheid (diagnostics) in 2016. Meanwhile, the acquisition of General Electric's biopharma business, now called Cytiva, is already proving to be a great success.

Danaher offers coronavirus tests, and its life science tools are used in vaccine development. Image source: Getty Images.

Danaher has slowly moved toward becoming a focused life sciences and diagnostics company. It's a process that Joyce continued to pursue by spinning off its industrial businesses into a new company, Fortive, in 2016. The underperforming dental segment was then spun off in 2019 as a company called Envista.

As such, Danaher shareholders now find themselves holding a company growing revenue at a mid-single-digit rate and positioned in the exciting growth markets of life sciences and diagnostics that have seen a boost during the pandemic. Moreover, most of the success comes down to management's relentless application of DBS and having the confidence to restructure the portfolio of businesses.

Illinois Tool Works: Blocking and tackling gets the job done

CEO Scott Santi has spent his whole career at multi-industry industrial company Illinois Tool Works, and he's been the top dog since 2012. That year, he launched an enterprise strategy aimed at generating growth and improving margin through the application of its "80/20 front-to-back process." In essence, management is continually focusing the business on the 80% of revenue that it generates from 20% of its customers.

The automotive sector is a key end market for Illinois Tool Works. Image source: Getty Images.

In practice, Santi has been relentlessly pruning less profitable business and product lines, improving its supply chain based on 80/20 principles, and focusing on the needs of its key customers. It's nothing revolutionary, but it is a demonstration of what a highly committed team following a game plan can achieve.

This chart, which uses multi-industry industrial peer 3M as a comparison, shows just how Santi has expanded margin over time. As such, the company now trades at a valuation premium in its sector -- and at a premium to 3M.

ITW Operating Margin (TTM) data by YCharts

And this chart shows how the margin expansion has largely been achieved as a result of the enterprise strategy initiatives, and the good news is management thinks it has plenty of room to run with its strategy.

Data source: Illinois Tool Works presentations. BP is basis points, where 100 bp = %.

Roper Technologies: An asset-light business model

Here again, we see the principle of a management team consistently following a successful set of management principles. In Roper's case, late CEO Brian Jellison ran the company for 17 years until 2018 with a unique business model. In operating a highly acquisitive company, Jellison would look for asset-light business with high margins that operated in niche market areas.

Unlike Danaher, whose management would set about applying DBS to the new businesses, Roper's leaders tend to let the management of the acquired companies continue to run their businesses, while offering some coaching along the way. However, the capital allocation decisions are made centrally under the CEOs leadership. Finally, the ample cash flows from the collection of businesses would then be used to make new acquisitions.

It's proved to be a highly successful business model, and its application has led to an increased focus on software business -- even if that wasn't the intention from the outset.

What it means to investors

Perhaps the key takeaway from these three companies is how they continued to outperform on a sustained basis while staying true to their management principles. Good management matters, and it pays to stay invested in companies that are continuously replicating a successful model, even if the company is only a few years into its practice.